- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:6088

Top Asian Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

As Asian markets navigate a complex landscape influenced by global economic shifts and trade negotiations, investors are increasingly looking toward unique opportunities within the region. Penny stocks, though an old term, continue to represent intriguing prospects for those interested in smaller or newer companies with potential for growth at accessible price points. By focusing on stocks with strong financials and clear growth paths, investors can uncover hidden gems that might offer both stability and upside potential.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.102 | SGD43.35M | ✅ 2 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.33 | HK$839.16M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.24 | HK$1.87B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.425 | SGD172.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.15 | HK$1.92B | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.44 | THB2.66B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.28 | SGD8.97B | ✅ 5 ⚠️ 0 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.93 | THB1.37B | ✅ 2 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.23 | SGD46.51M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.33 | SGD913.59M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 984 stocks from our Asian Penny Stocks screener.

Let's review some notable picks from our screened stocks.

FIT Hon Teng (SEHK:6088)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: FIT Hon Teng Limited is a company that manufactures and sells mobile and wireless devices and connectors both in Taiwan and internationally, with a market cap of HK$18.58 billion.

Operations: The company's revenue is primarily derived from its Intermediate Products segment, which accounts for $3.90 billion, followed by the Consumer Products segment at $685.67 million.

Market Cap: HK$18.58B

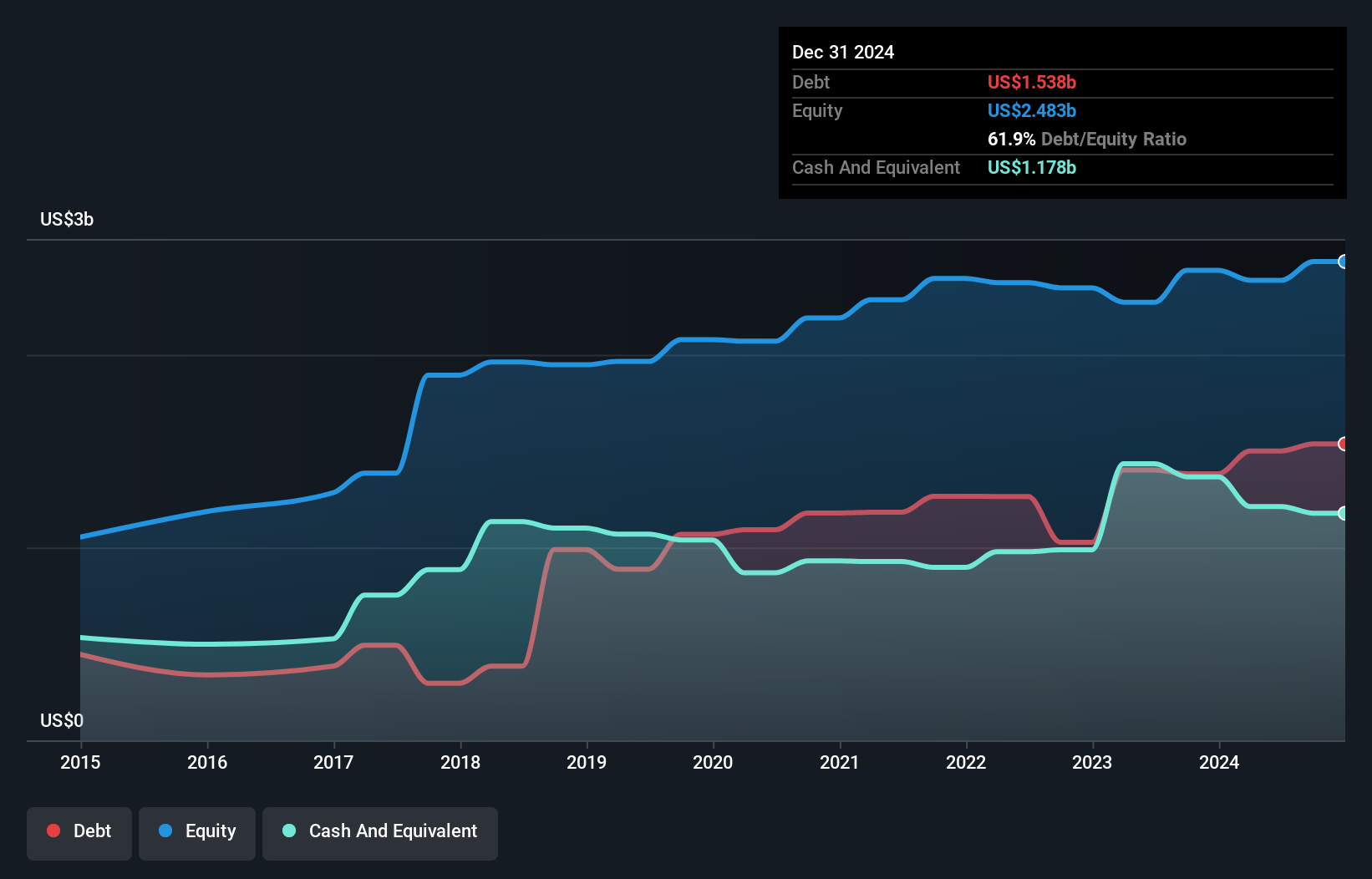

FIT Hon Teng Limited maintains a satisfactory net debt to equity ratio of 14.5%, with short-term assets ($3.2B) exceeding both short-term and long-term liabilities, indicating solid liquidity management. The company's board and management teams are experienced, with average tenures of 8.7 and 6.3 years respectively, suggesting stability in leadership. While earnings have grown by 19.2% over the past year, boosted by a large one-off gain of $95.2M, the return on equity remains low at 6.2%. Recent executive changes include the election of Mr. LU Pochin Christopher as an executive director at the AGM on June 20, 2025.

- Click to explore a detailed breakdown of our findings in FIT Hon Teng's financial health report.

- Gain insights into FIT Hon Teng's outlook and expected performance with our report on the company's earnings estimates.

Sunshine Insurance Group (SEHK:6963)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sunshine Insurance Group Company Limited offers a range of insurance products and related services in the People’s Republic of China, with a market capitalization of approximately HK$38.76 billion.

Operations: The company generates its revenue primarily from Property and Casualty Insurance through Sunshine P&C with CN¥50.22 billion, followed by Life Insurance at CN¥25.03 billion, and a smaller contribution from Property and Casualty Insurance via Sunshine Surety at CN¥52 million.

Market Cap: HK$38.76B

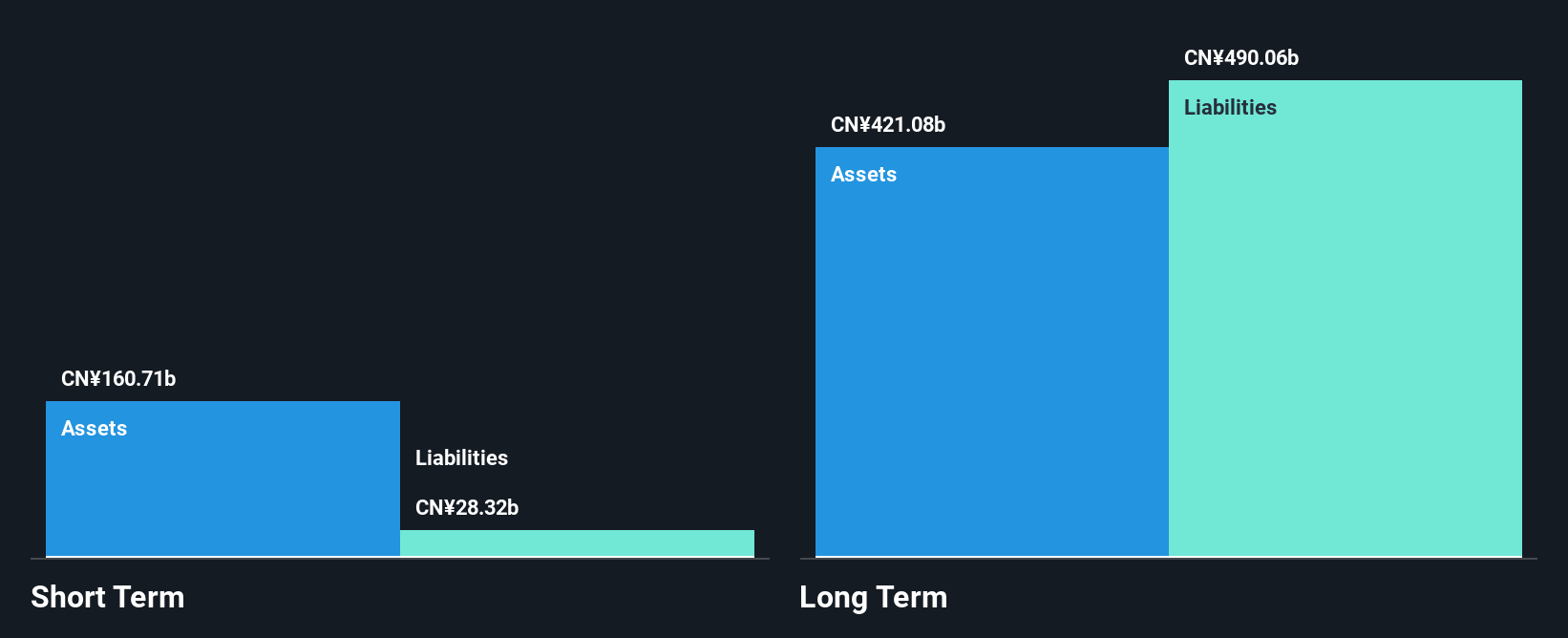

Sunshine Insurance Group exhibits a strong financial position with short-term assets (CN¥160.7B) comfortably exceeding short-term liabilities (CN¥28.3B), and more cash than total debt, indicating robust liquidity management. The company trades at a significant discount to its estimated fair value, suggesting potential undervaluation in the market. Recent board changes include the appointment of Mr. Dong Bin and Mr. Wang Xiaopeng as directors, reflecting ongoing governance adjustments. While earnings grew 45.8% last year, surpassing its five-year average decline of 6.6% per year, long-term liabilities remain uncovered by current assets (CN¥490.1B).

- Click here to discover the nuances of Sunshine Insurance Group with our detailed analytical financial health report.

- Gain insights into Sunshine Insurance Group's future direction by reviewing our growth report.

Yangzijiang Shipbuilding (Holdings) (SGX:BS6)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yangzijiang Shipbuilding (Holdings) Ltd. is an investment holding company involved in shipbuilding activities across Greater China and various international markets, with a market cap of SGD8.97 billion.

Operations: The company's revenue is primarily derived from its shipbuilding segment, generating CN¥25.22 billion, followed by shipping activities contributing CN¥1.24 billion.

Market Cap: SGD8.97B

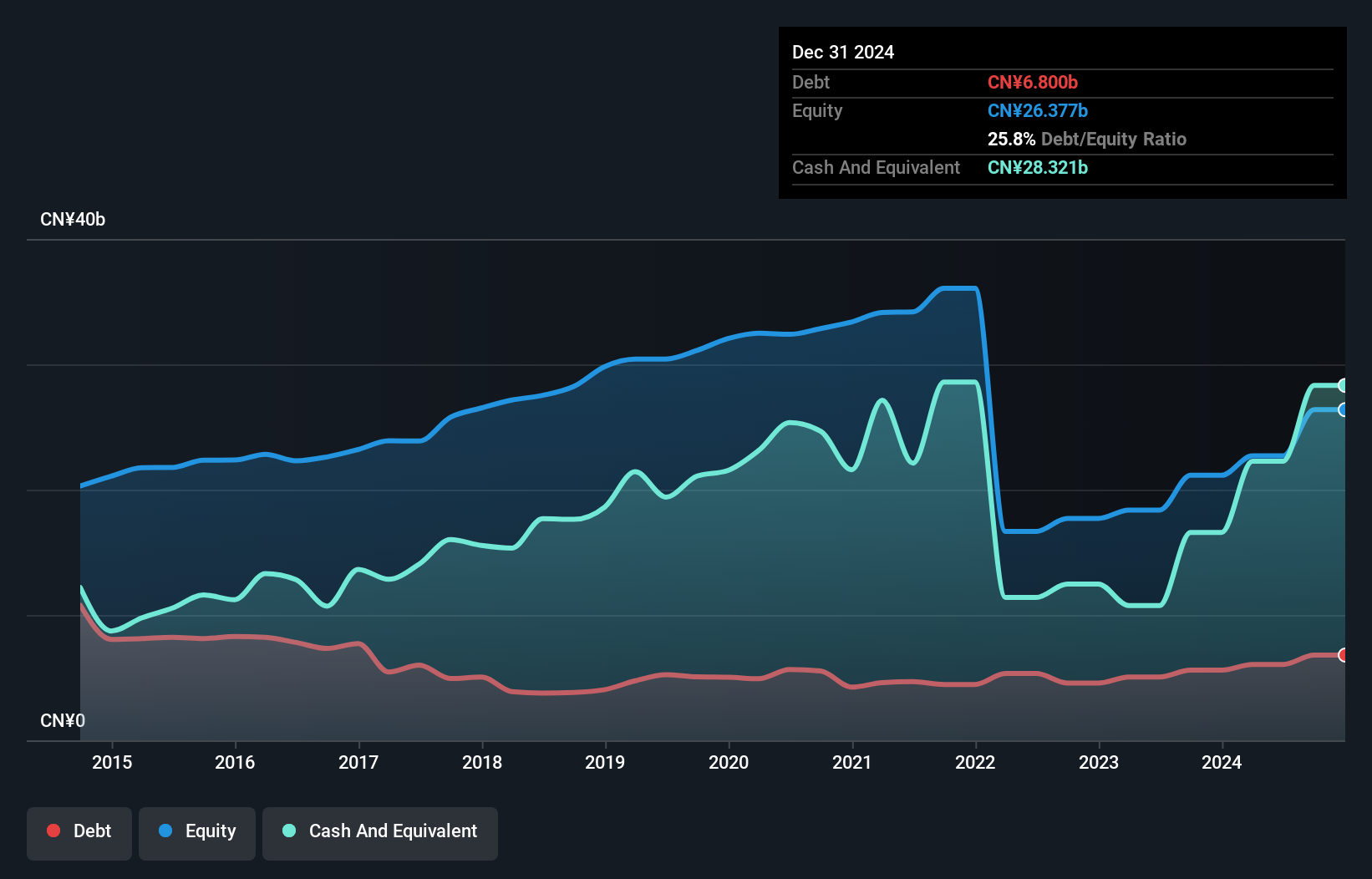

Yangzijiang Shipbuilding (Holdings) demonstrates a strong financial foundation, with short-term assets of CN¥42.1 billion surpassing both short and long-term liabilities, ensuring solid liquidity. The company is trading significantly below its estimated fair value, indicating potential undervaluation. Earnings have grown impressively by 61.7% over the past year, outpacing the industry and its five-year average growth rate of 19.7%. With a high return on equity at 25.2% and reliable dividend payments recently increased to SGD0.12 per share, Yangzijiang's financial health is robust despite an inexperienced board with an average tenure of 2.9 years.

- Get an in-depth perspective on Yangzijiang Shipbuilding (Holdings)'s performance by reading our balance sheet health report here.

- Explore Yangzijiang Shipbuilding (Holdings)'s analyst forecasts in our growth report.

Make It Happen

- Gain an insight into the universe of 984 Asian Penny Stocks by clicking here.

- Interested In Other Possibilities? Uncover 15 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6088

FIT Hon Teng

Manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion