- Sweden

- /

- Hospitality

- /

- OM:BETS B

Top European Dividend Stocks To Consider In June 2025

Reviewed by Simply Wall St

As European markets navigate renewed uncertainties surrounding U.S. trade policies and escalating geopolitical tensions in the Middle East, investors are increasingly focused on stable returns amid the volatility. In this environment, dividend stocks can offer a reliable income stream, making them an attractive option for those seeking to balance risk with consistent payouts.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.49% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.00% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.96% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.54% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.93% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.78% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.31% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.20% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.89% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.48% | ★★★★★★ |

Click here to see the full list of 236 stocks from our Top European Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a range of banking products and services to diverse customer segments in France, with a market cap of €1.23 billion.

Operations: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative generates its revenue primarily from Retail Banking in France, amounting to €456.43 million.

Dividend Yield: 4.3%

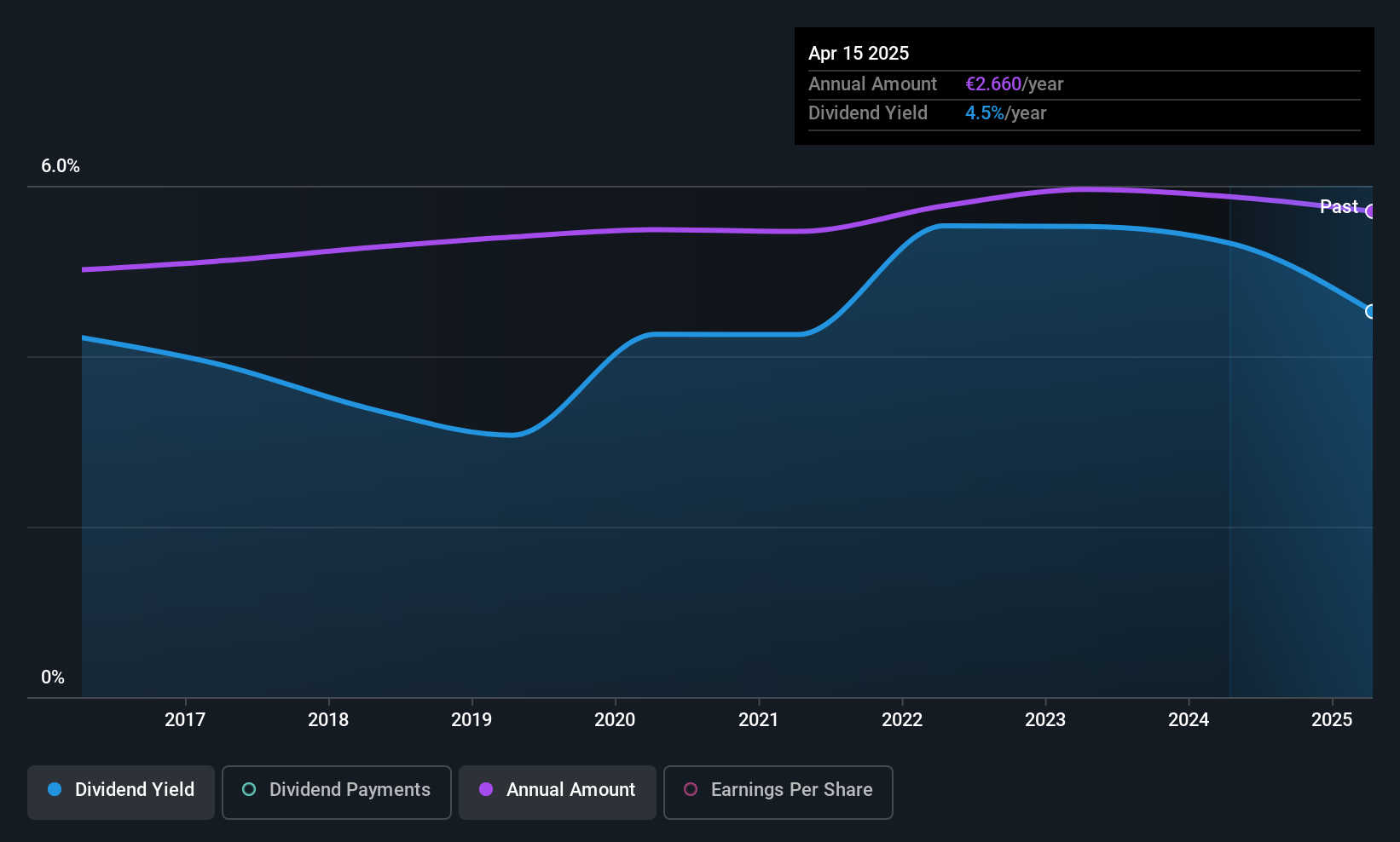

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a reliable dividend with a stable history over the past decade and consistent growth. Despite its 4.29% yield being lower than the top quartile in France, its low payout ratio of 30.3% suggests dividends are well covered by earnings, enhancing sustainability. Trading at 30.5% below estimated fair value may present an attractive opportunity for investors seeking stability and potential capital appreciation in European dividend stocks.

- Get an in-depth perspective on Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative's performance by reading our dividend report here.

- According our valuation report, there's an indication that Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative's share price might be on the cheaper side.

Betsson (OM:BETS B)

Simply Wall St Dividend Rating: ★★★★☆☆

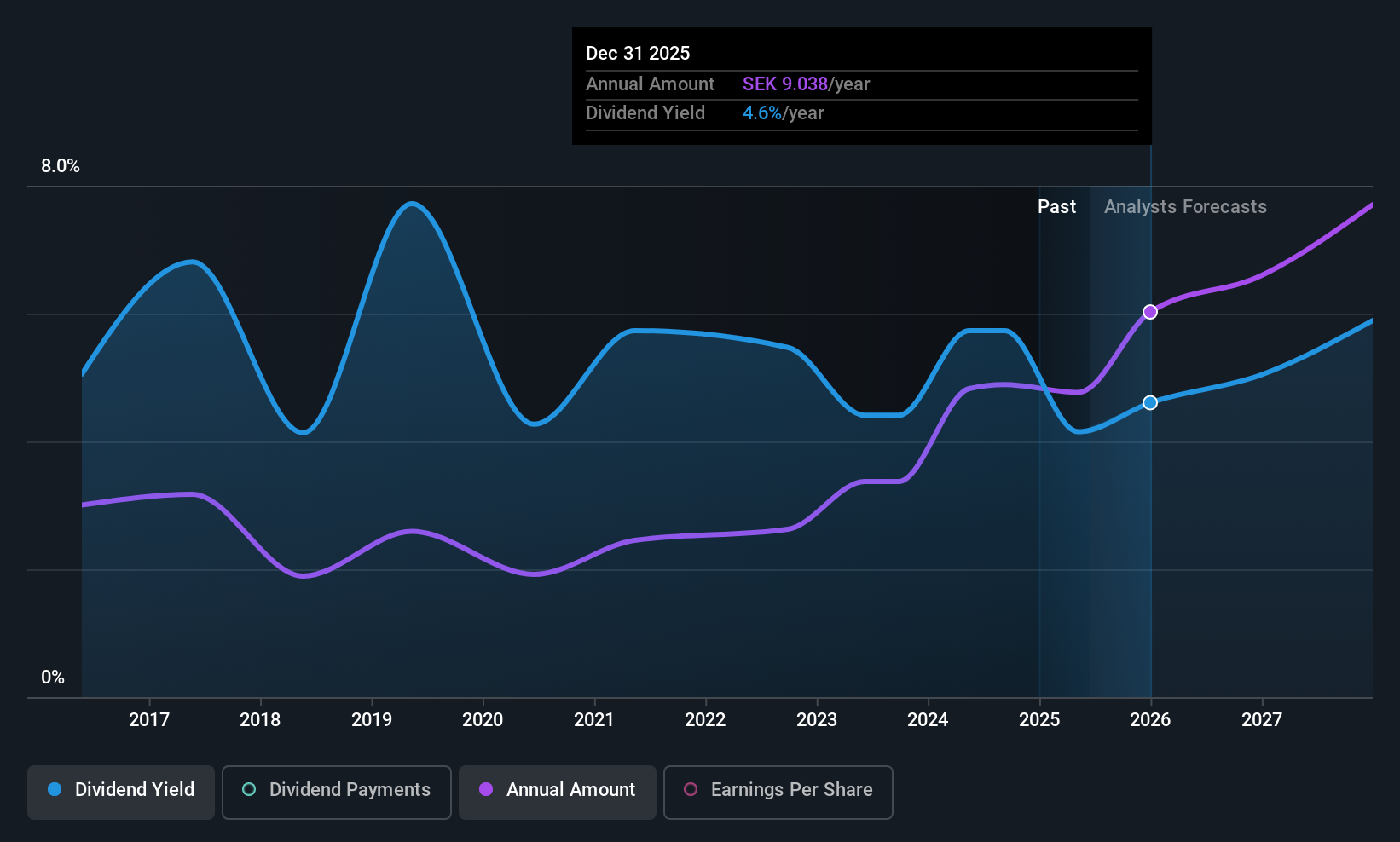

Overview: Betsson AB (publ) operates and manages online gaming businesses across various regions including the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally, with a market cap of SEK26.98 billion.

Operations: Betsson AB's revenue is primarily derived from its Casinos & Resorts segment, generating €1.15 billion.

Dividend Yield: 3.7%

Betsson AB's dividend payments, though volatile over the past decade, are well covered by earnings and cash flows with payout ratios of 48% and 34.8%, respectively. The company recently approved a dividend increase to EUR 0.66 per share plus an additional EUR 0.10 in two installments for 2025, reflecting its commitment to returning value to shareholders despite a lower yield than top Swedish payers. Trading at significant discount to estimated fair value suggests potential investment appeal.

- Take a closer look at Betsson's potential here in our dividend report.

- The analysis detailed in our Betsson valuation report hints at an deflated share price compared to its estimated value.

Amadeus FiRe (XTRA:AAD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Amadeus FiRe AG offers personnel and training services in Germany, with a market cap of €423.17 million.

Operations: Amadeus FiRe AG's revenue is primarily derived from its Personal Services segment, generating €254.84 million, and its Training segment, contributing €165.74 million.

Dividend Yield: 5.2%

Amadeus FiRe AG's dividend of €4.03 per share, while in the top 25% of German payers, is marked by volatility over the past decade. The payout is covered by earnings and cash flows with ratios of 88.5% and 61.1%, respectively, despite a recent decrease due to declining profits and revenues (€436.91 million). Although trading below fair value estimates, investors should consider its unstable dividend track record when evaluating its long-term reliability for income generation.

- Click to explore a detailed breakdown of our findings in Amadeus FiRe's dividend report.

- Our comprehensive valuation report raises the possibility that Amadeus FiRe is priced lower than what may be justified by its financials.

Where To Now?

- Access the full spectrum of 236 Top European Dividend Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Betsson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BETS B

Betsson

Through its subsidiaries, invests in and manages online gaming business in the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives