- United States

- /

- Entertainment

- /

- NYSE:TKO

TKO Group Holdings (NYSE:TKO) Declares US$75 Million Dividend Amidst Ongoing Legal Challenges

Reviewed by Simply Wall St

TKO Group Holdings (NYSE:TKO) has declared a quarterly cash dividend of $0.38 per share and faced a class action antitrust lawsuit, challenging the practices of its UFC segment. These developments provide context for TKO's 5% increase over the last quarter. The company's decision to maintain its dividend payout reflects a commitment to shareholder returns, while the legal challenges may present ongoing considerations for its market position. During this period, TKO also announced a revenue guidance increase and saw favorable index changes, potentially adding positive weight to its stock performance amidst broader market growth trends.

We've spotted 2 possible red flags for TKO Group Holdings you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

Over the past year, TKO Group Holdings has achieved a total return, including both share price appreciation and dividends, of 45.08%. This outpaces the overall US market return of 12.5% for the same period, although it underperformed the US Entertainment industry, which saw a significant 56.6% increase. TKO’s commitment to returning value to shareholders is underscored by the declared quarterly dividend of $0.38 per share, which remains a key component of its shareholder remuneration strategy.

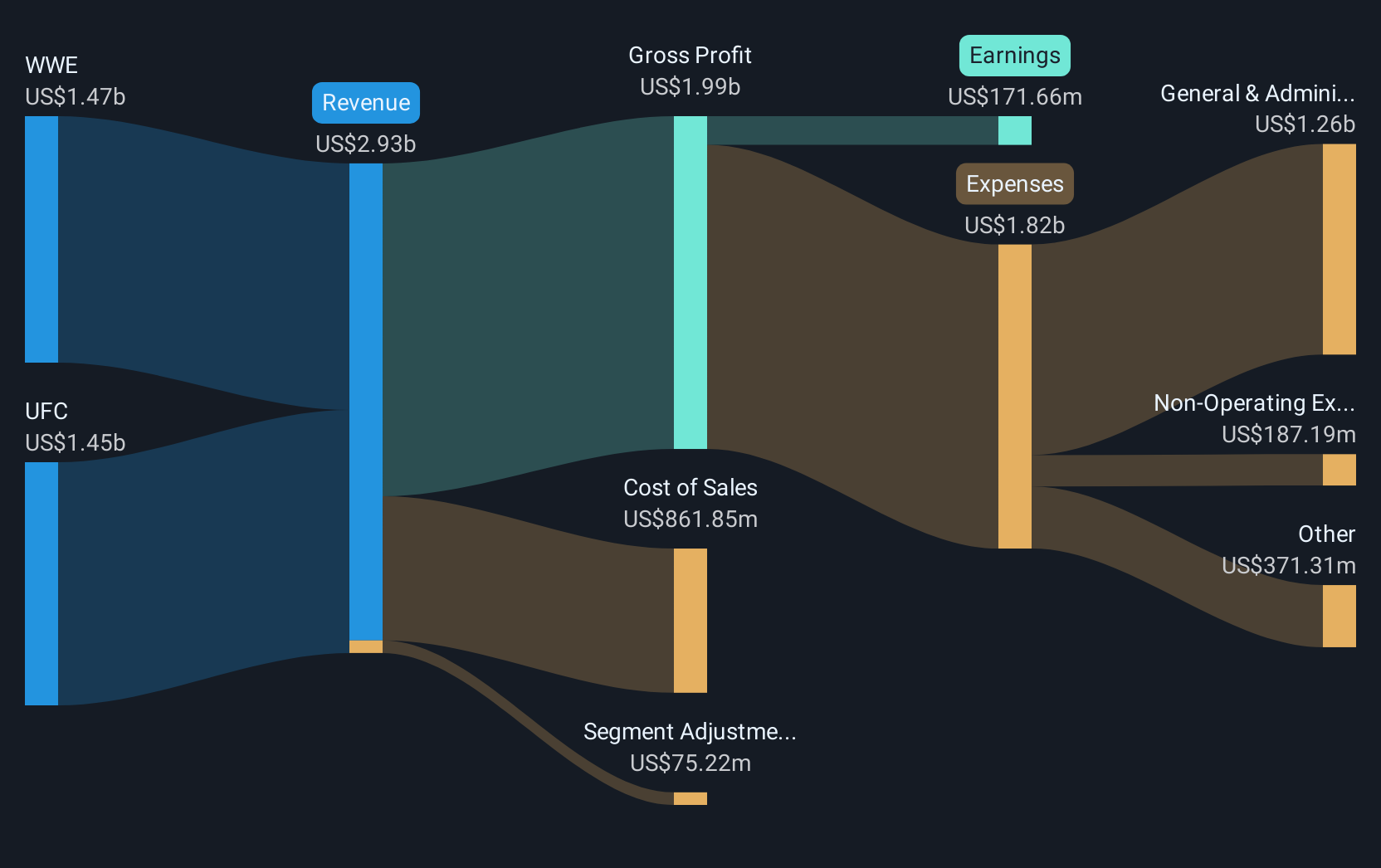

The company's recent revenue guidance increase, amid favorable earnings reports, indicates a strong focus on growth, as it targets a revenue range of $3.01 billion to $3.08 billion for 2025. This, coupled with ongoing robust performance from its UFC and WWE segments, might enhance earnings and potentially realign market expectations positively. TKO's current trading price remains lower than the consensus analyst price target of $181.72, suggesting a market perception of potential upside. However, legal challenges, such as the antitrust class action, warrant attention as they may impact the company’s strategic positioning and financial outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TKO Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TKO

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives