- Canada

- /

- Oil and Gas

- /

- TSX:CCO

TSX Value Picks Featuring First Majestic Silver And Two More Stocks Trading Below Estimated Worth

Reviewed by Simply Wall St

As the Canadian market navigates ongoing tariff uncertainties, investors have remained resilient, with the TSX showing strong performance in recent months. In this environment, identifying undervalued stocks can be a strategic move for those looking to capitalize on potential growth opportunities; First Majestic Silver and two other stocks present intriguing cases of trading below their estimated worth.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TerraVest Industries (TSX:TVK) | CA$169.13 | CA$302.04 | 44% |

| OceanaGold (TSX:OGC) | CA$6.65 | CA$12.25 | 45.7% |

| Magna Mining (TSXV:NICU) | CA$1.64 | CA$3.08 | 46.7% |

| Lithium Royalty (TSX:LIRC) | CA$5.21 | CA$8.50 | 38.7% |

| Journey Energy (TSX:JOY) | CA$1.80 | CA$2.90 | 38% |

| Groupe Dynamite (TSX:GRGD) | CA$15.99 | CA$28.78 | 44.4% |

| First Majestic Silver (TSX:AG) | CA$11.48 | CA$20.38 | 43.7% |

| Endeavour Silver (TSX:EDR) | CA$6.22 | CA$11.92 | 47.8% |

| Docebo (TSX:DCBO) | CA$36.72 | CA$57.16 | 35.8% |

| Alphamin Resources (TSXV:AFM) | CA$0.85 | CA$1.34 | 36.4% |

Let's explore several standout options from the results in the screener.

First Majestic Silver (TSX:AG)

Overview: First Majestic Silver Corp. focuses on the acquisition, exploration, development, and production of mineral properties in North America with a market cap of CA$4.82 billion.

Operations: The company's revenue segments include $214.85 million from San Dimas in Mexico, $306.40 million from Santa Elena in Mexico, $73.16 million from La Encantada in Mexico, and $22.88 million from First Mint in the United States.

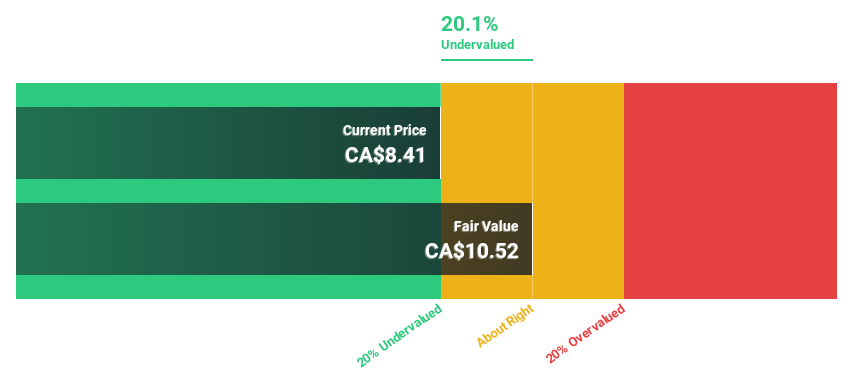

Estimated Discount To Fair Value: 43.7%

First Majestic Silver Corp. appears undervalued based on discounted cash flow analysis, trading at CA$11.48, significantly below its estimated fair value of CA$20.38. Recent discoveries at the Navidad and Santo Nino veins have expanded their mineral resource base, enhancing potential future cash flows. Despite past shareholder dilution, the company reported improved financial results with a net income of US$2.26 million for Q1 2025 and is expected to achieve profitability within three years, outpacing market growth expectations.

- The analysis detailed in our First Majestic Silver growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of First Majestic Silver.

Cameco (TSX:CCO)

Overview: Cameco Corporation is a company that supplies uranium for electricity generation and has a market capitalization of CA$35.70 billion.

Operations: Cameco's revenue is primarily derived from its Uranium segment at CA$2.73 billion, Fuel Services at CA$521.38 million, and Westinghouse (WEC) contributing CA$3.01 billion.

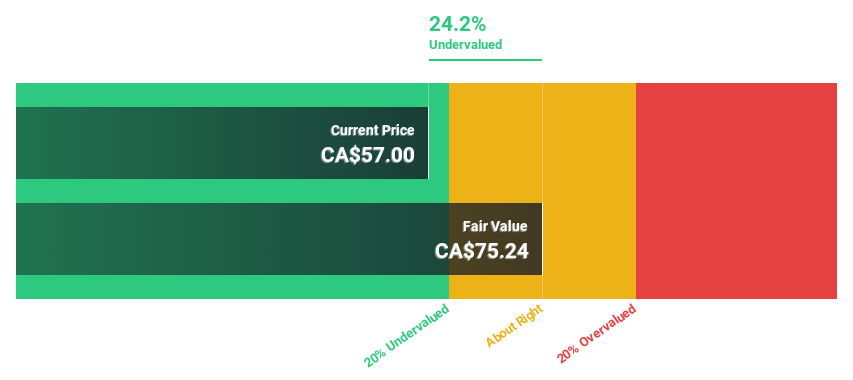

Estimated Discount To Fair Value: 11.1%

Cameco Corporation is trading at CA$82.07, which is 11.1% below its estimated fair value of CA$92.27, indicating potential undervaluation based on cash flows. The company's earnings are expected to grow significantly at 27.12% annually over the next three years, outpacing the Canadian market's growth rate of 12.2%. Recent financial results show a turnaround with a net income of CA$69.76 million for Q1 2025 compared to a loss last year, supporting its positive cash flow outlook.

- Upon reviewing our latest growth report, Cameco's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Cameco.

Endeavour Silver (TSX:EDR)

Overview: Endeavour Silver Corp. is a silver mining company involved in the acquisition, exploration, development, extraction, processing, refining, and reclamation of mineral properties across Mexico, Chile, Peru, and the United States with a market cap of CA$1.67 billion.

Operations: The company's revenue is derived from its operations at the Bolanitos mine, which generated $72.36 million, and the Guanaceví mine, contributing $145.05 million.

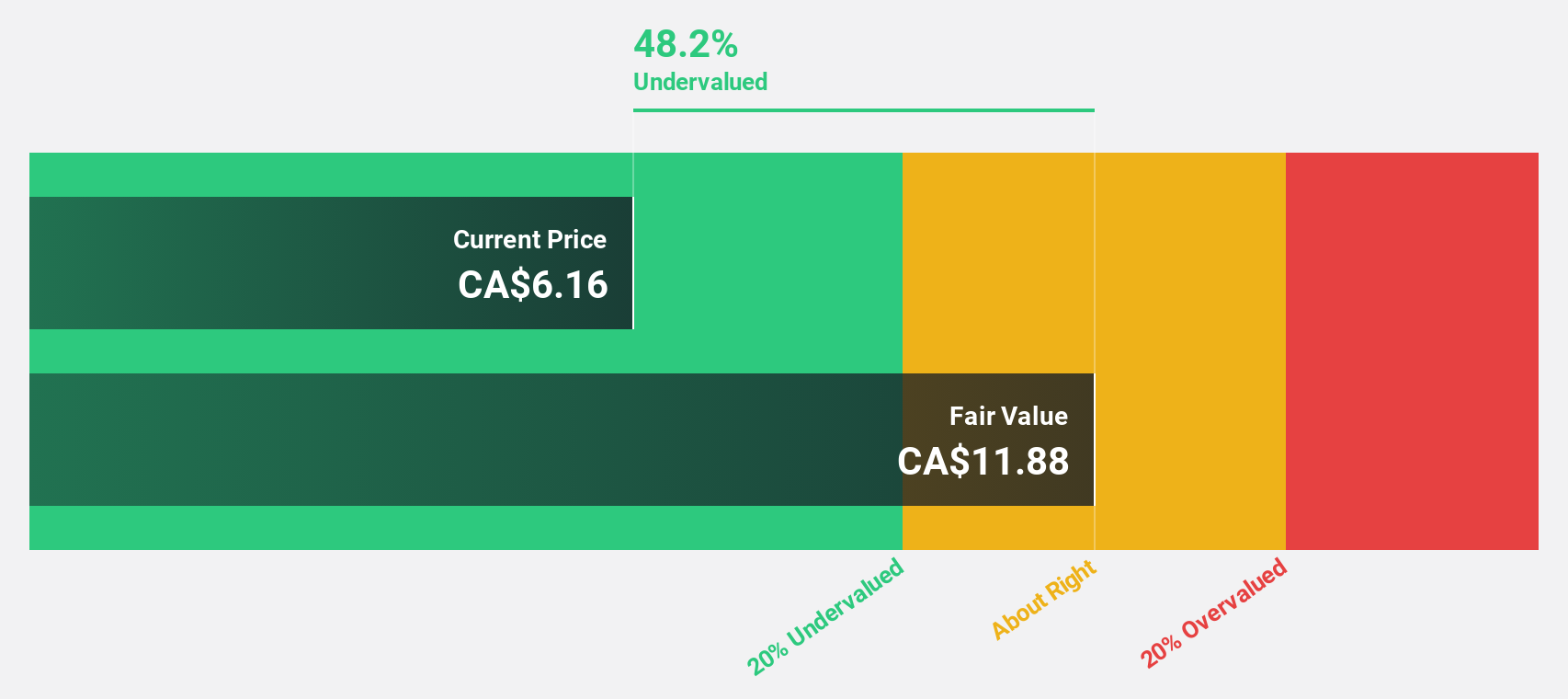

Estimated Discount To Fair Value: 47.8%

Endeavour Silver, trading at CA$6.22, is valued significantly below its estimated fair value of CA$11.92, presenting a potential undervaluation based on cash flows. Despite recent shareholder dilution and insider selling, the company is expected to become profitable within three years with revenue growth forecasted at 35.3% annually—outpacing the Canadian market's 3.9%. Recent positive drill results from Mexico enhance resource confidence, while ongoing project developments suggest operational advancements ahead.

- Our earnings growth report unveils the potential for significant increases in Endeavour Silver's future results.

- Navigate through the intricacies of Endeavour Silver with our comprehensive financial health report here.

Summing It All Up

- Gain an insight into the universe of 23 Undervalued TSX Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CCO

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives