- United States

- /

- Pharma

- /

- NasdaqGS:TLRY

Tilray Brands (NasdaqGS:TLRY) Approves Potential Reverse Stock Split Adjustment

Reviewed by Simply Wall St

Tilray Brands (NasdaqGS:TLRY) has witnessed a 4.82% price move over the past week, which coincides with the company's recent approval of a reverse stock split, granting more flexibility in its stock structure. This governance change occurred against the backdrop of an overall positive market environment, as the S&P 500 and Nasdaq experienced gains amid encouraging inflation data and positive developments in U.S.-China trade talks. Though the broader markets were up 1.3% in the same period, Tilray's organizational adjustments added weight to its performance, aligning with the market's general upward trend.

Be aware that Tilray Brands is showing 3 possible red flags in our investment analysis.

The recent approval of a reverse stock split by Tilray Brands aims to provide more flexibility in its stock structure, potentially impacting its long-term operational strategies and market perceptions. While the company's stock saw a 4.82% increase in the past week, it remains significantly down over the past year, with a total shareholder return of 75.95% decline. This contrasts sharply with the broader market, as the S&P 500 and Nasdaq indices have experienced gains in the same timeframe.

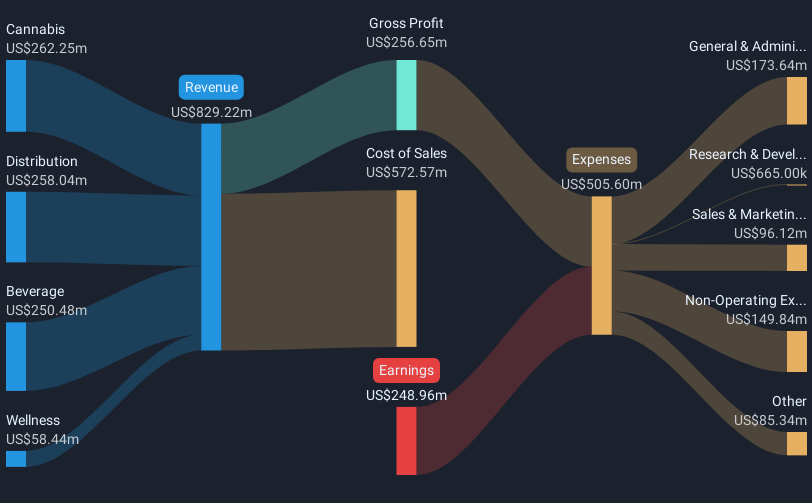

In the context of Tilray's revenue and earnings forecasts, the reverse stock split could influence investor sentiment and future analyst evaluations. The company's current revenue stands at US$826.66 million, and it suffers from a net loss of US$945.69 million, underscoring significant ongoing challenges. Despite these hurdles, analysts have a consensus price target of US$1.35, indicating a substantial upside potential from the current share price of US$0.40. However, this is predicated on expectations of substantial improvement in profit margins and revenue growth over time.

The reverse stock split and its proposed flexibility may serve to fortify Tilray's efforts to revitalize growth, especially in the face of fierce competition and macroeconomic challenges. As the company seeks to expand its footprint in the U.S. and European markets, particularly in the cannabis and THC beverage segments, any improvement in market conditions or regulatory landscapes could positively affect its revenue and earnings forecasts.

Learn about Tilray Brands' future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Tilray Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLRY

Tilray Brands

A lifestyle consumer products company, engages in the research, cultivation, processing, and distribution of medical cannabis products in Canada, the United States, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion