- United States

- /

- Semiconductors

- /

- NasdaqGS:TXN

This Insider Has Just Sold Shares In Texas Instruments Incorporated (NASDAQ:TXN)

We wouldn't blame Texas Instruments Incorporated (NASDAQ:TXN) shareholders if they were a little worried about the fact that Haviv Ilan, the Senior Vice President of Analog Signal Chain recently netted about US$1.2m selling shares at an average price of US$123. However, that sale only accounted for 9.6% of their holding, so arguably it doesn't say much about their conviction.

View our latest analysis for Texas Instruments

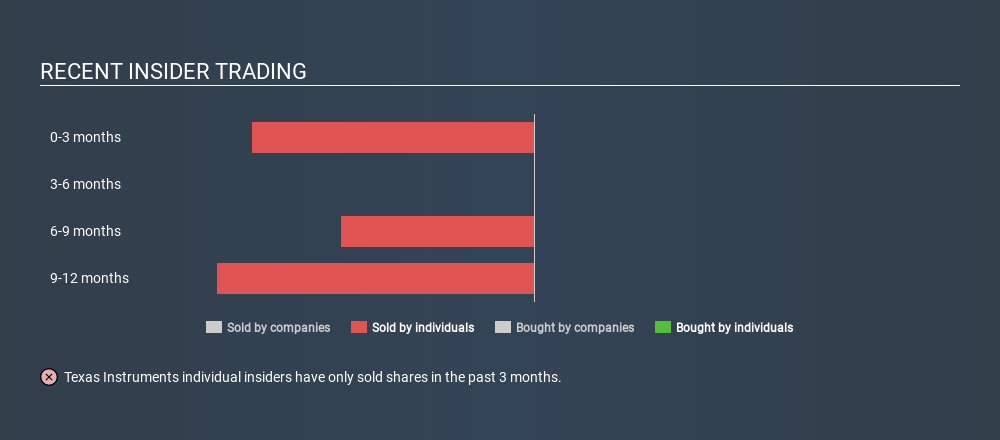

The Last 12 Months Of Insider Transactions At Texas Instruments

In the last twelve months, the biggest single sale by an insider was when the Senior Vice President of Analog Power Products, Niels Anderskouv, sold US$6.5m worth of shares at a price of US$117 per share. So it's clear an insider wanted to take some cash off the table, even below the current price of US$132. As a general rule we consider it to be discouraging when insiders are selling below the current price, because it suggests they were happy with a lower valuation. While insider selling is not a positive sign, we can't be sure if it does mean insiders think the shares are fully valued, so it's only a weak sign. We note that the biggest single sale was only 40% of Niels Anderskouv's holding.

Insiders in Texas Instruments didn't buy any shares in the last year. You can see a visual depiction of insider transactions (by individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: insiders have been buying them).

Does Texas Instruments Boast High Insider Ownership?

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. A high insider ownership often makes company leadership more mindful of shareholder interests. It's great to see that Texas Instruments insiders own 0.2% of the company, worth about US$219m. I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

So What Does This Data Suggest About Texas Instruments Insiders?

Insiders sold stock recently, but they haven't been buying. Looking to the last twelve months, our data doesn't show any insider buying. While insiders do own a lot of shares in the company (which is good), our analysis of their transactions doesn't make us feel confident about the company. If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:TXN

Texas Instruments

Designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States, China, rest of Asia, Europe, Middle East, Africa, Japan, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives