- United States

- /

- Biotech

- /

- NasdaqGS:CCCC

Top Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

In the last week, the market has been flat, but it is up 12% over the past year, with earnings expected to grow by 15% per annum over the next few years. Investing in penny stocks—though often seen as a niche area—can still offer growth opportunities, particularly when these stocks are supported by strong financial health. As we explore several penny stocks today, we'll focus on those that combine balance sheet strength with long-term potential.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.42 | $517.18M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.9386 | $154.96M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.34 | $241.38M | ✅ 3 ⚠️ 0 View Analysis > |

| Talkspace (TALK) | $2.78 | $456.77M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $99.78M | ✅ 3 ⚠️ 2 View Analysis > |

| Safe Bulkers (SB) | $3.77 | $384.69M | ✅ 2 ⚠️ 3 View Analysis > |

| Sequans Communications (SQNS) | $2.07 | $52.57M | ✅ 4 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.85 | $6.17M | ✅ 2 ⚠️ 3 View Analysis > |

| North European Oil Royalty Trust (NRT) | $4.90 | $45.95M | ✅ 2 ⚠️ 2 View Analysis > |

| TETRA Technologies (TTI) | $3.54 | $467.09M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 422 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

C4 Therapeutics (CCCC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: C4 Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on developing novel therapeutic candidates to degrade disease-causing proteins, with a market cap of $121.42 million.

Operations: C4 Therapeutics generates its revenue primarily through its Pharmaceuticals segment, which reported $39.78 million.

Market Cap: $121.42M

C4 Therapeutics, Inc. is navigating a challenging landscape as it remains unprofitable with increasing losses over the past five years. Despite having no debt and short-term assets of US$232.5 million exceeding both short and long-term liabilities, the company faces volatility in its share price and was recently dropped from multiple Russell indices, which may impact investor sentiment. The firm reported a net loss of US$26.32 million for Q1 2025 but has a cash runway for nearly two years if current cash flow trends persist. An increase in authorized shares suggests potential future capital raising activities.

- Dive into the specifics of C4 Therapeutics here with our thorough balance sheet health report.

- Learn about C4 Therapeutics' future growth trajectory here.

Sana Biotechnology (SANA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sana Biotechnology, Inc. is a biotechnology company that specializes in developing engineered cells as medicines in the United States, with a market cap of approximately $913.50 million.

Operations: Sana Biotechnology, Inc. currently does not report any revenue segments.

Market Cap: $913.5M

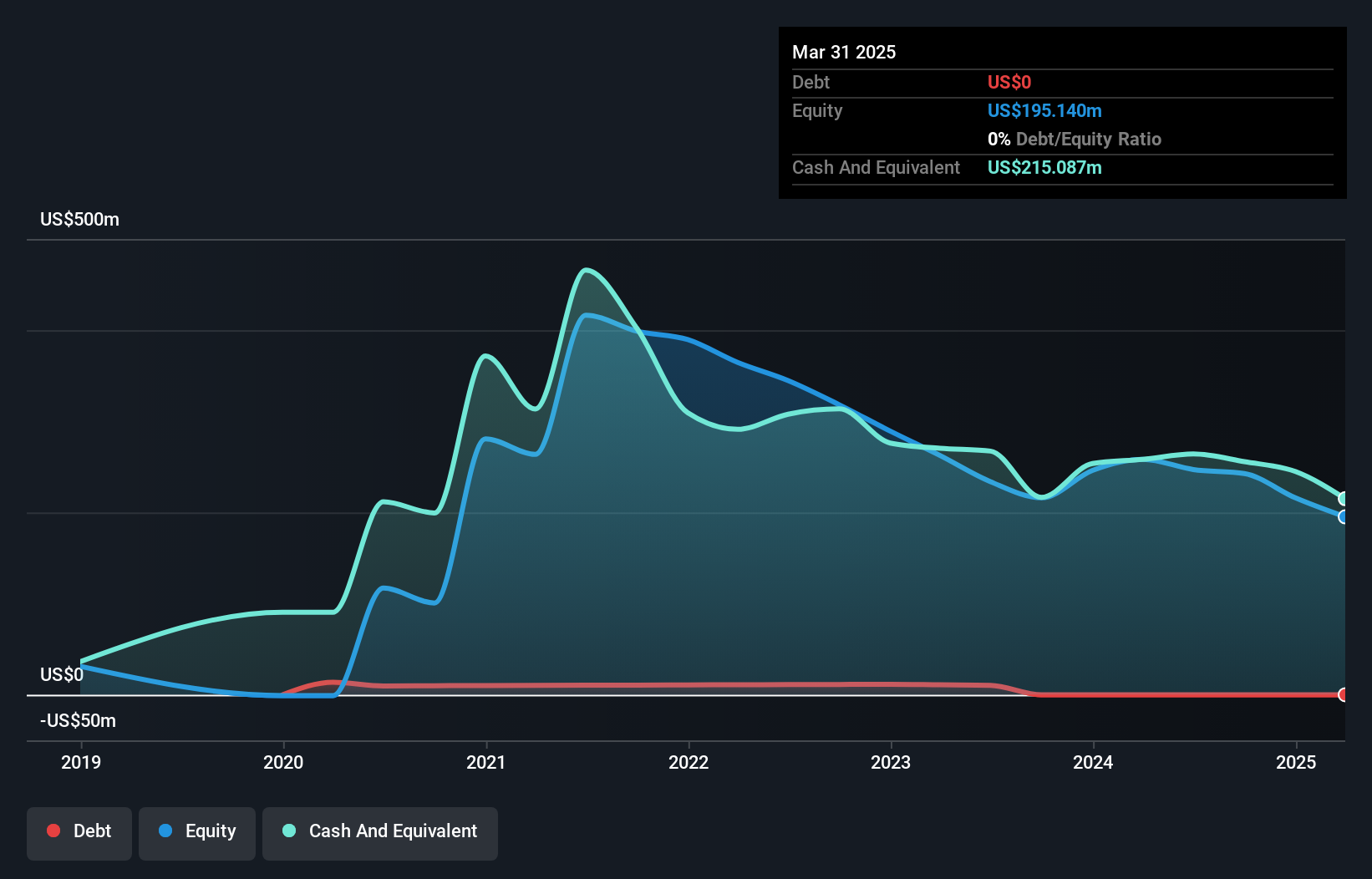

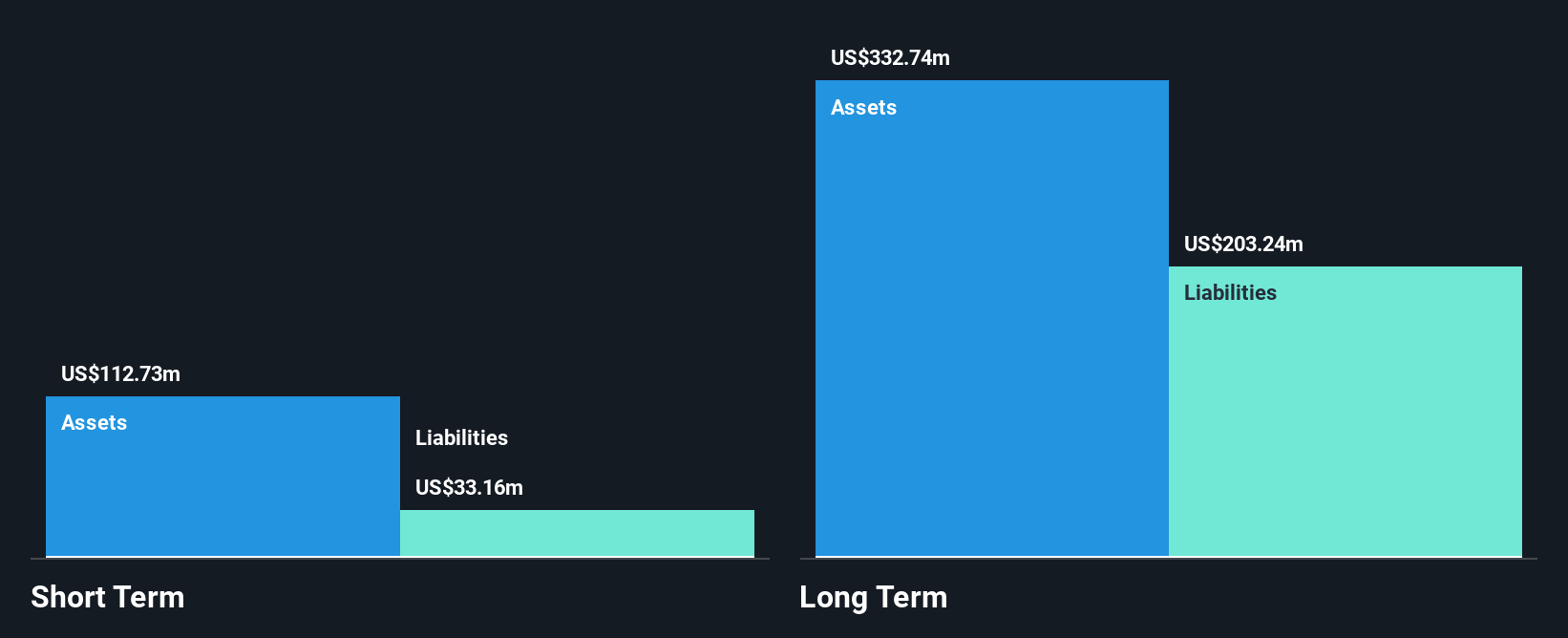

Sana Biotechnology, Inc. is pre-revenue and faces challenges with short-term assets of US$112.7 million not covering long-term liabilities of US$203.2 million, though it has no debt and a seasoned board. Recent volatility in its share price remains high despite a reduction over the past year. The company announced promising six-month results from its UP421 study for type 1 diabetes but faces legal challenges with a class action lawsuit alleging misleading statements about financial stability and product prospects. Sana's inclusion in multiple Russell indices may enhance visibility among investors despite ongoing financial hurdles.

- Click here to discover the nuances of Sana Biotechnology with our detailed analytical financial health report.

- Examine Sana Biotechnology's earnings growth report to understand how analysts expect it to perform.

Tuya (TUYA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tuya Inc. operates as an AI cloud platform service provider in the People’s Republic of China and internationally, with a market cap of approximately $1.49 billion.

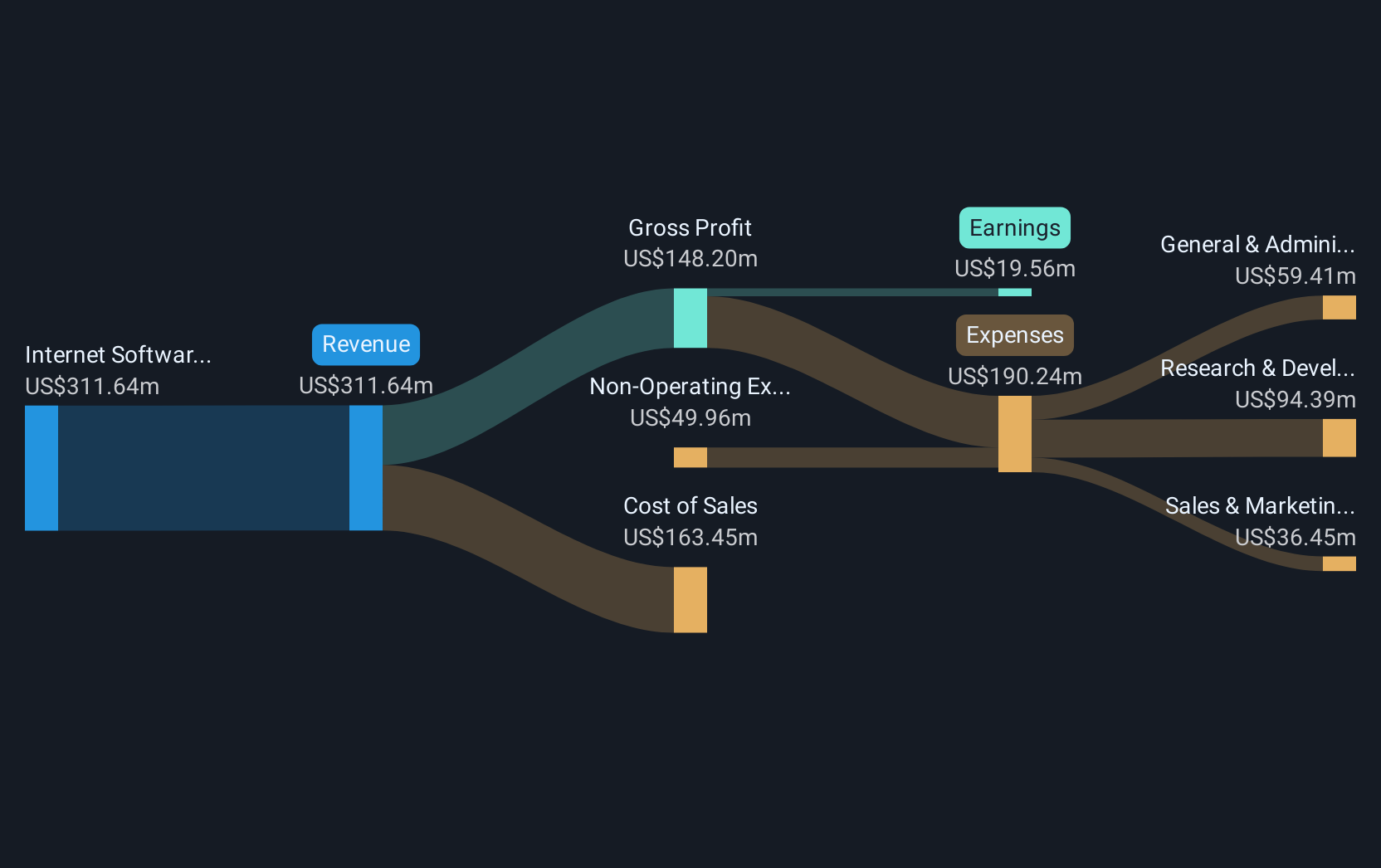

Operations: The company's revenue is derived from its Internet Software & Services segment, amounting to $311.64 million.

Market Cap: $1.49B

Tuya Inc. has shown significant growth, achieving profitability with a net income of US$11.02 million in Q1 2025, compared to a loss the previous year. The company is debt-free, with strong short-term assets of US$913.6 million covering both short and long-term liabilities comfortably. Recent strategic changes include board adjustments and amendments to bylaws for enhanced governance and compliance. Tuya's focus on AIoT innovations through its AI Agent Development Platform positions it well for future opportunities, though its dividend coverage remains weak at 2.4%. The management team is experienced, contributing to stable operations amidst industry competition.

- Jump into the full analysis health report here for a deeper understanding of Tuya.

- Assess Tuya's future earnings estimates with our detailed growth reports.

Next Steps

- Unlock more gems! Our US Penny Stocks screener has unearthed 419 more companies for you to explore.Click here to unveil our expertly curated list of 422 US Penny Stocks.

- Searching for a Fresh Perspective? We've found 16 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCCC

C4 Therapeutics

A clinical-stage biopharmaceutical company, develops novel therapeutic candidates to degrade disease-causing proteins.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives