- United States

- /

- Software

- /

- NasdaqGM:RPD

The Rapid7 (NASDAQ:RPD) Share Price Has Soared 315%, Delighting Many Shareholders

Investing can be hard but the potential fo an individual stock to pay off big time inspires us. Mistakes are inevitable, but a single top stock pick can cover any losses, and so much more. For example, the Rapid7, Inc. (NASDAQ:RPD) share price is up a whopping 315% in the last three years, a handsome return for long term holders. On the other hand, the stock price has retraced 8.8% in the last week. This could be related to the recent financial results, released recently -- you can catch up on the most recent data by reading our company report.

Check out our latest analysis for Rapid7

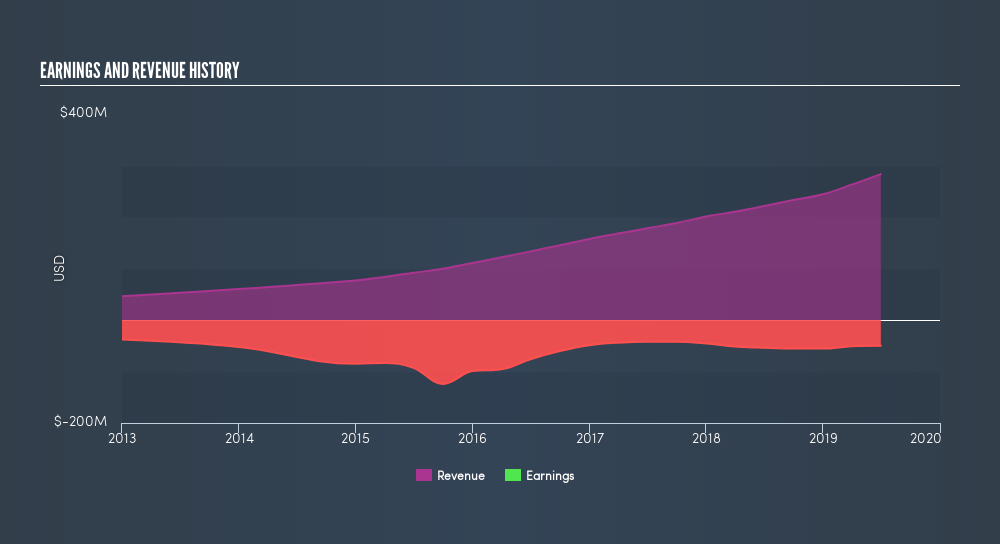

Rapid7 isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 3 years Rapid7 saw its revenue grow at 23% per year. That's well above most pre-profit companies. And it's not just the revenue that is taking off. The share price is up 61% per year in that time. Despite the strong run, top performers like Rapid7 have been known to go on winning for decades. In fact, it might be time to put it on your watchlist, if you're not already familiar with the stock.

Rapid7 is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Rapid7 in this interactive graph of future profit estimates.

A Different Perspective

Pleasingly, Rapid7's total shareholder return last year was 94%. So this year's TSR was actually better than the three-year TSR (annualized) of 61%. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. If you would like to research Rapid7 in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGM:RPD

Rapid7

Provides cybersecurity software and services under the Rapid7, Nexpose, and Metasploit brand names.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives