- United States

- /

- Transportation

- /

- NYSE:UBER

Uber Technologies (UBER) Announces Q2 Earnings Growth and US$20 Billion Share Repurchase

Reviewed by Simply Wall St

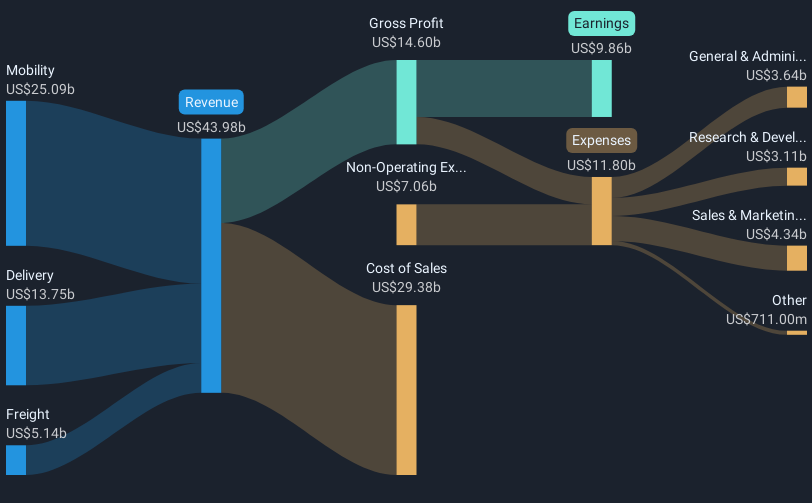

Uber Technologies (UBER) recently announced considerable positive developments, including robust second-quarter revenue growth and a significant share buyback program, which may have bolstered investor confidence. The company's stock rose 8%, aligning with a broader market uptrend influenced by positive corporate earnings announcements and a general uptick in the tech sector. Uber's optimistic third-quarter guidance, including contributions from its Trendyol Go acquisition, and collaborative strategic initiatives like partnerships in autonomous vehicle operations, suggest a positive trajectory. These factors seem to have portended well with the prevailing sentiment, enhancing its appeal against recent market volatility concerns.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

Uber Technologies's recent announcements of robust quarterly revenue growth and a major share buyback program bode well for enhancing shareholder value, aligning with its strategic narrative of expanding user engagement and cross-platform integration. Over the past five years, Uber's total return, including share price appreciation and dividends, has been 189.30%, showcasing strong longer-term performance. Comparatively, Uber's shares have outpaced both the broader market and the US Transportation industry in the past year, demonstrating resilience and adaptability amid market shifts.

The company's strategic moves in autonomous vehicles and partnerships could potentially impact future revenue and earnings forecasts. Analysts expect Uber's revenue to grow 12.14% per year, although earnings are anticipated to decline by an average of 1.7% annually over the next three years. Recent positive developments, however, could refine these outlooks if execution aligns with growth expectations.

Currently trading at US$89.22, Uber's share price is below the consensus price target of US$103.05, indicating a potential upside according to analyst consensus. While the price target suggests further growth potential, investors should consider both risks and opportunities as part of their own assessments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives