- United Kingdom

- /

- Luxury

- /

- LSE:BRBY

UK Stocks: Burberry Group And 2 Other Companies That May Be Priced Below Intrinsic Estimates

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China and falling commodity prices impacting major companies. In such a fluctuating environment, identifying stocks that might be undervalued compared to their intrinsic worth can present potential opportunities for investors seeking value amidst broader economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Topps Tiles (LSE:TPT) | £0.35 | £0.61 | 42.6% |

| TBC Bank Group (LSE:TBCG) | £46.40 | £92.54 | 49.9% |

| LSL Property Services (LSE:LSL) | £3.17 | £5.64 | 43.8% |

| Jubilee Metals Group (AIM:JLP) | £0.0345 | £0.063 | 45% |

| Informa (LSE:INF) | £8.058 | £14.54 | 44.6% |

| Hostelworld Group (LSE:HSW) | £1.37 | £2.44 | 43.9% |

| Deliveroo (LSE:ROO) | £1.759 | £3.03 | 41.9% |

| Carr's Group (LSE:CARR) | £1.475 | £2.92 | 49.5% |

| Burberry Group (LSE:BRBY) | £11.82 | £22.29 | 47% |

| AstraZeneca (LSE:AZN) | £101.20 | £178.16 | 43.2% |

Let's uncover some gems from our specialized screener.

Burberry Group (LSE:BRBY)

Overview: Burberry Group plc operates in the manufacturing, retail, and wholesale of luxury goods under the Burberry brand across various global regions including Asia Pacific, Europe, the Middle East, India, Africa, and the Americas with a market cap of £4.25 billion.

Operations: The company's revenue is primarily derived from its Retail/Wholesale segment, generating £2.40 billion, and Licensing, contributing £67 million.

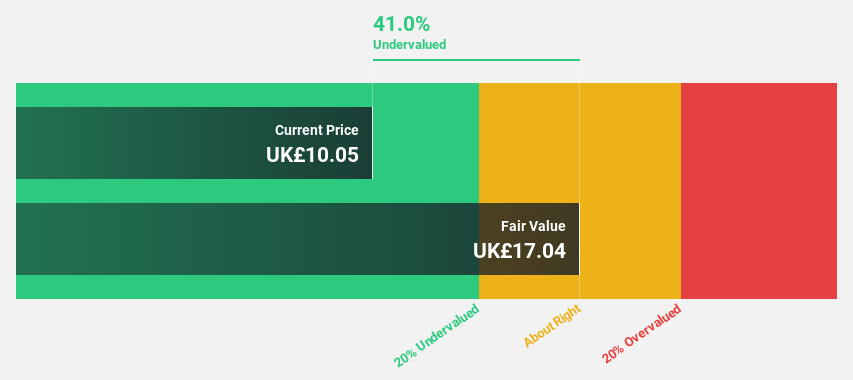

Estimated Discount To Fair Value: 47%

Burberry Group is trading at £11.82, significantly below its estimated fair value of £22.29, suggesting it could be undervalued based on cash flows. Despite a recent net loss of £75 million and no dividend declaration for 2025, earnings are forecast to grow 47.71% annually, with revenue growth outpacing the UK market at 4.2% per year. However, share price volatility and declining wholesale revenue guidance remain concerns for investors.

- Our comprehensive growth report raises the possibility that Burberry Group is poised for substantial financial growth.

- Get an in-depth perspective on Burberry Group's balance sheet by reading our health report here.

Empiric Student Property (LSE:ESP)

Overview: Empiric Student Property plc is a leading provider and operator of modern, premium student accommodation primarily offered directly to students at key UK universities, with a market cap of £682.72 million.

Operations: The company's revenue is primarily generated from its investment in student and associated commercial lettings, amounting to £84.20 million.

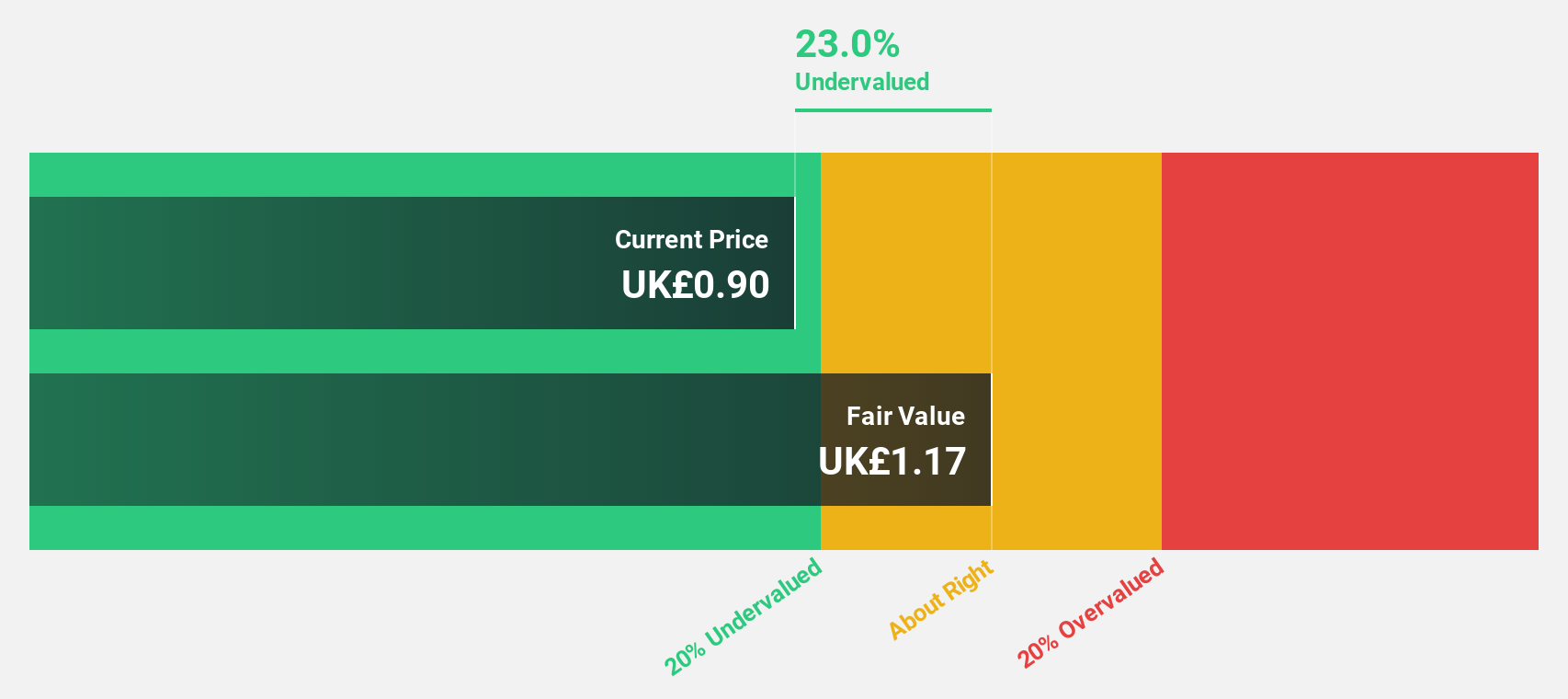

Estimated Discount To Fair Value: 10.7%

Empiric Student Property is trading at £1.03, slightly below its estimated fair value of £1.15, indicating potential undervaluation based on cash flows. Despite a decrease in profit margins from 66.3% to 40.9%, earnings are expected to grow significantly at 22.8% annually, outpacing the UK market's growth rate of 14.3%. The company's recent acquisition proposal by Unite Group PLC for £710 million could influence future valuation dynamics and investment considerations.

- Upon reviewing our latest growth report, Empiric Student Property's projected financial performance appears quite optimistic.

- Take a closer look at Empiric Student Property's balance sheet health here in our report.

TBC Bank Group (LSE:TBCG)

Overview: TBC Bank Group PLC, with a market cap of £2.57 billion, offers banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan through its subsidiaries.

Operations: The company generates revenue primarily from Georgian Financial Services, amounting to GEL 2.34 billion.

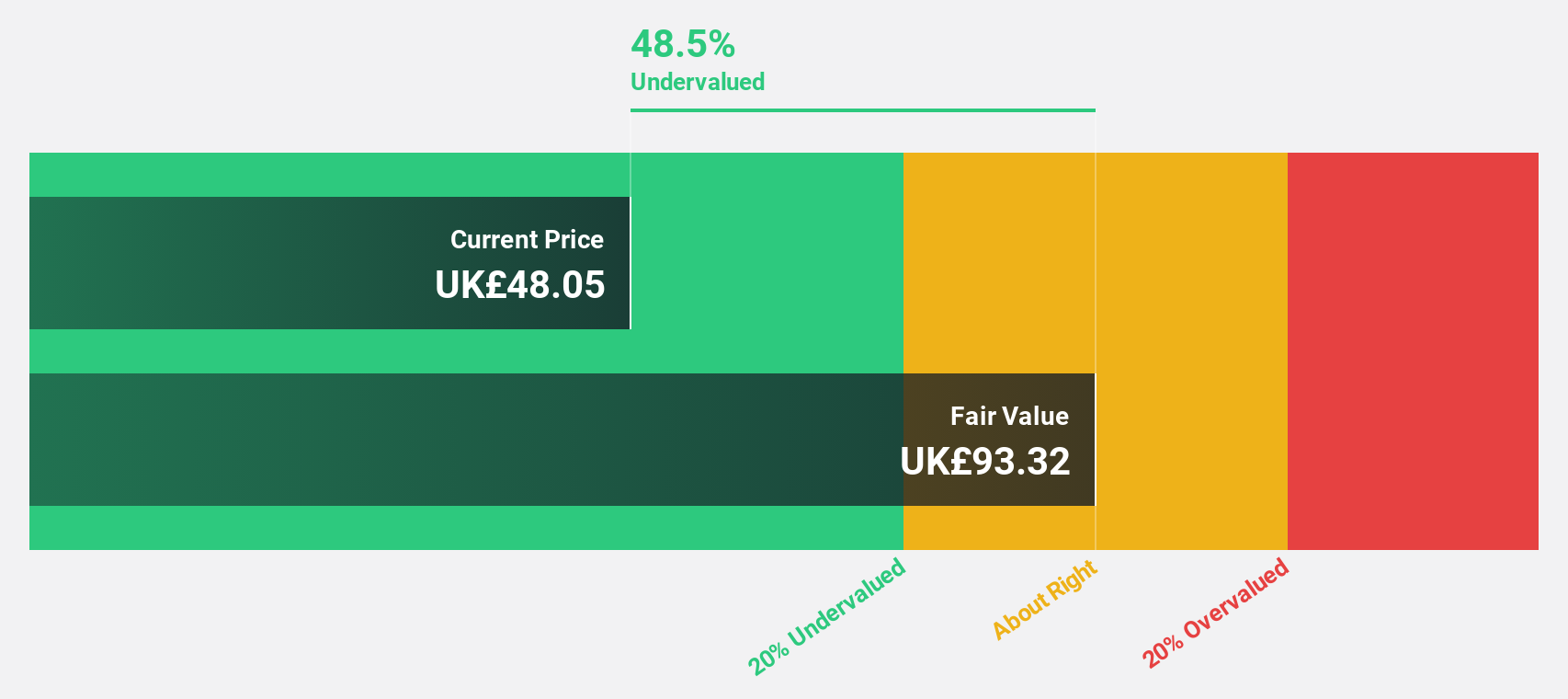

Estimated Discount To Fair Value: 49.9%

TBC Bank Group, trading at £46.40, is significantly undervalued with a fair value estimate of £92.54 based on cash flows. Earnings have grown 23.9% annually over five years and are forecast to rise 17.2% per year, surpassing the UK market's growth rate of 14.3%. Despite a high level of bad loans at 2.5%, recent earnings show strong performance with net interest income increasing and dividends declared for Q1 2025 payable in September.

- Our expertly prepared growth report on TBC Bank Group implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of TBC Bank Group here with our thorough financial health report.

Seize The Opportunity

- Click this link to deep-dive into the 54 companies within our Undervalued UK Stocks Based On Cash Flows screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Burberry Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BRBY

Burberry Group

Engages in manufacturing, retail, and wholesale of luxury goods under the Burberry brand in the Asia Pacific, Europe, the Middle East, India, Africa, and the Americas.

Adequate balance sheet and fair value.

Market Insights

Community Narratives