As the U.S. government shutdown creates uncertainty south of the border, Canada's market remains resilient, buoyed by strong consumer spending and significant investments in artificial intelligence. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for investors seeking to navigate these turbulent times.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Sun Life Financial (TSX:SLF) | 4.13% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.11% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.00% | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | 13.70% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.03% | ★★★★★☆ |

| Olympia Financial Group (TSX:OLY) | 6.00% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.12% | ★★★★★☆ |

| Magna International (TSX:MG) | 3.94% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 3.41% | ★★★★★☆ |

| Bank of Montreal (TSX:BMO) | 3.61% | ★★★★★☆ |

Click here to see the full list of 23 stocks from our Top TSX Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Evertz Technologies (TSX:ET)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Evertz Technologies Limited designs, manufactures, and distributes video and audio infrastructure solutions for the production, post-production, broadcast, and telecommunications markets globally with a market cap of CA$914.21 million.

Operations: Evertz Technologies generates revenue primarily from the Television Broadcast Equipment Market, amounting to CA$502.13 million.

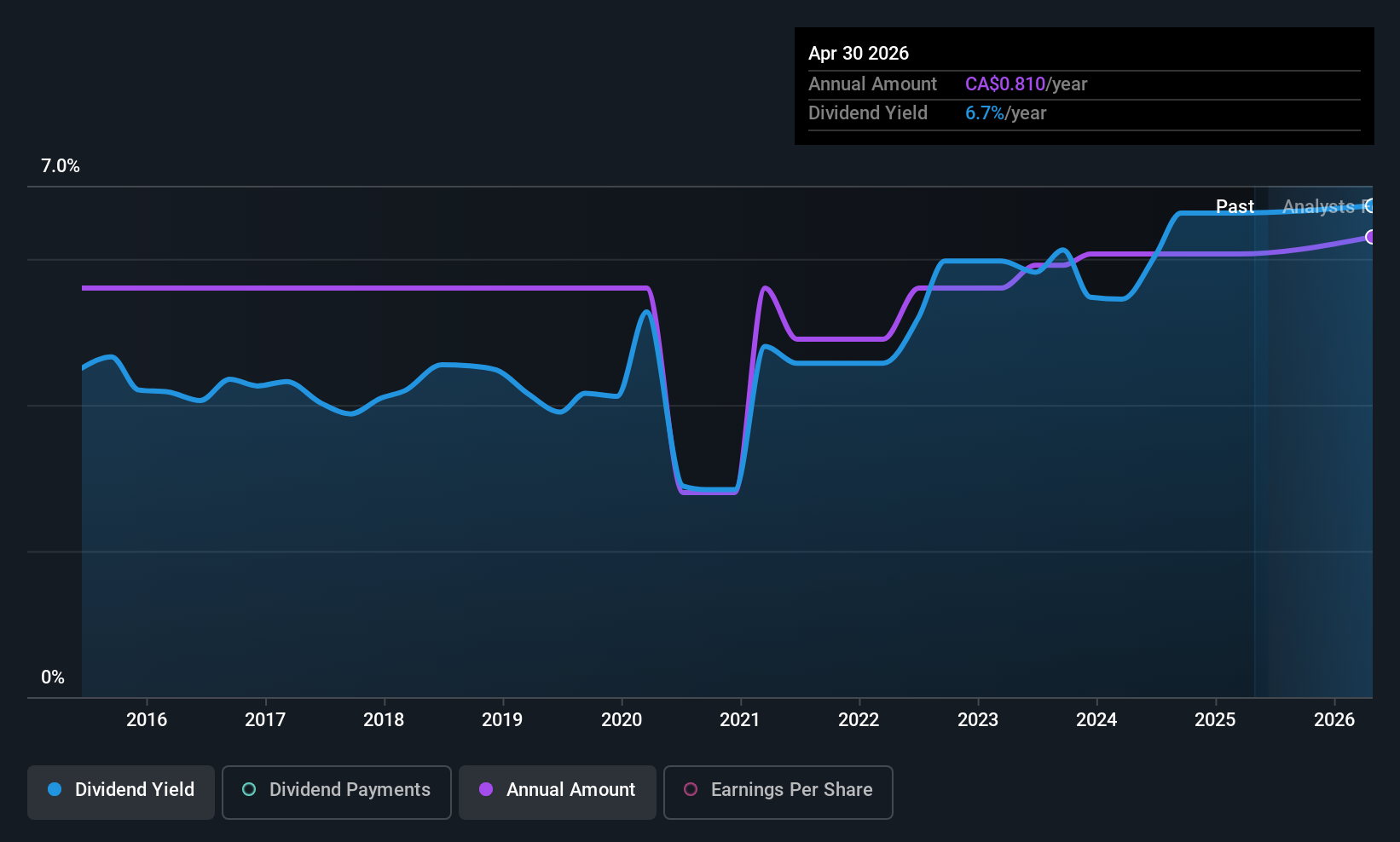

Dividend Yield: 6.6%

Evertz Technologies offers a dividend yield of 6.6%, placing it in the top 25% of Canadian dividend payers. However, its dividends have been volatile over the past decade and are not well covered by earnings due to a high payout ratio of 98.6%. While cash flows cover dividends with a cash payout ratio of 58.3%, the company's focus on acquisitions may impact future payouts despite recent affirmations and share buybacks amounting to CAD 5.8 million.

- Unlock comprehensive insights into our analysis of Evertz Technologies stock in this dividend report.

- Our valuation report unveils the possibility Evertz Technologies' shares may be trading at a discount.

High Liner Foods (TSX:HLF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: High Liner Foods Incorporated processes and markets prepared and packaged frozen seafood products in North America, with a market cap of CA$492.63 million.

Operations: High Liner Foods generates revenue of $971.97 million from its manufacturing and marketing of prepared and packaged frozen seafood products.

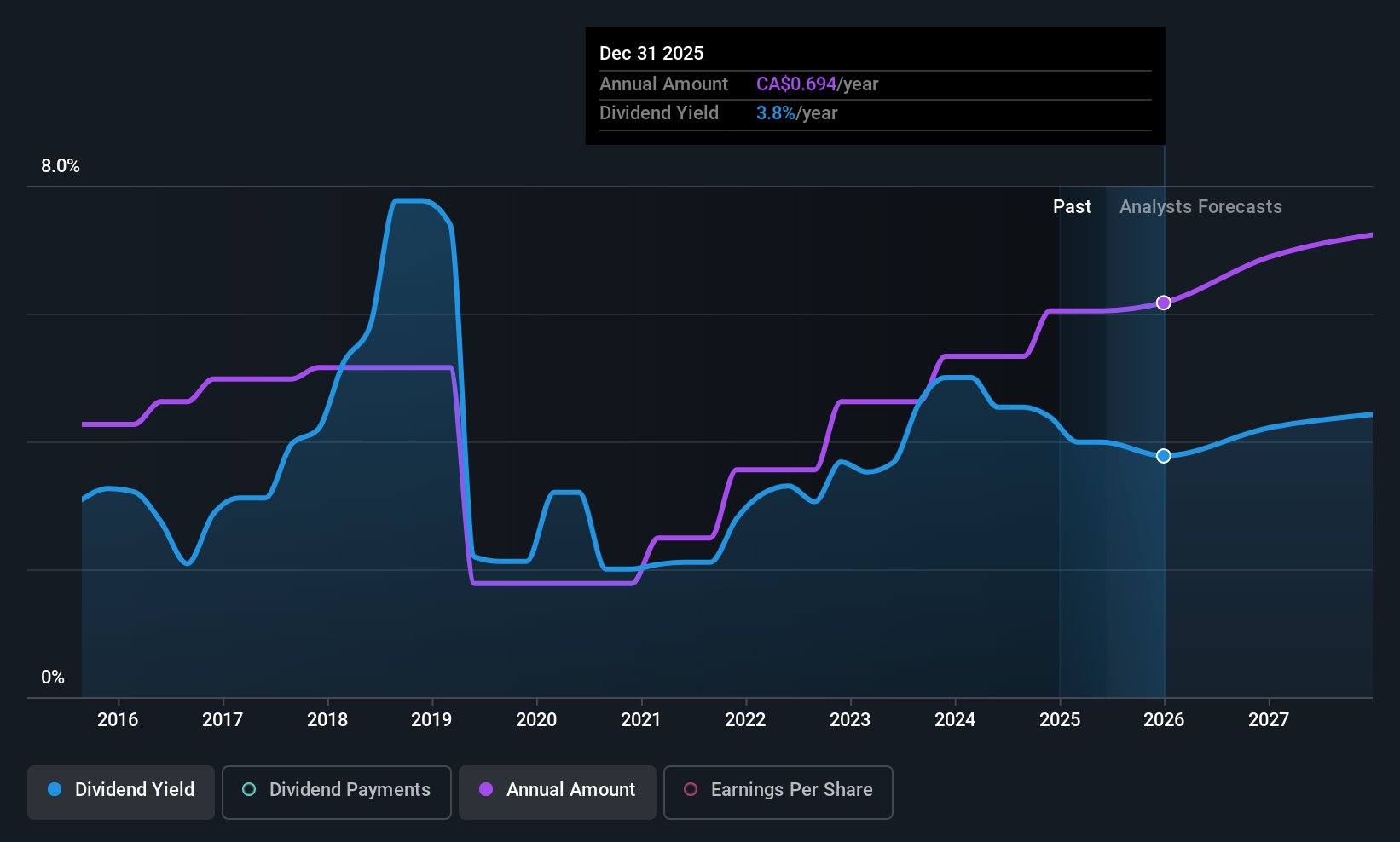

Dividend Yield: 4.1%

High Liner Foods' dividend payments are covered by earnings with a payout ratio of 28.9%, though cash flow coverage is tighter at 81.4%. Despite a history of volatility, dividends have grown over the past decade. The stock trades below estimated fair value, offering potential upside. Recent executive changes saw Kimberly Stephens appointed as CFO, succeeding Darryl Bergman. Earnings have been mixed; Q2 sales rose to US$239.61 million, but net income declined to US$8.47 million year-over-year.

- Click here and access our complete dividend analysis report to understand the dynamics of High Liner Foods.

- Upon reviewing our latest valuation report, High Liner Foods' share price might be too pessimistic.

National Bank of Canada (TSX:NA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Bank of Canada offers financial services to individuals, businesses, institutional clients, and governments both domestically and internationally, with a market cap of CA$59.30 billion.

Operations: National Bank of Canada's revenue is primarily derived from its Personal and Commercial segment at CA$4.44 billion, Wealth Management at CA$3.10 billion, Financial Markets (excluding USSF&I) at CA$3.67 billion, and U.S. Specialty Finance and International (USSF&I) at CA$1.36 billion.

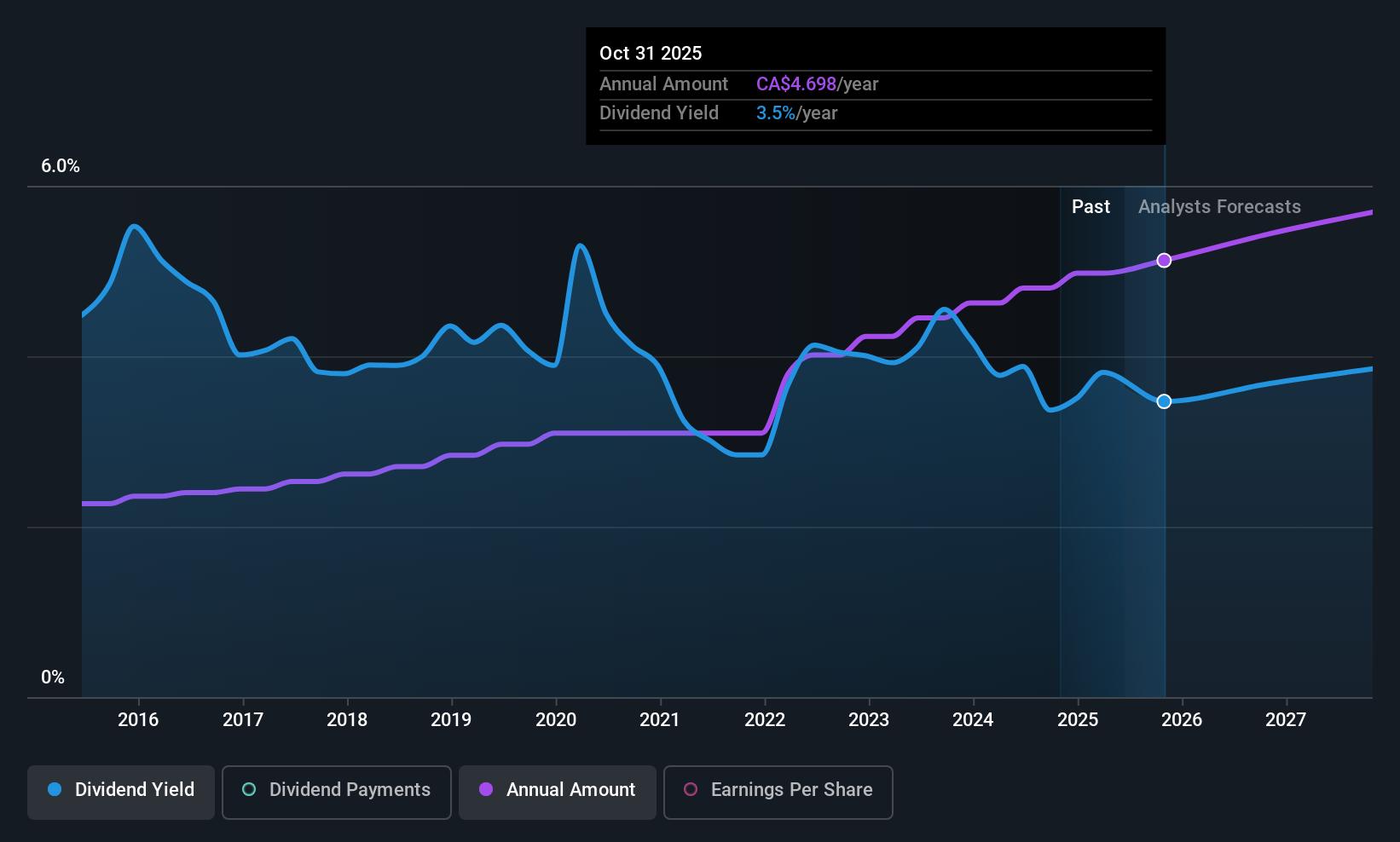

Dividend Yield: 3.1%

National Bank of Canada's dividends are well-covered with a payout ratio of 44.5%, and earnings have grown 10% annually over five years. However, the dividend yield of 3.12% is below the top quartile in Canada. The bank's strategy includes redeeming $500 million in capital notes and a share buyback program for up to 8 million shares, reflecting active capital management. Despite recent shareholder dilution, dividends remain stable and have increased over the past decade.

- Get an in-depth perspective on National Bank of Canada's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of National Bank of Canada shares in the market.

Turning Ideas Into Actions

- Delve into our full catalog of 23 Top TSX Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if National Bank of Canada might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NA

National Bank of Canada

Provides financial services to individuals, businesses, institutional clients, and governments in Canada and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion