- United States

- /

- Banks

- /

- NasdaqGS:TCBK

TriCo Bancshares And 2 Other Leading Dividend Stocks

Reviewed by Simply Wall St

In the current U.S. market, where stocks have been inching higher amid benign inflation data and progress in China-U.S. trade talks, investors are keenly observing the S&P 500 and Nasdaq as they aim for their fourth consecutive day of gains. With these positive economic indicators, dividend stocks like TriCo Bancshares offer potential stability and income opportunities, making them an attractive consideration for those looking to navigate the evolving financial landscape.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Universal (UVV) | 5.42% | ★★★★★★ |

| Southside Bancshares (SBSI) | 4.98% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.68% | ★★★★★★ |

| Ennis (EBF) | 5.32% | ★★★★★★ |

| Dillard's (DDS) | 6.44% | ★★★★★★ |

| CompX International (CIX) | 5.04% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.98% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.88% | ★★★★★☆ |

| Chevron (CVX) | 4.77% | ★★★★★★ |

| Carter's (CRI) | 9.82% | ★★★★★☆ |

Click here to see the full list of 146 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

TriCo Bancshares (TCBK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TriCo Bancshares is a bank holding company for Tri Counties Bank, offering commercial banking services to individual and corporate customers, with a market cap of approximately $1.35 billion.

Operations: TriCo Bancshares generates its revenue primarily through its Community Banking segment, which accounts for $389.80 million.

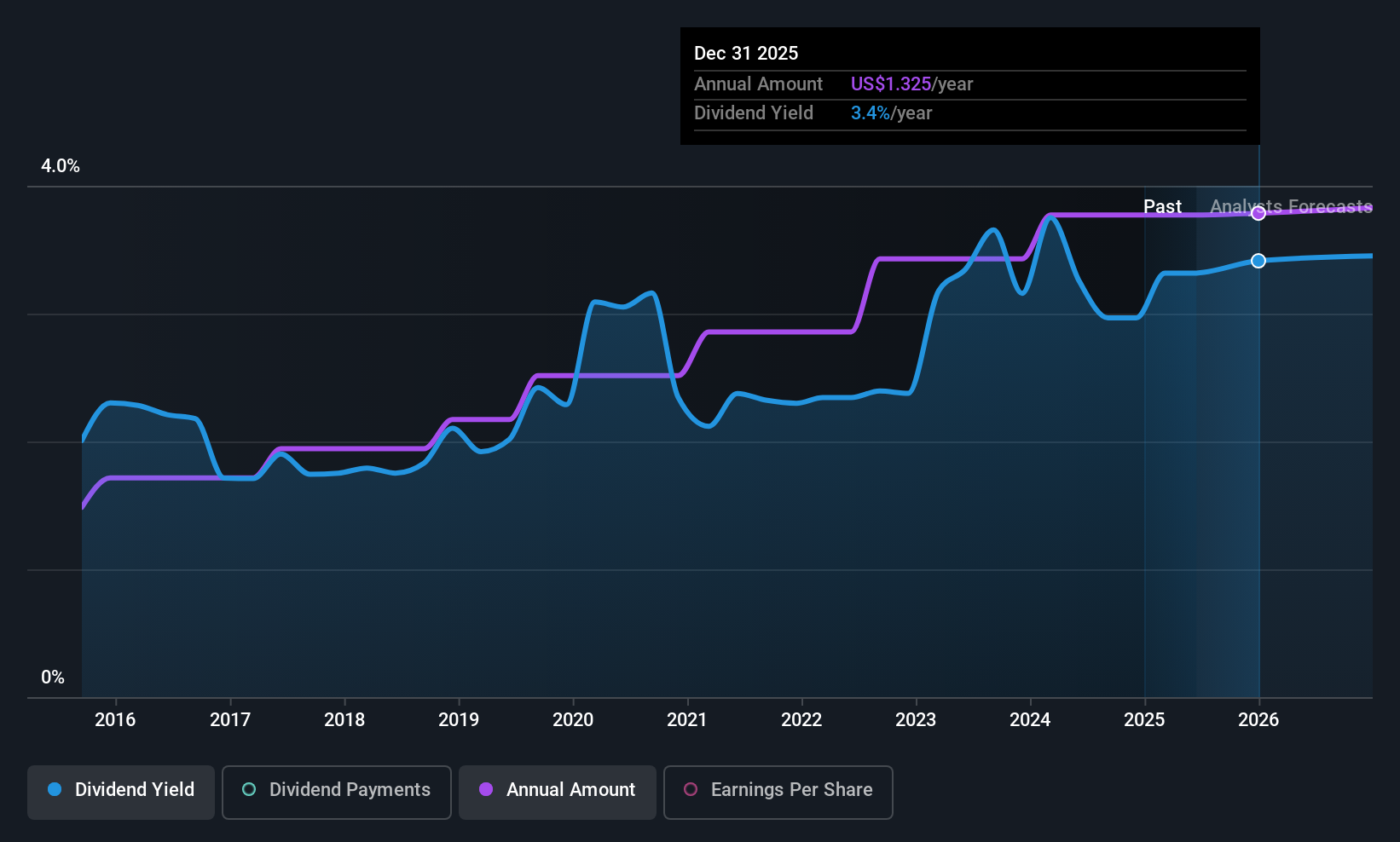

Dividend Yield: 3.2%

TriCo Bancshares offers a stable dividend yield of 3.21%, which is reliable and well-covered by earnings due to a low payout ratio of 38.4%. Although the yield is below the top quartile in the US, dividends have grown steadily over the past decade. Recent financials show slight declines in net income and earnings per share year-over-year, but loan charge-offs have decreased significantly. The company continues to return value through share buybacks, completing a repurchase program totaling $51.8 million since 2021.

- Delve into the full analysis dividend report here for a deeper understanding of TriCo Bancshares.

- Our comprehensive valuation report raises the possibility that TriCo Bancshares is priced lower than what may be justified by its financials.

Carter's (CRI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Carter's, Inc. designs, sources, and markets branded childrenswear and related products under various brands such as Carter's and OshKosh in the United States and internationally, with a market cap of approximately $1.16 billion.

Operations: Carter's revenue segments include U.S. Retail at $1.40 billion, International at $401.18 million, and U.S. Wholesale at $1.01 billion.

Dividend Yield: 9.8%

Carter's dividend yield of 9.82% ranks in the top quartile of US payers, but its history is marked by volatility and unreliability. Despite a reasonable payout ratio covered by earnings (70.9%) and cash flows (52.7%), recent financials show declining sales and net income, with Q1 2025 net income at US$15.54 million compared to US$38.03 million a year ago, highlighting potential sustainability concerns amidst leadership changes and strategic brand collaborations like Little Planet's partnership with Once Upon a Farm.

- Click here to discover the nuances of Carter's with our detailed analytical dividend report.

- Our valuation report unveils the possibility Carter's shares may be trading at a premium.

Southside Bancshares (SBSI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Southside Bancshares, Inc. is the bank holding company for Southside Bank, offering a range of financial services to individuals, businesses, municipal entities, and nonprofit organizations with a market cap of $861.40 million.

Operations: Southside Bancshares, Inc. generates revenue primarily through its banking segment, which accounts for $254.82 million in financial services provided to a diverse clientele.

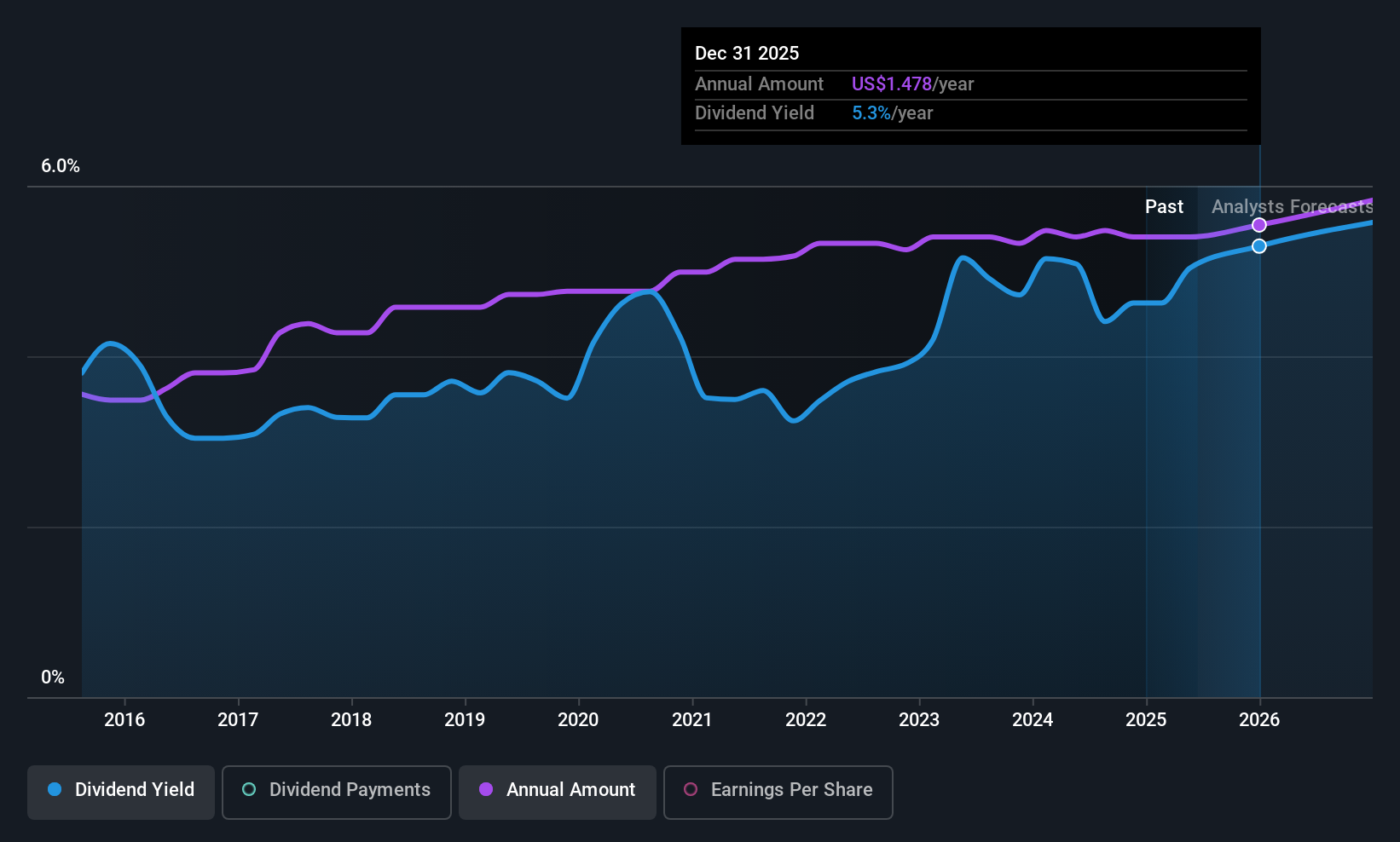

Dividend Yield: 5%

Southside Bancshares offers a stable dividend yield of 4.98%, ranking in the top 25% of US payers, with consistent growth over the past decade. Its payout ratio of 49.4% suggests dividends are well covered by earnings, though future sustainability remains uncertain due to insufficient data on long-term coverage. Recently, Southside filed a $34.43 million shelf registration and completed share buybacks worth $17.21 million, indicating strategic capital management amidst steady earnings performance.

- Navigate through the intricacies of Southside Bancshares with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Southside Bancshares is trading behind its estimated value.

Key Takeaways

- Access the full spectrum of 146 Top US Dividend Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TriCo Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TCBK

TriCo Bancshares

Operates as a bank holding company for Tri Counties Bank that provides commercial banking services to individual and corporate customers.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives