- Canada

- /

- Specialty Stores

- /

- TSX:ROOT

TSX Spotlight: 3 Penny Stocks With Market Caps Over CA$60M

Reviewed by Simply Wall St

As global economic dynamics shift, Canadian markets are navigating a complex landscape influenced by new tariffs and fiscal policies. Despite these challenges, certain investment areas continue to offer potential opportunities for growth. Penny stocks, often misunderstood as relics of past market eras, still hold promise when backed by strong financials and fundamentals. In this article, we explore several penny stocks that stand out for their financial resilience and potential for long-term success in the current market climate.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.69 | CA$70.8M | ✅ 3 ⚠️ 3 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$2.16 | CA$104.26M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.44 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.41 | CA$429.38M | ✅ 4 ⚠️ 0 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.76 | CA$498.97M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.60 | CA$190.84M | ✅ 1 ⚠️ 1 View Analysis > |

| ACT Energy Technologies (TSX:ACX) | CA$4.54 | CA$153.38M | ✅ 4 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.93 | CA$184.2M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.22 | CA$9.14M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 445 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Roots (TSX:ROOT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Roots Corporation, along with its subsidiaries, designs, markets, and sells apparel, leather goods, footwear, and accessories under the Roots brand in Canada and internationally with a market cap of CA$123.34 million.

Operations: The company's revenue is primarily generated from its Direct-To-Consumer segment, which accounts for CA$226.46 million, supplemented by CA$38.98 million from Partners and Other activities.

Market Cap: CA$123.34M

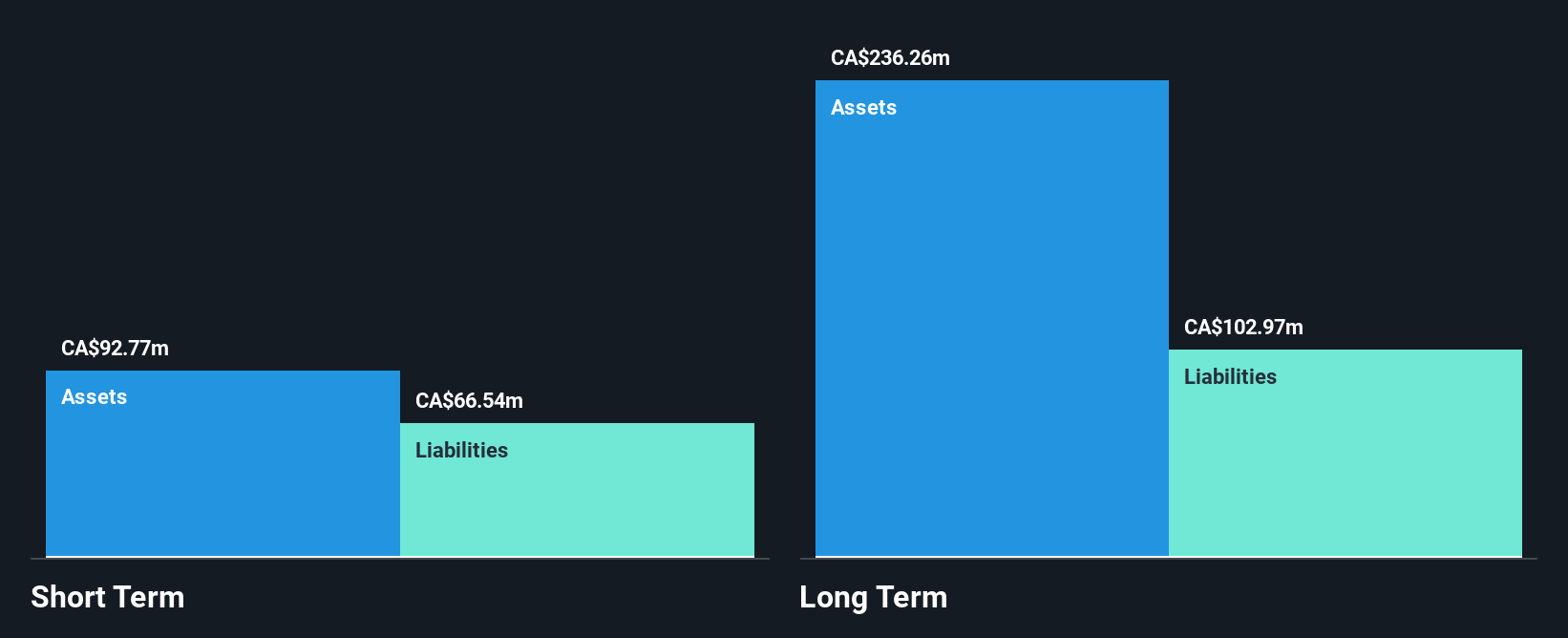

Roots Corporation, with a market cap of CA$123.34 million, has shown resilience despite being unprofitable. The company reported first-quarter sales of CA$39.98 million, an increase from the previous year, and reduced its net loss to CA$7.91 million. Roots maintains a satisfactory net debt to equity ratio of 20.1% and has not significantly diluted shareholders over the past year. The management team is experienced with an average tenure of 2.5 years, while the board's tenure averages 7.1 years, offering stability in leadership as it navigates financial challenges and seeks growth opportunities in the retail sector.

- Click to explore a detailed breakdown of our findings in Roots' financial health report.

- Learn about Roots' future growth trajectory here.

BuildDirect.com Technologies (TSXV:BILD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BuildDirect.com Technologies Inc. operates an online marketplace for buying and selling building materials across the United States, Canada, and internationally, with a market cap of CA$65.22 million.

Operations: The company's revenue is derived from two segments: Builddirect, generating $15.59 million, and Pro Centers, contributing $49.38 million.

Market Cap: CA$65.22M

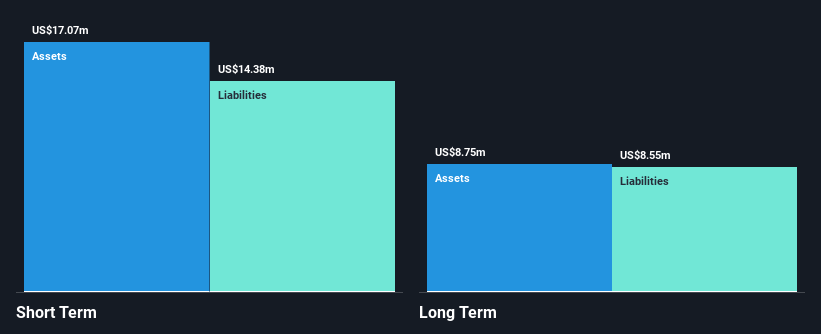

BuildDirect.com Technologies Inc., with a market cap of CA$65.22 million, is navigating financial challenges as it remains unprofitable but has improved its position by reducing losses over the past five years. The company's short-term assets exceed both its short and long-term liabilities, providing some financial stability despite a high net debt to equity ratio of 369%. Recent developments include securing loans to facilitate management's acquisition of shares, aligning their interests with shareholders. Additionally, BuildDirect entered into a supply agreement valued at up to US$2 million, marking progress in its commercial strategy within the recreational sector.

- Get an in-depth perspective on BuildDirect.com Technologies' performance by reading our balance sheet health report here.

- Explore historical data to track BuildDirect.com Technologies' performance over time in our past results report.

American Lithium (TSXV:LI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: American Lithium Corp. focuses on the identification, acquisition, and exploration of mineral properties in Canada, the United States, and Peru with a market cap of CA$81.56 million.

Operations: There are no reported revenue segments for American Lithium Corp.

Market Cap: CA$81.56M

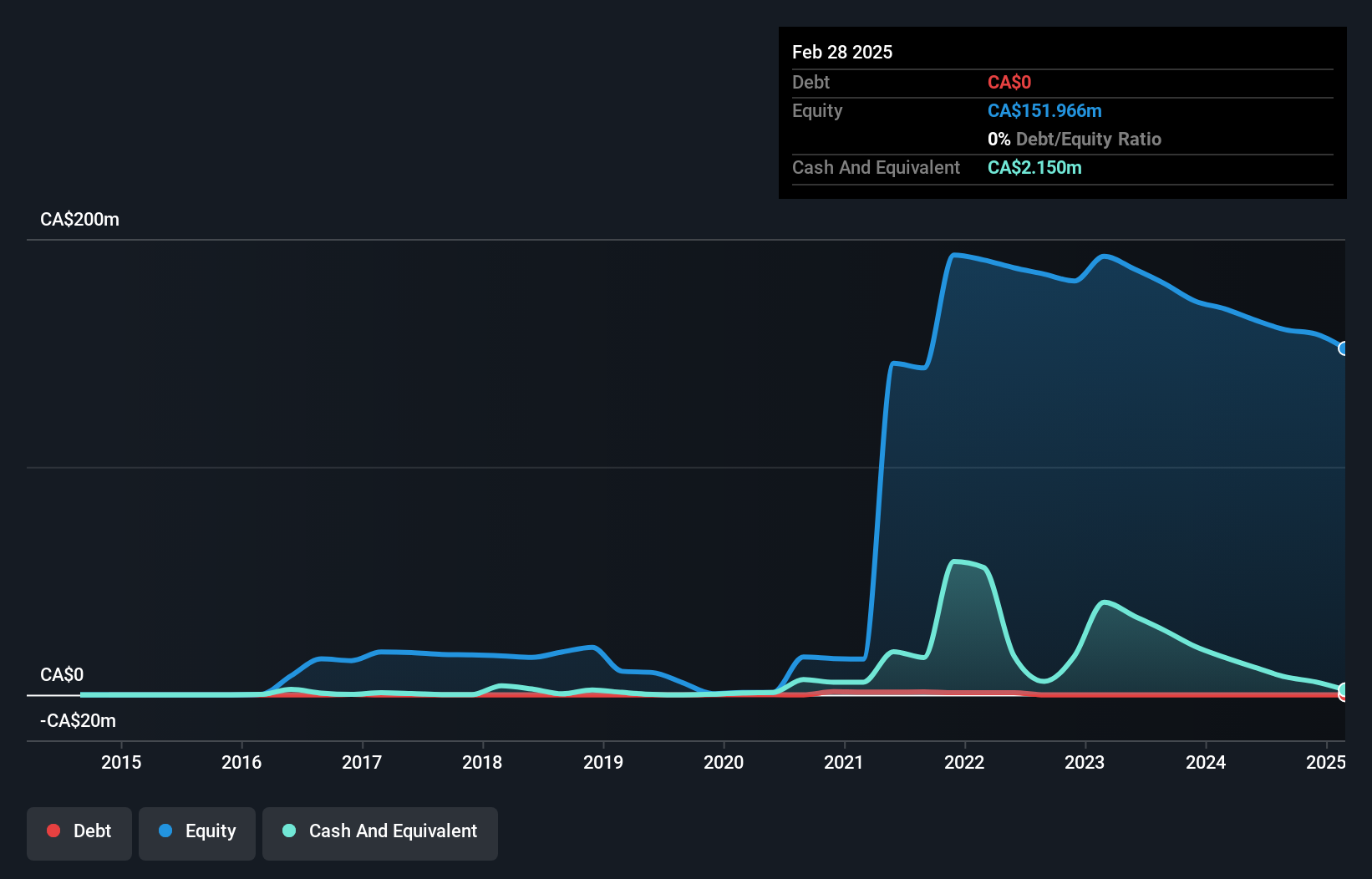

American Lithium Corp., with a market cap of CA$81.56 million, is pre-revenue and faces financial challenges, including a recent net loss of CA$25 million for the year ended February 28, 2025. The company has no debt but struggles with short-term liabilities exceeding its assets by CA$1.3 million. Despite this, it recently raised CA$8.1 million through a private placement to bolster its cash runway beyond the current two-month estimate based on past free cash flow trends. However, auditor concerns about its ability to continue as a going concern remain significant hurdles for potential investors.

- Click here and access our complete financial health analysis report to understand the dynamics of American Lithium.

- Assess American Lithium's previous results with our detailed historical performance reports.

Seize The Opportunity

- Embark on your investment journey to our 445 TSX Penny Stocks selection here.

- Looking For Alternative Opportunities? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 26 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ROOT

Roots

Designs, markets, and sells apparel, leather goods, footwear, and accessories under the Roots brand in Canada and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives