- United Kingdom

- /

- Metals and Mining

- /

- AIM:ALL

UK Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently experienced a downturn, influenced by weak trade data from China, highlighting the interconnected nature of global markets. In such fluctuating conditions, investors often look for opportunities that may not be immediately apparent in larger indices. Penny stocks—typically representing smaller or newer companies—remain an intriguing area for potential growth when they possess strong financial health and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.46 | £11.56M | ✅ 3 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.675 | £533.4M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.08 | £168.04M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.92 | £13.89M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.15 | £27.28M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.69 | $401.12M | ✅ 4 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.748 | £276.59M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.42 | £244.82M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £2.60 | £93.49M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.105 | £176.36M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 296 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Atlantic Lithium (AIM:ALL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Atlantic Lithium Limited explores and develops mineral properties in Australia, Ivory Coast, and Ghana, with a market cap of £79.10 million.

Operations: The company's revenue is primarily derived from exploration activities for base and precious metals, totaling A$0.69 million.

Market Cap: £79.1M

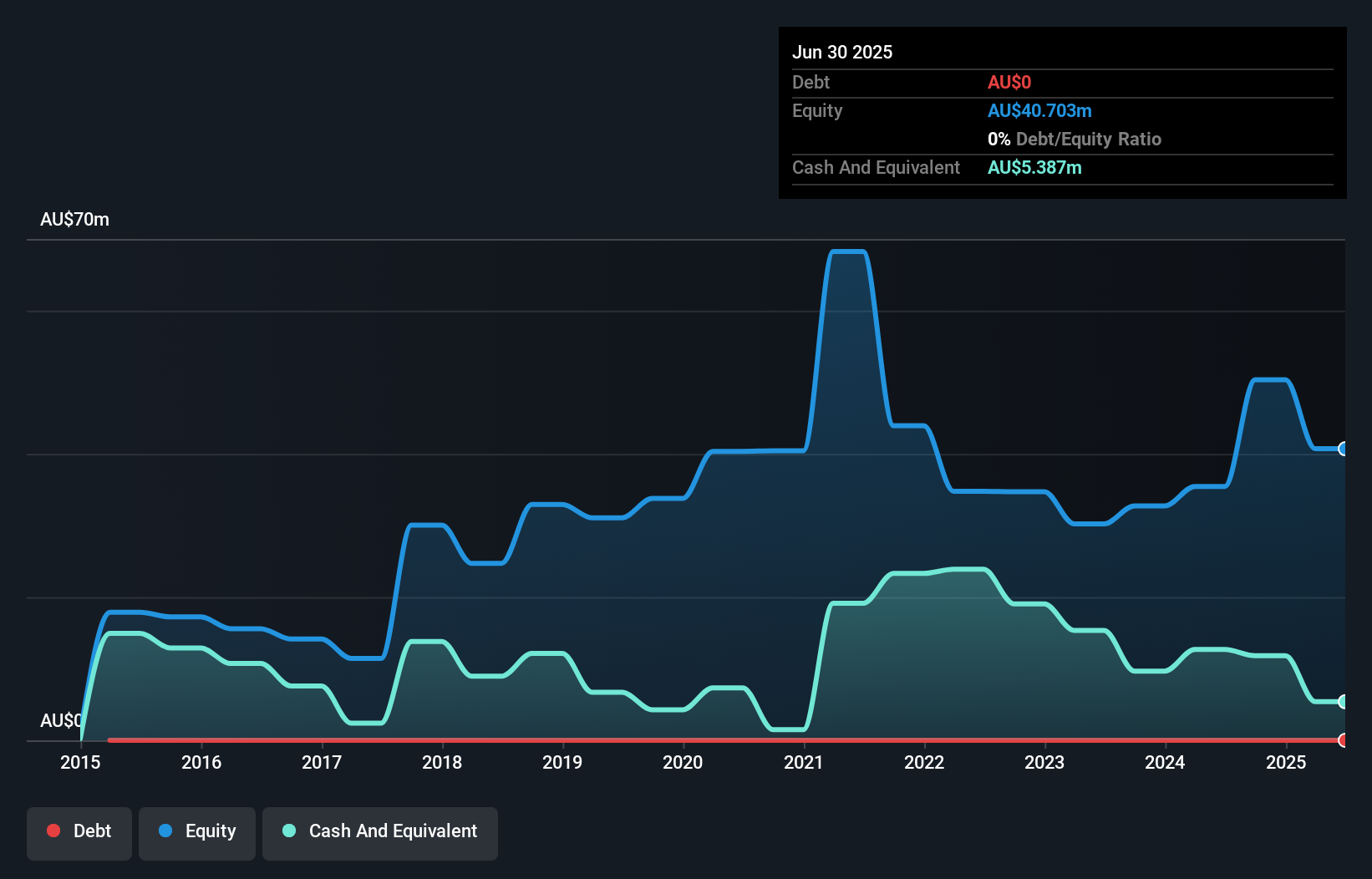

Atlantic Lithium Limited, with a market cap of £79.10 million, is pre-revenue and focuses on mineral exploration in Australia, Ivory Coast, and Ghana. The company recently submitted its Mining Lease for the Ewoyaa Lithium Project in Ghana to Parliament for ratification—a critical step in advancing project funding and offtake arrangements. Despite reducing losses over five years and maintaining a debt-free status, Atlantic faces going concern doubts from auditors due to its unprofitable nature. The company's share price remains highly volatile with recent capital raises impacting cash runway stability but not causing significant shareholder dilution.

- Navigate through the intricacies of Atlantic Lithium with our comprehensive balance sheet health report here.

- Assess Atlantic Lithium's future earnings estimates with our detailed growth reports.

Ten Lifestyle Group (AIM:TENG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ten Lifestyle Group Plc provides concierge services to private banks, premium financial services, and high-net-worth individuals across Asia, the Middle East, Africa, and the Americas with a market cap of £56.70 million.

Operations: No specific revenue segments are reported for Ten Lifestyle Group.

Market Cap: £56.7M

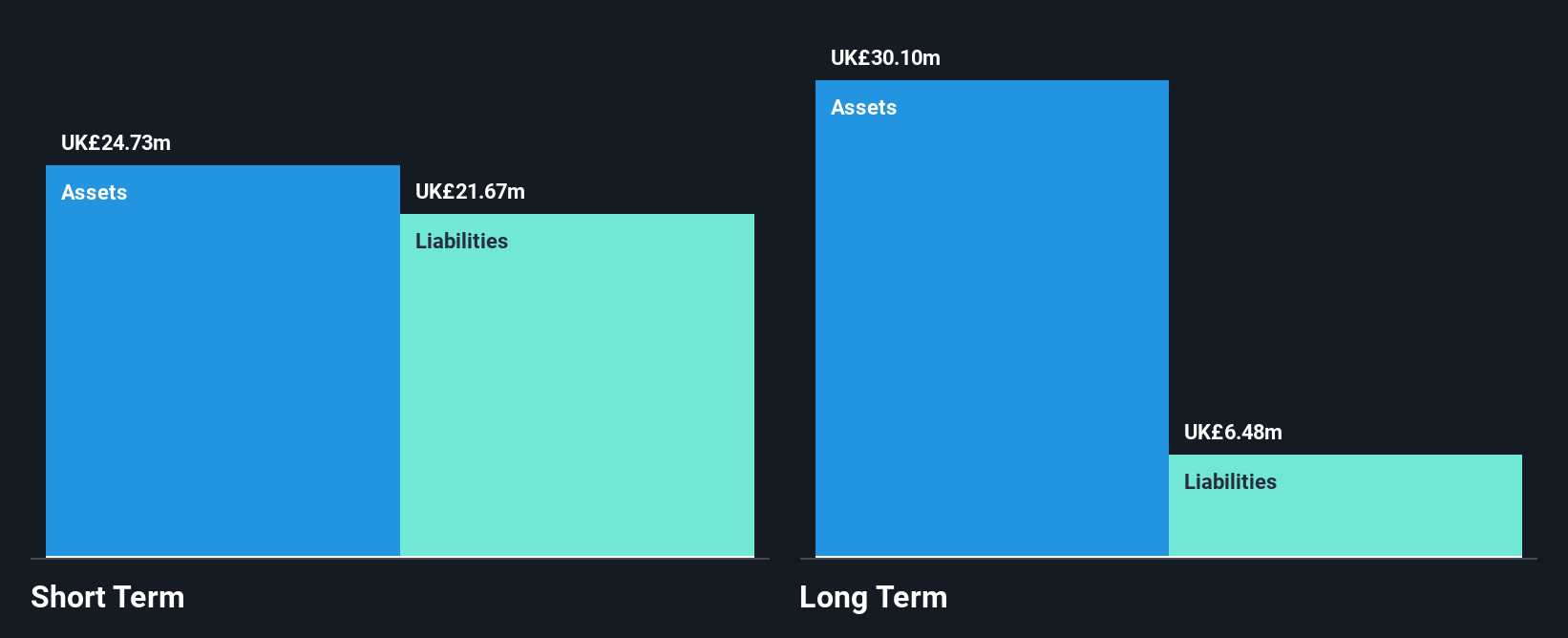

Ten Lifestyle Group, with a market cap of £56.70 million, has demonstrated robust earnings growth of 134.8% over the past year, significantly outpacing industry averages. The company maintains high-quality earnings and a seasoned management team with an average tenure of 6.8 years. Financially stable, it holds more cash than total debt and covers its interest payments well through EBIT. Its short-term assets exceed both short and long-term liabilities, indicating sound liquidity management. Recent events include participation in Mello London presentations and an earnings call on November 17, reflecting active engagement with stakeholders amid steady revenue forecasts for fiscal year-end results.

- Unlock comprehensive insights into our analysis of Ten Lifestyle Group stock in this financial health report.

- Understand Ten Lifestyle Group's earnings outlook by examining our growth report.

MJ Gleeson (LSE:GLE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MJ Gleeson plc operates in the United Kingdom, focusing on house building and land promotion and sales, with a market cap of £216.02 million.

Operations: The company generates revenue from two primary segments: Gleeson Homes, contributing £348.25 million, and Gleeson Land, which adds £17.57 million.

Market Cap: £216.02M

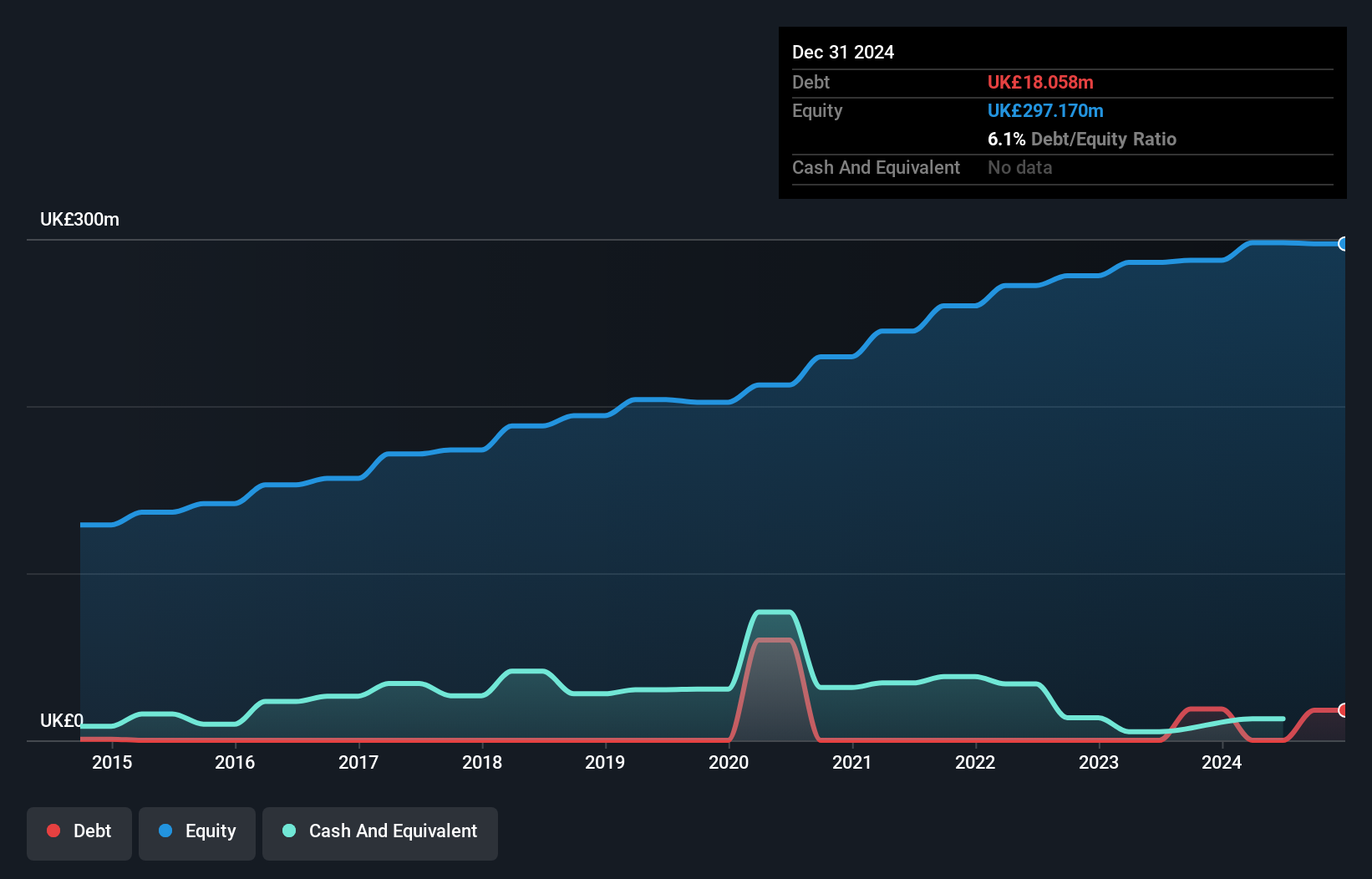

MJ Gleeson, with a market cap of £216.02 million, operates in house building and land promotion, generating significant revenue from Gleeson Homes (£348.25M) and Gleeson Land (£17.57M). Despite a decline in earnings by 2.9% annually over five years, the company has reduced its debt-to-equity ratio from 28.2% to 2.4%, showcasing improved financial health. Short-term assets of £407.6M comfortably cover liabilities, though operating cash flow remains negative affecting debt coverage by cash flow directly; however, interest payments are well covered by EBIT (9x). Recent board changes include new director appointments to strengthen governance ahead of its Q1 2026 earnings release today.

- Dive into the specifics of MJ Gleeson here with our thorough balance sheet health report.

- Examine MJ Gleeson's earnings growth report to understand how analysts expect it to perform.

Next Steps

- Explore the 296 names from our UK Penny Stocks screener here.

- Ready For A Different Approach? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ALL

Atlantic Lithium

Engages in the exploration and development of mineral properties in Australia, Ivory Coast, and Ghana.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success