- United States

- /

- Banks

- /

- NasdaqGM:SFST

The Southern First Bancshares (NASDAQ:SFST) Share Price Has Gained 134%, So Why Not Pay It Some Attention?

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on the bright side, you can make far more than 100% on a really good stock. For instance, the price of Southern First Bancshares, Inc. (NASDAQ:SFST) stock is up an impressive 134% over the last five years.

Check out our latest analysis for Southern First Bancshares

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

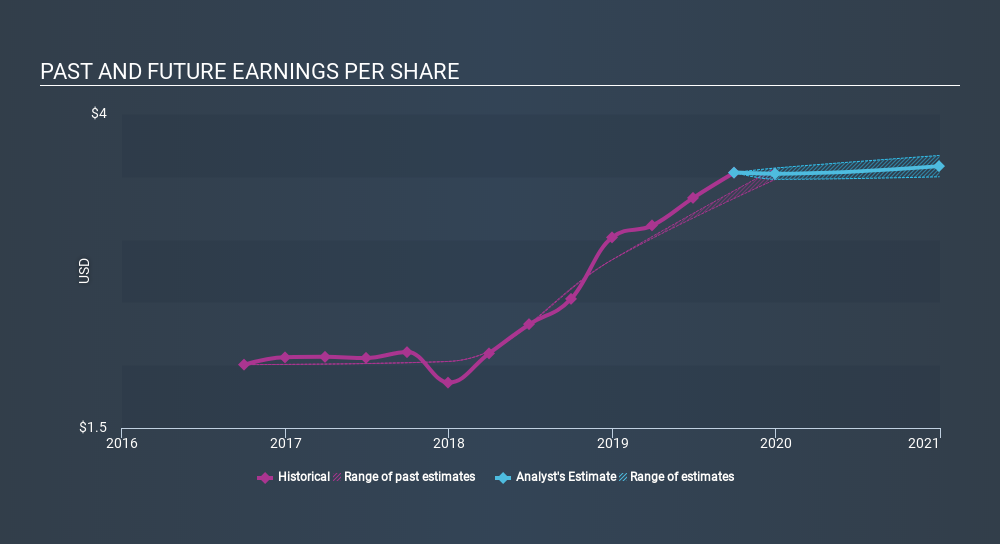

Over half a decade, Southern First Bancshares managed to grow its earnings per share at 26% a year. This EPS growth is higher than the 19% average annual increase in the share price. Therefore, it seems the market has become relatively pessimistic about the company. The reasonably low P/E ratio of 11.92 also suggests market apprehension.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Southern First Bancshares has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Southern First Bancshares will grow revenue in the future.

A Different Perspective

Southern First Bancshares shareholders gained a total return of 24% during the year. But that was short of the market average. The silver lining is that the gain was actually better than the average annual return of 19% per year over five year. This suggests the company might be improving over time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 1 warning sign for Southern First Bancshares which any shareholder or potential investor should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGM:SFST

Southern First Bancshares

Operates as the bank holding company for Southern First Bank that provides commercial, consumer, and mortgage loans to the general public in South Carolina, North Carolina, and Georgia.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives