- United States

- /

- Software

- /

- NYSE:TYL

Tyler Technologies (NYSE:TYL) Expands Partnership With Kenosha To Modernize City Operations

Reviewed by Simply Wall St

Tyler Technologies (NYSE:TYL) recently signed an agreement with the city of Kenosha, Wisconsin, to upgrade its ERP system with Tyler’s integrated software solutions. This agreement, combined with the integration of Equifax’s The Work Number, positions the company to enhance its product offering in the public sector. While the company's stock rose by 3% over the past month, broadly in line with the market's upward trend of 2% over the past week and a 12% rise over the year, these strategic moves may have added weight to Tyler's stock performance relative to broader market trends.

Find companies with promising cash flow potential yet trading below their fair value.

Tyler Technologies' recent contract with the city of Kenosha and the integration of Equifax's The Work Number aim to bolster its offerings in the public sector, potentially boosting future revenue by expanding its client base and enhancing service capabilities. While the stock experienced a 3% rise over the past month, it's important to note that over the past three years, the company's total shareholder return reached 58.44%. This contrasts with its performance relative to the US Software industry, where it underperformed the industry average of 23.4% over the past year.

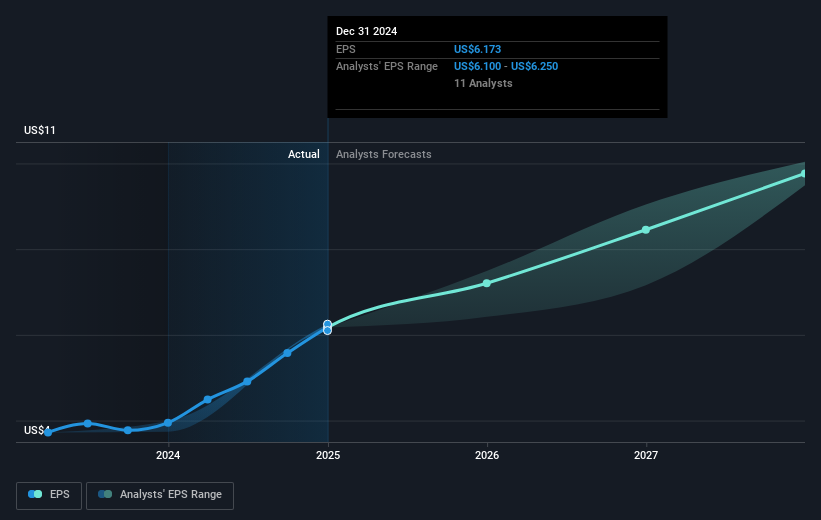

The focus on SaaS growth and a cloud-first strategy offers potential for increased recurring revenue streams. Analysts project that these strategic initiatives could lead to stronger revenue and earnings forecasts. Specifically, they expect Tyler Technologies' revenue to grow by 9.4% annually over the next three years. However, the recent news could add complexity to these forecasts, given the inherent challenges in timing and execution of SaaS and cloud transitions.

With the current share price at US$552.67 and an analyst price target of US$673.39, the potential upside is about 17.9%. However, investors should consider that the stock's Price-To-Earnings ratio remains high compared to industry peers and the broader market, indicating that the market has already priced in some of the anticipated growth. Investors should consistently evaluate these projections against their expectations for Tyler Technologies' market positioning and strategic execution.

Jump into the full analysis health report here for a deeper understanding of Tyler Technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tyler Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TYL

Tyler Technologies

Provides integrated software and technology management solutions for the public sector.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives