- Spain

- /

- Energy Services

- /

- BME:TRE

The Técnicas Reunidas (BME:TRE) Share Price Is Down 40% So Some Shareholders Are Getting Worried

Ideally, your overall portfolio should beat the market average. But every investor is virtually certain to have both over-performing and under-performing stocks. At this point some shareholders may be questioning their investment in Técnicas Reunidas, S.A. (BME:TRE), since the last five years saw the share price fall 40%. The silver lining is that the stock is up 3.7% in about a week.

Check out our latest analysis for Técnicas Reunidas

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Técnicas Reunidas became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

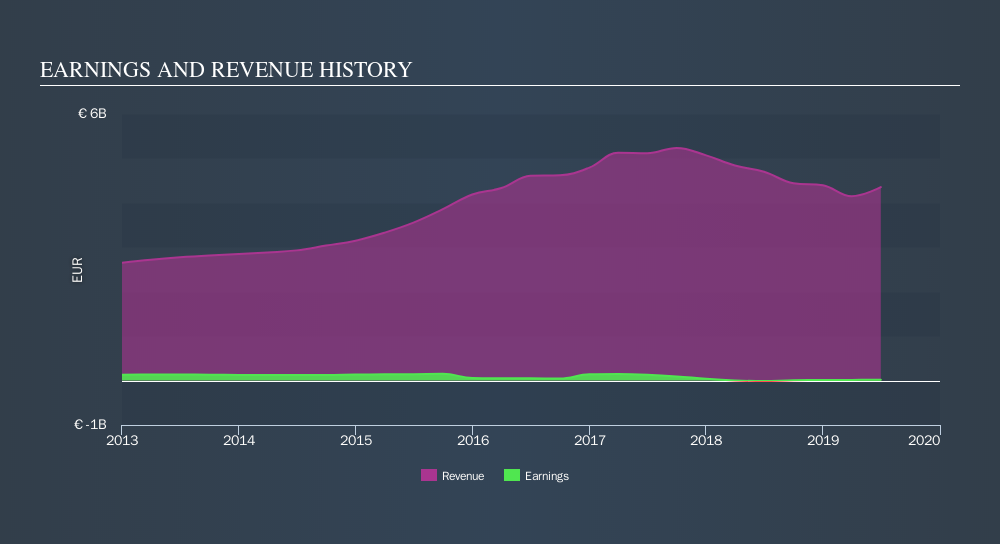

In contrast to the share price, revenue has actually increased by 7.5% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Técnicas Reunidas has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Técnicas Reunidas in this interactive graph of future profit estimates.

What about the Total Shareholder Return (TSR)?

We've already covered Técnicas Reunidas's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Técnicas Reunidas's TSR of was a loss of 32% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Técnicas Reunidas shareholders are up 6.0% for the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 7.3% endured over half a decade. So this might be a sign the business has turned its fortunes around. Is Técnicas Reunidas cheap compared to other companies? These 3 valuation measures might help you decide.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About BME:TRE

Técnicas Reunidas

An engineering and construction company, designs and manages industrial plant projects worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives