- China

- /

- Healthcare Services

- /

- SZSE:301015

Top Asian Dividend Stocks To Consider In July 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape of economic indicators and trade negotiations, Asian equities have shown resilience, with China's stock markets posting gains despite mixed economic signals. In this environment, dividend stocks offer investors the potential for steady income streams, making them an attractive consideration for those looking to balance growth with income stability.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Soliton Systems K.K (TSE:3040) | 4.02% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.06% | ★★★★★★ |

| NCD (TSE:4783) | 4.21% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.30% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.41% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.07% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.38% | ★★★★★★ |

| Daicel (TSE:4202) | 4.92% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.13% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.06% | ★★★★★★ |

Click here to see the full list of 1220 stocks from our Top Asian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

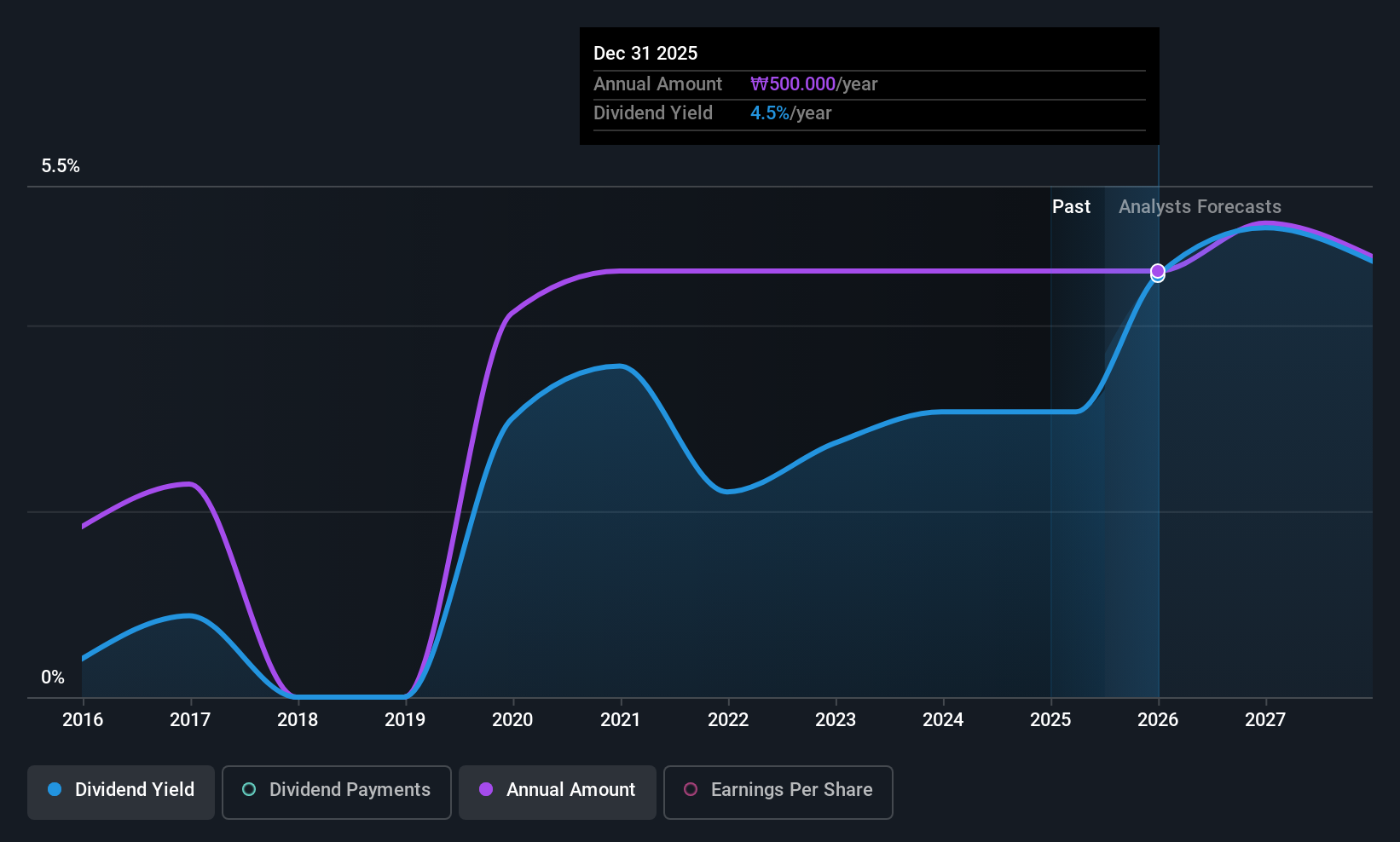

Hansae (KOSE:A105630)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hansae Co., Ltd. manufactures and sells finished clothing products across Vietnam, Indonesia, Nicaragua, Guatemala, Myanmar, and Haiti with a market cap of ₩457.63 billion.

Operations: Hansae Co., Ltd. generates revenue of ₩1.85 trillion from its clothing manufacturing operations in various countries including Vietnam, Indonesia, Nicaragua, Guatemala, Myanmar, and Haiti.

Dividend Yield: 4.3%

Hansae Co. Ltd's recent removal from the KOSPI 200 Index and declining net income highlight challenges for dividend sustainability, despite a stable 10-year dividend history. The company's dividends, yielding 4.3%, are in the top quartile of the Korean market but are not supported by free cash flows or earnings, raising concerns about future payouts. Although trading at a significant discount to its estimated fair value, profit margins have decreased significantly year-on-year, impacting financial health.

- Navigate through the intricacies of Hansae with our comprehensive dividend report here.

- Our expertly prepared valuation report Hansae implies its share price may be lower than expected.

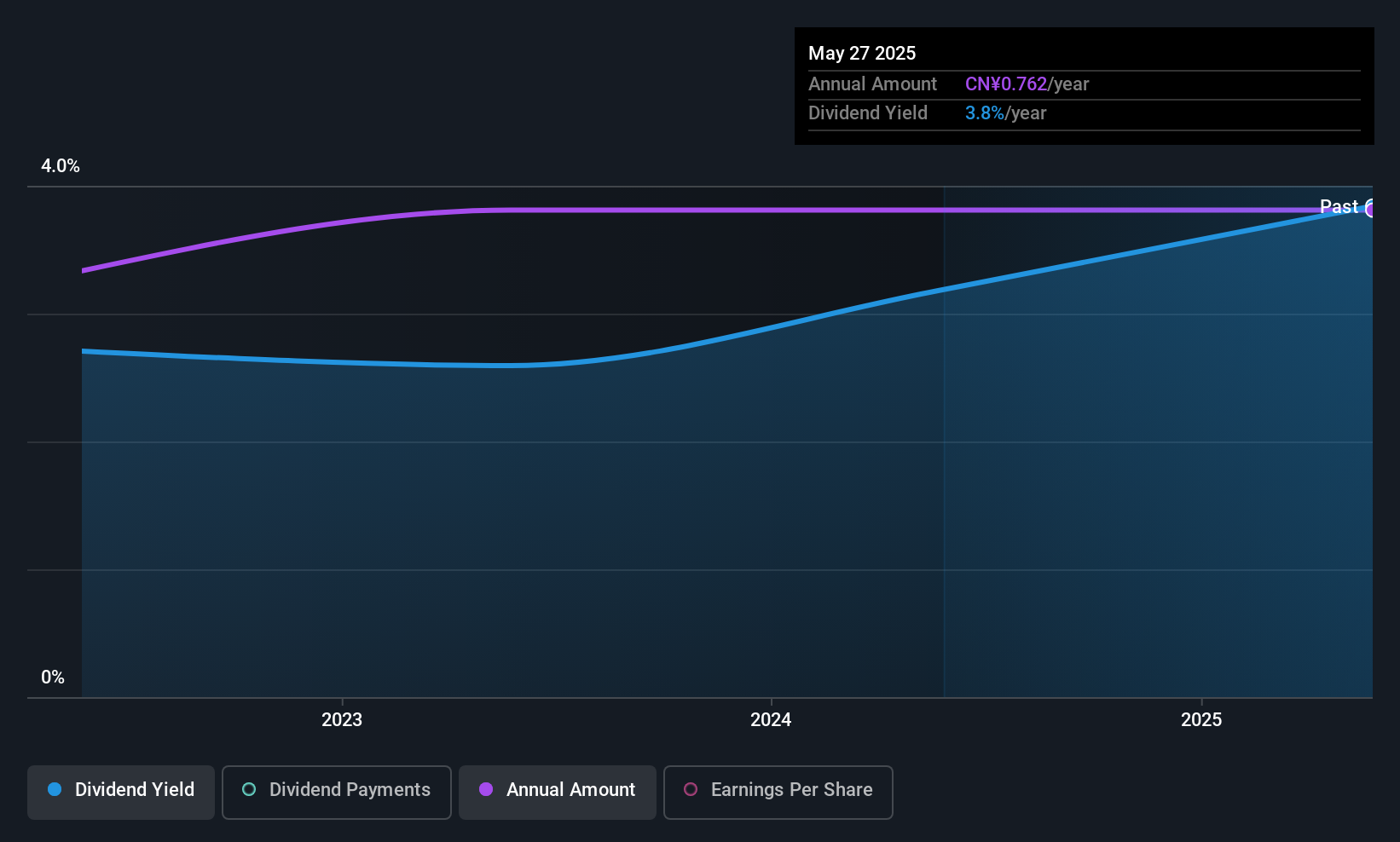

Qingdao Baheal Medical (SZSE:301015)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Qingdao Baheal Medical INC. is involved in the research, development, production, and sale of pharmaceutical products with a market cap of CN¥11.31 billion.

Operations: Qingdao Baheal Medical INC. generates revenue through its activities in the research, development, production, and sale of pharmaceutical products.

Dividend Yield: 3.5%

Qingdao Baheal Medical's dividend payments, while stable and covered by earnings (67.6% payout ratio) and cash flows (68.2% cash payout ratio), have only been made for three years, indicating limited historical reliability. The company recently affirmed a CNY 7.62 per 10 shares dividend for 2024 at its AGM. Despite trading below estimated fair value, the stock has experienced high price volatility recently, which may affect investor confidence in its dividend stability amidst fluctuating earnings performance.

- Get an in-depth perspective on Qingdao Baheal Medical's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Qingdao Baheal Medical is priced lower than what may be justified by its financials.

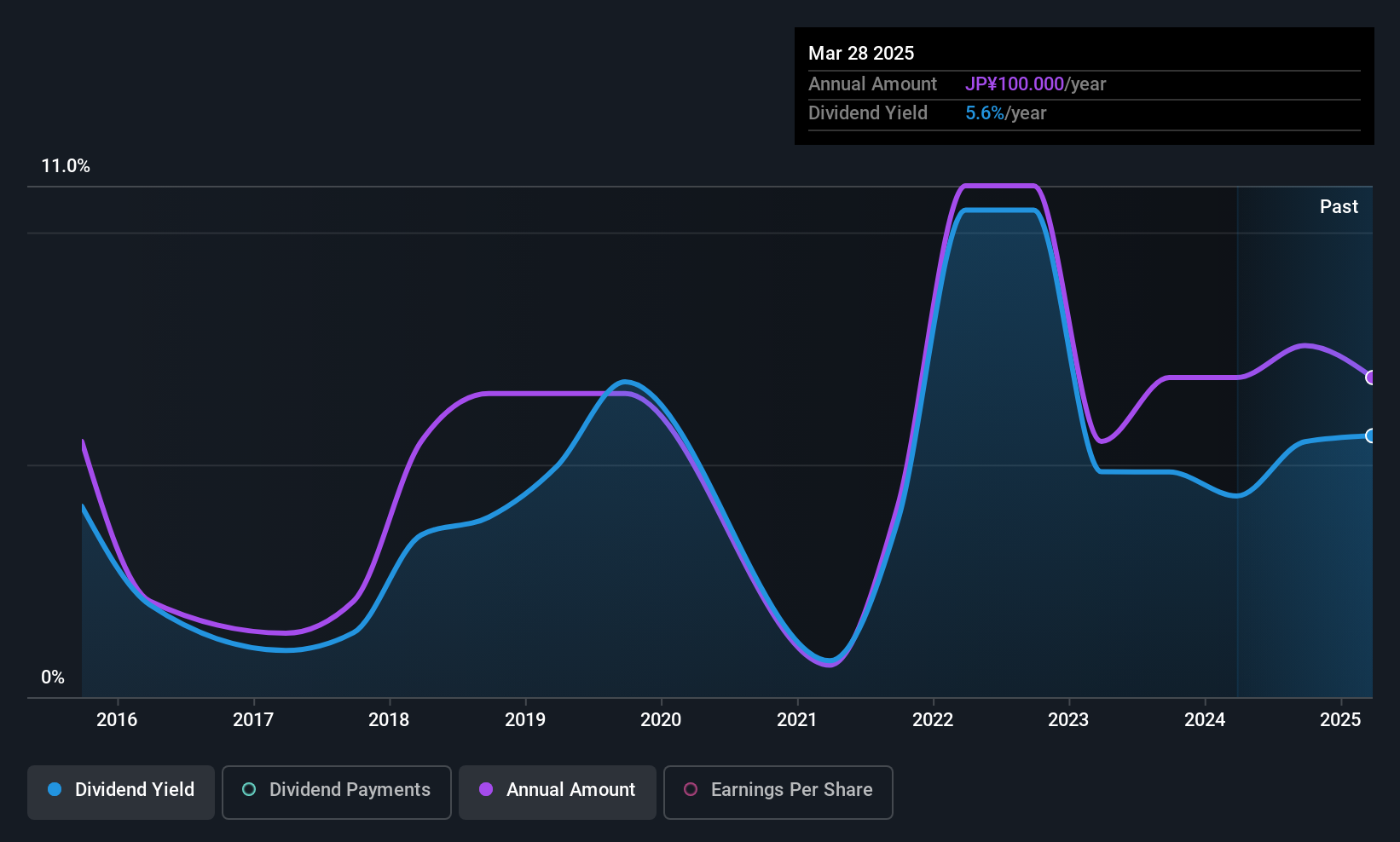

JFE Holdings (TSE:5411)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: JFE Holdings, Inc. operates in the steel, engineering, and trading sectors both in Japan and globally, with a market capitalization of approximately ¥1.14 trillion.

Operations: JFE Holdings generates revenue from its steel, engineering, and trading businesses across domestic and international markets.

Dividend Yield: 4.5%

JFE Holdings' dividend yield is in the top 25% of Japanese market payers, supported by a reasonable payout ratio (69.2%) and cash flow coverage (51.1%). However, its dividend history has been volatile with unreliable payments over the past decade. Despite a lower current profit margin compared to last year, earnings are expected to grow annually by 12.01%. Recent board meetings have focused on amending company bylaws and revising stock remuneration policies for directors and officers.

- Click here and access our complete dividend analysis report to understand the dynamics of JFE Holdings.

- According our valuation report, there's an indication that JFE Holdings' share price might be on the expensive side.

Summing It All Up

- Click through to start exploring the rest of the 1217 Top Asian Dividend Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qingdao Baheal Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301015

Qingdao Baheal Medical

Engages in the research and development, production, and sale of pharmaceutical products.

Good value with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives