- United Kingdom

- /

- Consumer Durables

- /

- LSE:SRAD

UK Penny Stocks: 3 Picks With Market Caps Below £400M

Reviewed by Simply Wall St

The London markets recently experienced a downturn, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over China's economic recovery. Despite these broader market challenges, certain investment opportunities remain attractive to those willing to explore beyond traditional blue-chip stocks. Penny stocks, often misunderstood due to their speculative past, can still offer significant potential when backed by strong financials and growth prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.555 | £509.96M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.14 | £253.67M | ✅ 5 ⚠️ 2 View Analysis > |

| FDM Group (Holdings) (LSE:FDM) | £1.36 | £148.67M | ✅ 2 ⚠️ 4 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.415 | £44.9M | ✅ 4 ⚠️ 3 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.839 | £310.24M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.68 | £275.57M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.475 | £124.97M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.18 | £187.55M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.785 | £10.81M | ✅ 2 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.26 | £69.45M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 299 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

FRP Advisory Group (AIM:FRP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FRP Advisory Group plc, with a market cap of £340.07 million, offers business advisory services to companies, lenders, investors, individuals, and other stakeholders through its subsidiaries.

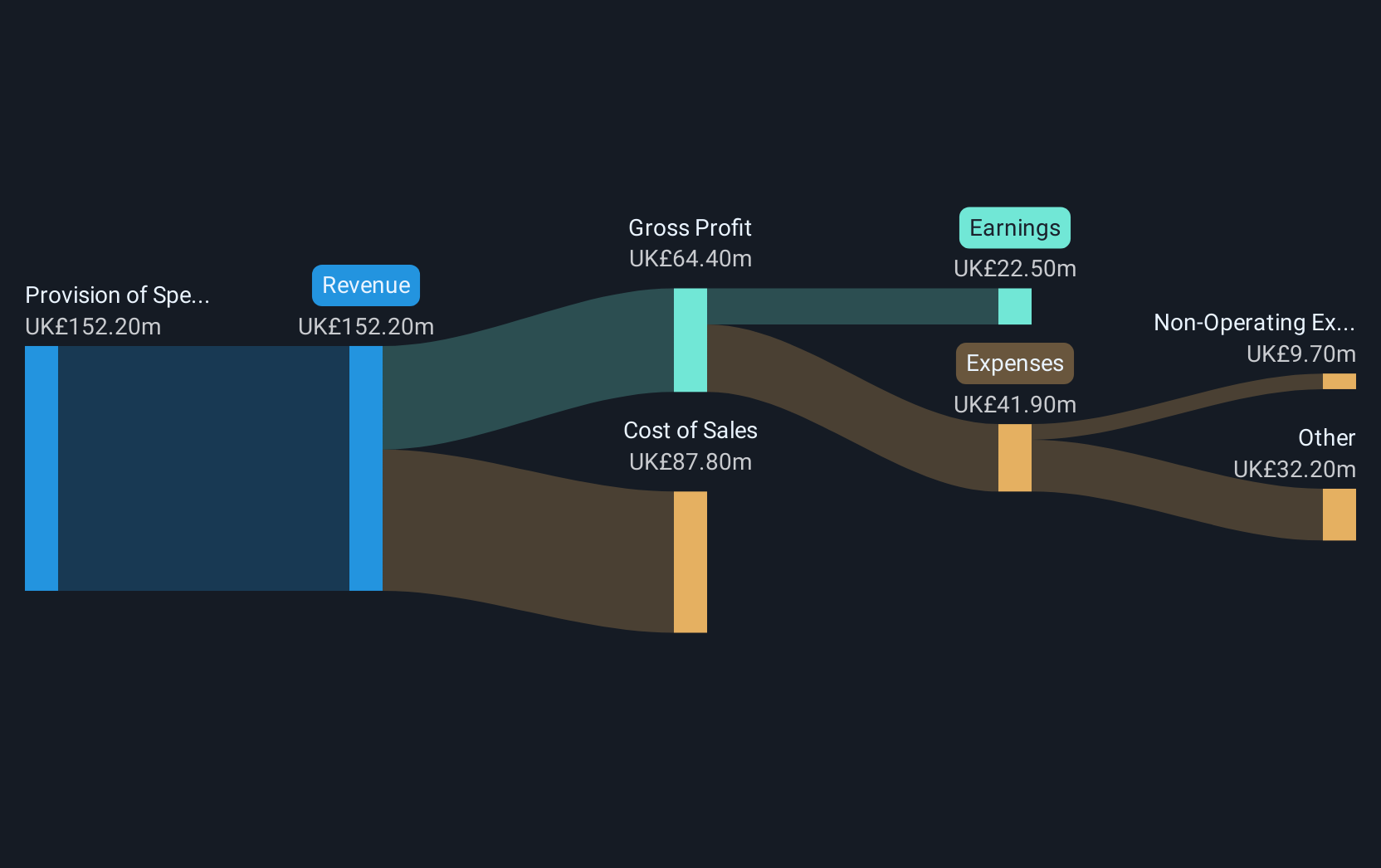

Operations: The company's revenue is primarily generated from the provision of specialist business advisory services, amounting to £152.2 million.

Market Cap: £340.07M

FRP Advisory Group has shown consistent revenue growth, reporting £152.2 million for the year ending April 2025, with net income at £22.5 million. Despite a modest earnings growth of 2.3% this past year, it maintains high-quality earnings and robust financial health with cash exceeding total debt and strong interest coverage (35.8x). The company’s seasoned management and board contribute to stability, while short-term assets comfortably cover liabilities. Analysts anticipate further stock price appreciation by 51.8%, supported by a forecasted annual earnings growth of 11.37%. Recent dividend increases reflect confidence in ongoing profitability despite slightly reduced profit margins.

- Unlock comprehensive insights into our analysis of FRP Advisory Group stock in this financial health report.

- Gain insights into FRP Advisory Group's outlook and expected performance with our report on the company's earnings estimates.

Strix Group (AIM:KETL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Strix Group Plc designs, manufactures, and supplies kettle safety controls and other components worldwide with a market cap of £97.35 million.

Operations: The company's revenue is derived from three segments: Controls (£67.26 million), Billi (£43.05 million), and Consumer Goods (£31.45 million).

Market Cap: £97.35M

Strix Group Plc, with a market cap of £97.35 million, faces challenges as its recent financial performance shows a significant one-off loss of £13.5 million impacting results to December 2024. Despite trading at 57.7% below estimated fair value and having short-term assets exceeding liabilities, the company's high net debt to equity ratio (142.4%) and low return on equity (4.3%) raise concerns about financial stability. While debt is well-covered by operating cash flow, profit margins have declined from last year’s 11.6% to 1.3%. The management team is relatively new, yet the board remains experienced with an average tenure of 8 years.

- Navigate through the intricacies of Strix Group with our comprehensive balance sheet health report here.

- Explore Strix Group's analyst forecasts in our growth report.

Stelrad Group (LSE:SRAD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Stelrad Group PLC manufactures and distributes radiators across the United Kingdom, Ireland, Europe, Turkey, and internationally with a market cap of £216.50 million.

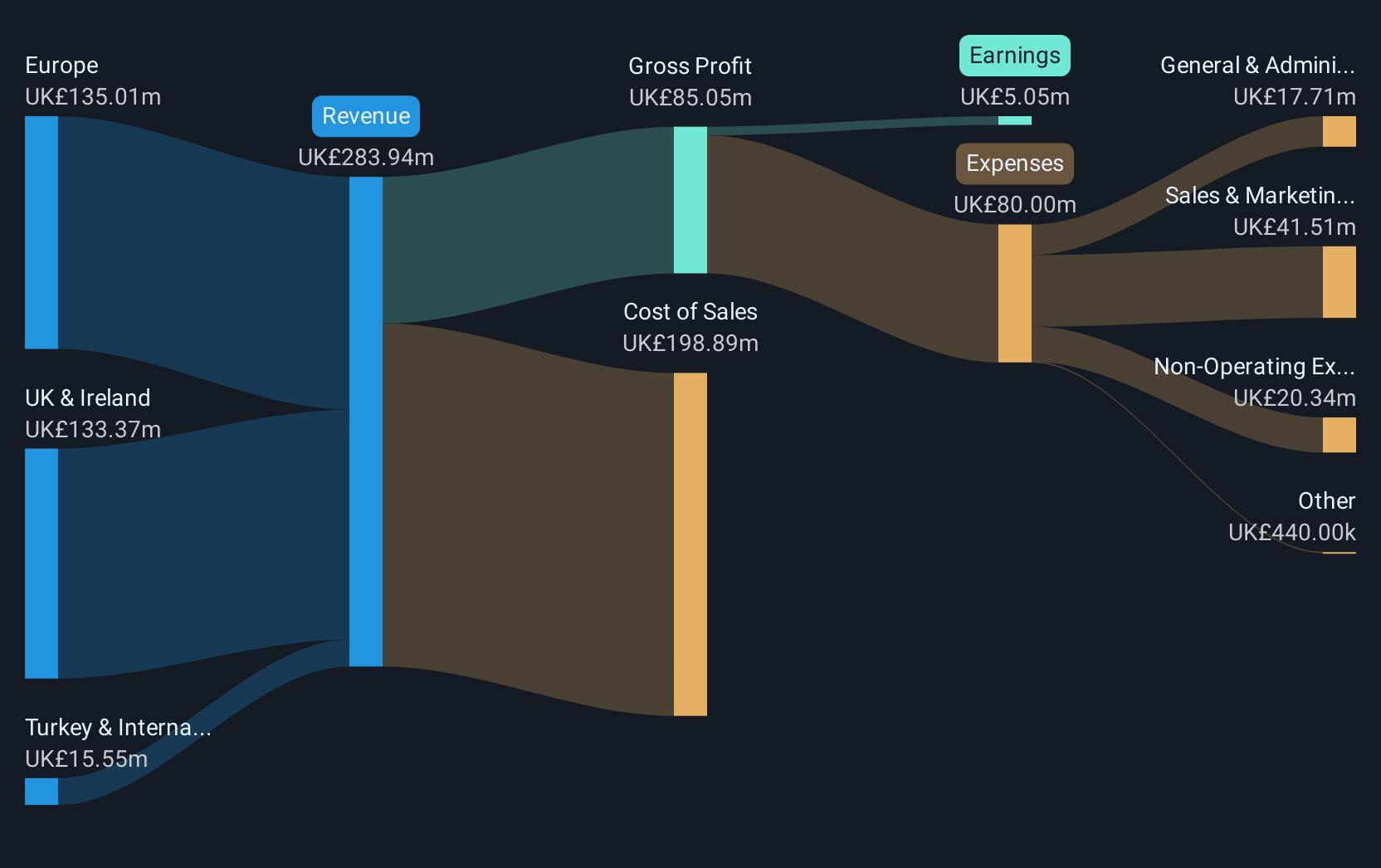

Operations: The company's revenue is generated entirely from its radiator manufacturing and distribution segment, amounting to £283.94 million.

Market Cap: £216.5M

Stelrad Group PLC, with a market cap of £216.50 million, has faced recent financial challenges, reporting a net loss of £3.45 million for the half year ended June 2025 due to a significant one-off loss of £9.6 million impacting results. Despite trading at 36% below estimated fair value and having short-term assets exceeding liabilities, the company struggles with high net debt to equity ratio (125.3%) and declining profit margins from 5.3% to 1.8%. While debt is well-covered by operating cash flow and interest payments are manageable, dividend sustainability remains questionable given current earnings coverage issues.

- Dive into the specifics of Stelrad Group here with our thorough balance sheet health report.

- Gain insights into Stelrad Group's future direction by reviewing our growth report.

Where To Now?

- Embark on your investment journey to our 299 UK Penny Stocks selection here.

- Curious About Other Options? The end of cancer? These 26 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SRAD

Stelrad Group

Manufactures and distributes radiators in the United Kingdom, Ireland, Europe, Turkey, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives