Those Who Purchased Oxurion (EBR:OXUR) Shares Five Years Ago Have A 64% Loss To Show For It

Generally speaking long term investing is the way to go. But unfortunately, some companies simply don't succeed. For example, after five long years the Oxurion NV (EBR:OXUR) share price is a whole 64% lower. That's an unpleasant experience for long term holders. And some of the more recent buyers are probably worried, too, with the stock falling 54% in the last year. On top of that, the share price has dropped a further 45% in a month. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Check out our latest analysis for Oxurion

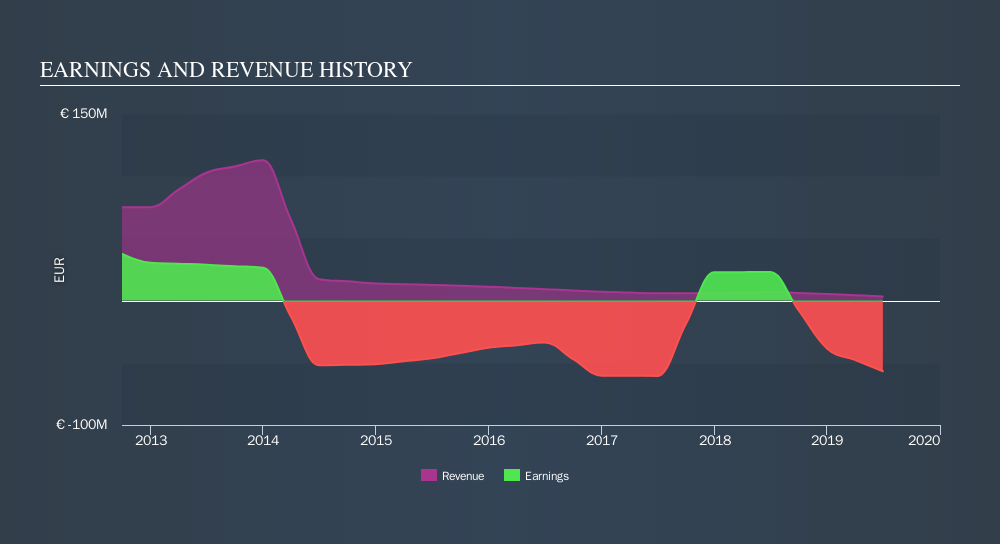

Because Oxurion is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade Oxurion reduced its trailing twelve month revenue by 27% for each year. That puts it in an unattractive cohort, to put it mildly. Arguably, the market has responded appropriately to this business performance by sending the share price down 18% (annualized) in the same time period. It's fair to say most investors don't like to invest in loss making companies with falling revenue. You'd want to research this company pretty thoroughly before buying, it looks a bit too risky for us.

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While the broader market gained around 4.6% in the last year, Oxurion shareholders lost 54%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 18% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course Oxurion may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTBR:OXUR

Oxurion

A biopharmaceutical company, develops medicines to prevent blindness in Belgium.

Medium-low risk with acceptable track record.

Market Insights

Community Narratives