As the Australian market navigates fluctuating foreign direct investment flows and a dynamic global landscape, investors are keenly observing opportunities that offer stable returns amidst the volatility. In such an environment, dividend stocks stand out as attractive options for those seeking consistent income, particularly when yields can reach up to 7.0%.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Treasury Wine Estates (ASX:TWE) | 5.64% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 5.85% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.70% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.28% | ★★★★★☆ |

| Smartgroup (ASX:SIQ) | 6.14% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.72% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 5.67% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.69% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 3.71% | ★★★★★☆ |

| EQT Holdings (ASX:EQT) | 4.66% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top ASX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

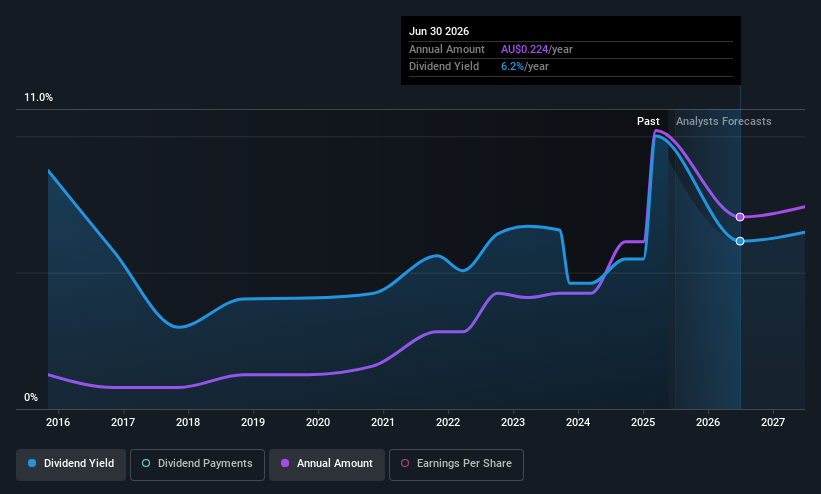

Bisalloy Steel Group (ASX:BIS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bisalloy Steel Group Limited manufactures and sells quenched and tempered, high-tensile, and abrasion resistant steel plates in Australia, Indonesia, Thailand, and internationally with a market cap of A$257.02 million.

Operations: Bisalloy Steel Group Limited generates revenue through the production and distribution of high-performance steel plates designed for strength and durability across various international markets.

Dividend Yield: 7.0%

Bisalloy Steel Group recently announced a fully franked dividend of A$0.165 per share, reflecting its commitment to returning value to shareholders despite historical volatility in payments. While the company's earnings grew by 24.4% last year, supporting a reasonable payout ratio of 59.9%, dividends are not well covered by free cash flows with a high cash payout ratio of 148.1%. The dividend yield remains attractive at 7.01%, outperforming the Australian market average of 5.5%.

- Click to explore a detailed breakdown of our findings in Bisalloy Steel Group's dividend report.

- According our valuation report, there's an indication that Bisalloy Steel Group's share price might be on the expensive side.

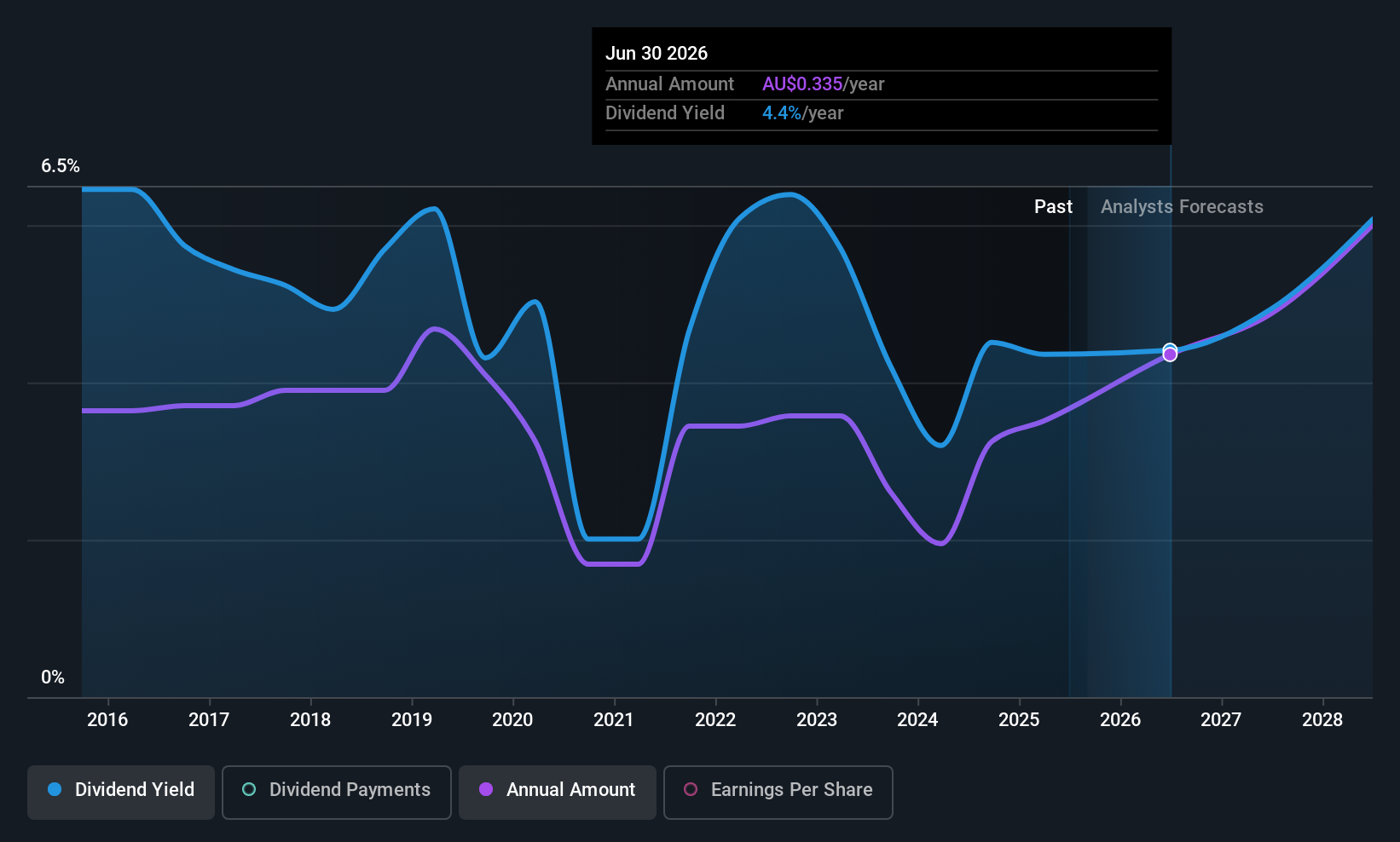

Cedar Woods Properties (ASX:CWP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cedar Woods Properties Limited is an Australian company that develops and invests in properties, with a market cap of A$642.96 million.

Operations: Cedar Woods Properties Limited generates revenue primarily from its property development and investment segment, amounting to A$465.94 million.

Dividend Yield: 3.8%

Cedar Woods Properties offers a mixed outlook for dividend investors. While trading at 19.9% below its estimated fair value and maintaining a sustainable payout ratio of 49.7%, its dividend yield of 3.76% is modest compared to top Australian payers. Despite earnings growth, dividends have been volatile over the past decade, though recent increases show potential improvement. The company recently declared a fully franked dividend of A$0.19 per share and continues to pursue acquisitions for future growth, supported by a solid balance sheet.

- Get an in-depth perspective on Cedar Woods Properties' performance by reading our dividend report here.

- Our expertly prepared valuation report Cedar Woods Properties implies its share price may be lower than expected.

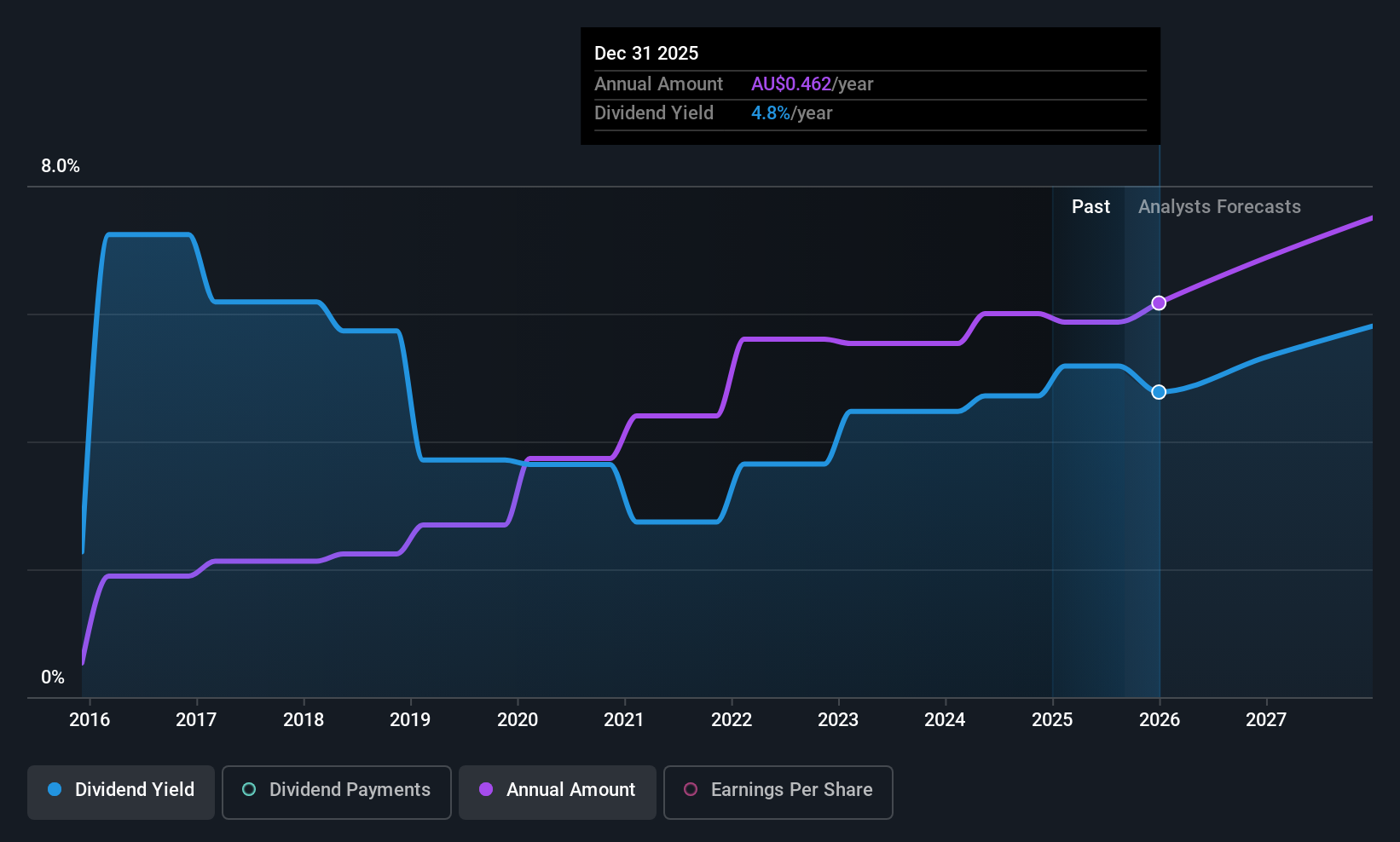

Dicker Data (ASX:DDR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dicker Data Limited is a wholesale distributor of computer hardware, software, and related products for corporate and commercial markets in Australia and New Zealand, with a market cap of A$1.78 billion.

Operations: Dicker Data Limited generates revenue primarily through the wholesale distribution of computer peripherals, amounting to A$2.44 billion.

Dividend Yield: 4.5%

Dicker Data's dividend prospects present a nuanced picture. Despite reliable and stable dividends over the past decade, its current yield of 4.46% is below top-tier Australian payers. The dividend is not well covered by earnings due to a high payout ratio of 96.2%, although cash flows do cover it with an 83.2% cash payout ratio. Recent earnings growth and forecasted revenue between A$3.7 billion to A$3.8 billion for FY25 highlight potential, but significant insider selling raises caution.

- Click here and access our complete dividend analysis report to understand the dynamics of Dicker Data.

- The valuation report we've compiled suggests that Dicker Data's current price could be quite moderate.

Where To Now?

- Click this link to deep-dive into the 30 companies within our Top ASX Dividend Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DDR

Dicker Data

Engages in the wholesale distribution of computer hardware, software, and related products for corporate and commercial markets in Australia and New Zealand.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives