- United Kingdom

- /

- Real Estate

- /

- LSE:LSL

UK Penny Stocks To Watch: Intercede Group And Two Others

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interdependencies. Despite these headwinds, investors continue to seek opportunities that can thrive amid broader market volatility. Penny stocks, often representing smaller or newer companies, remain an intriguing area of interest; when backed by strong financials and solid fundamentals, they can offer potential growth at lower price points.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Supreme (AIM:SUP) | £2.01 | £235.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.22 | £474.08M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.40 | £355.46M | ✅ 5 ⚠️ 3 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.802 | £1.12B | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.442 | £47.82M | ✅ 5 ⚠️ 2 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.44 | £428.04M | ✅ 2 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.14 | £323.51M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.095 | £174.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.865 | £11.91M | ✅ 4 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.20 | £68.45M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 302 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Intercede Group (AIM:IGP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Intercede Group plc is a cybersecurity company that develops and supplies identity and credential management software for digital trust across the United Kingdom, Europe, the United States, and internationally, with a market cap of £107.56 million.

Operations: The company generates revenue from its Software & Programming segment, totaling £17.71 million.

Market Cap: £107.56M

Intercede Group plc, a cybersecurity company with a market cap of £107.56 million, has shown mixed financial performance. Despite being debt-free and having high-quality earnings, its recent full-year results for March 31, 2025, reported a decline in sales to £17.71 million from £19.96 million the previous year and lower net income at £4.06 million compared to £6.02 million last year. The company's Price-To-Earnings ratio of 26.5x is below the industry average, indicating good relative value despite negative earnings growth over the past year (-32.7%). Recent product innovations and international contracts suggest strategic efforts to enhance revenue streams amidst these challenges.

- Unlock comprehensive insights into our analysis of Intercede Group stock in this financial health report.

- Gain insights into Intercede Group's outlook and expected performance with our report on the company's earnings estimates.

Ground Rents Income Fund (LSE:GRIO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ground Rents Income Fund plc is a closed-ended real estate investment trust listed on The International Stock Exchange and traded on the SETSqx platform of the London Stock Exchange, with a market cap of £29.27 million.

Operations: The company generates its revenue primarily from ground rent income, totaling £5.34 million.

Market Cap: £29.27M

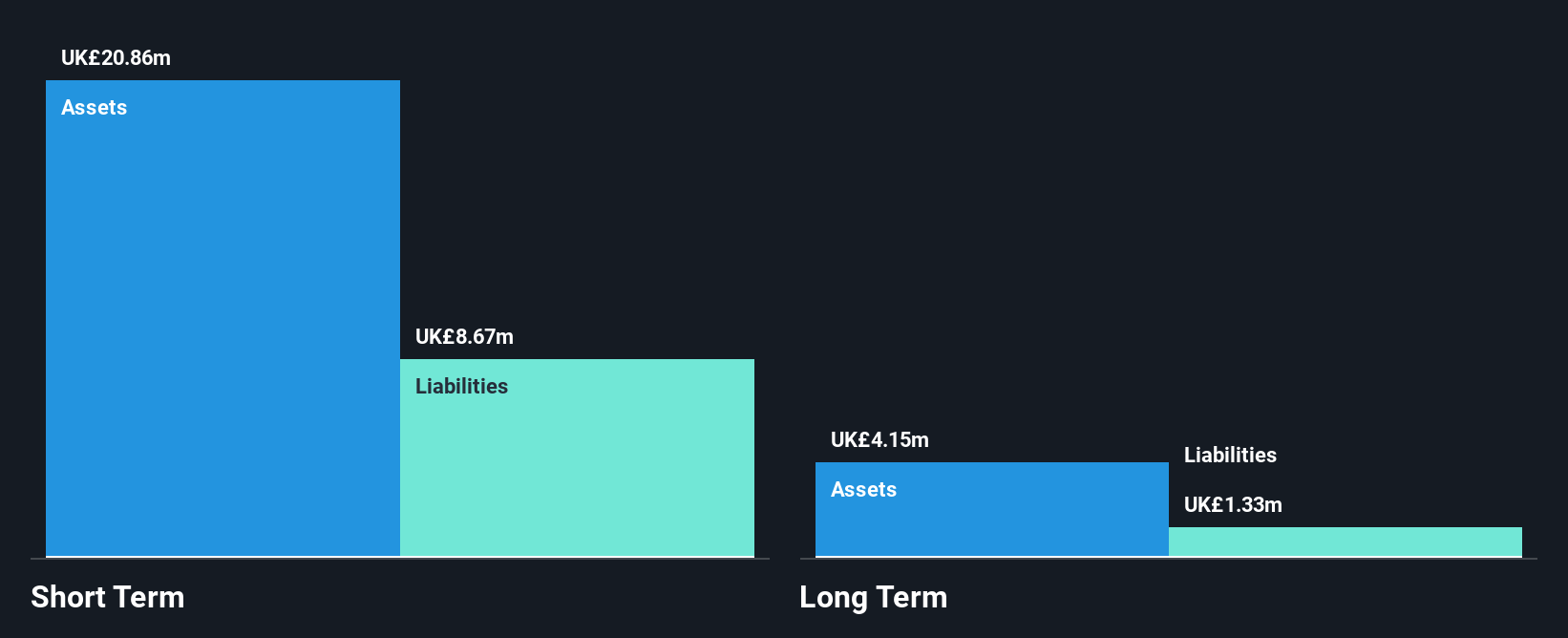

Ground Rents Income Fund plc, with a market cap of £29.27 million, reported half-year sales of £3.09 million, reflecting slight growth from the previous year. Despite being unprofitable and having a negative return on equity, its net loss has significantly narrowed to £6.07 million from £20.02 million last year. The company trades below its estimated fair value and maintains a satisfactory net debt to equity ratio of 9.2%. While short-term assets cover liabilities, long-term liabilities remain uncovered by current assets; however, it has a cash runway exceeding three years due to positive free cash flow management despite shrinking by 11.7% annually.

- Click to explore a detailed breakdown of our findings in Ground Rents Income Fund's financial health report.

- Understand Ground Rents Income Fund's track record by examining our performance history report.

LSL Property Services (LSE:LSL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: LSL Property Services plc operates in the United Kingdom, offering business-to-business services to mortgage intermediaries and estate agent franchisees, along with valuation services for lenders, and has a market cap of £323.51 million.

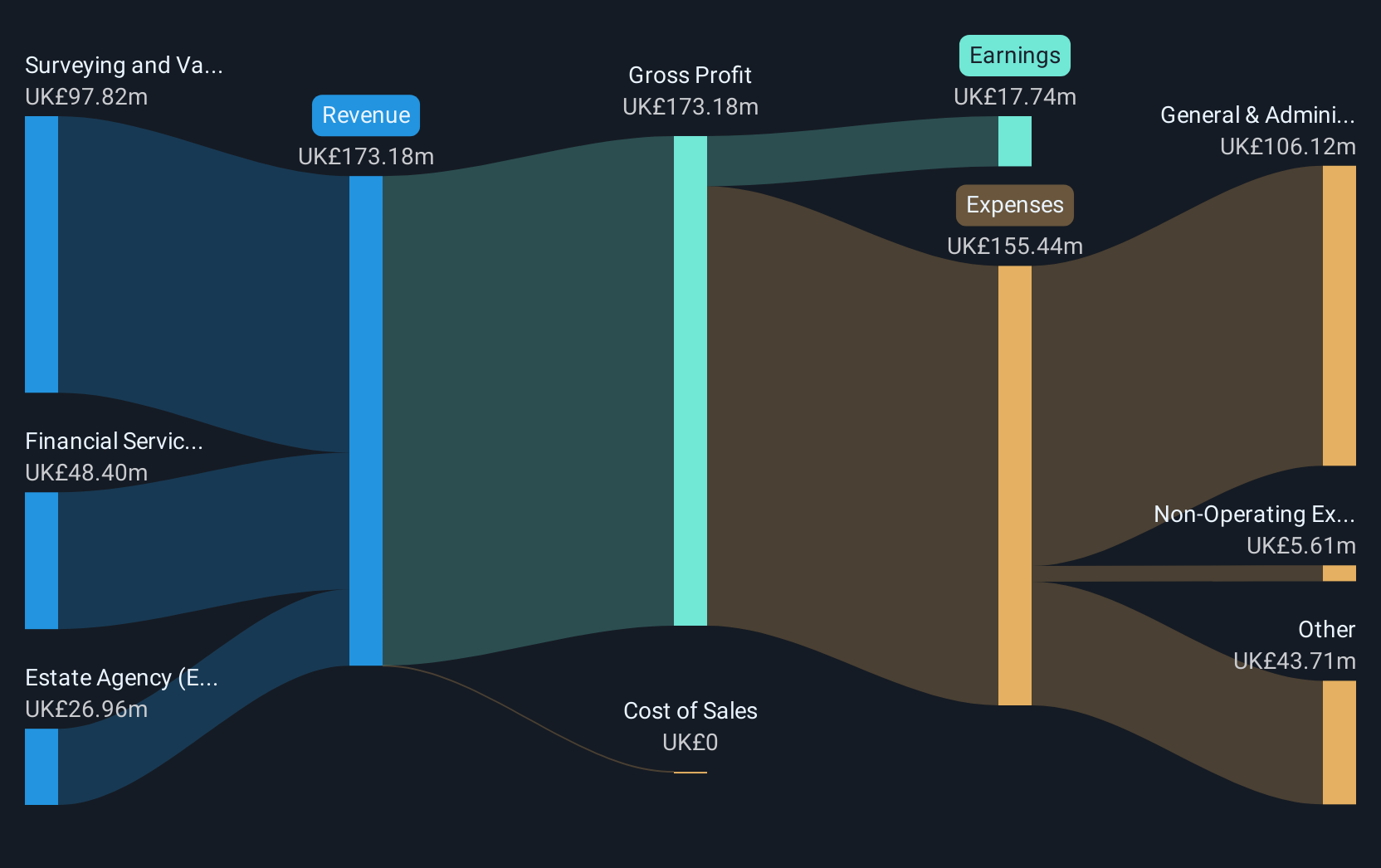

Operations: LSL Property Services generates revenue through three main segments: Financial Services (£48.40 million), Surveying and Valuation (£97.82 million), and Estate Agency excluding Financial Services (£26.96 million).

Market Cap: £323.51M

LSL Property Services, with a market cap of £323.51 million, shows promising aspects for investors interested in penny stocks. The company has demonstrated strong earnings growth over the past year at 119.2%, surpassing industry averages and reversing a five-year decline trend. LSL's financial health is reinforced by its ability to cover interest payments and maintain cash reserves exceeding total debt, although its debt-to-equity ratio has risen slightly over time. Despite an inexperienced management team, the board is seasoned with an average tenure of 3.8 years. Recent dividend affirmations and share buyback extensions indicate shareholder-friendly initiatives amidst stable volatility levels.

- Take a closer look at LSL Property Services' potential here in our financial health report.

- Assess LSL Property Services' future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Take a closer look at our UK Penny Stocks list of 302 companies by clicking here.

- Searching for a Fresh Perspective? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 24 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LSL

LSL Property Services

Engages in the provision of business-to-business services to mortgage intermediaries and estate agent franchisees, and valuation services to lenders in the United Kingdom.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives