- United States

- /

- REITS

- /

- NYSE:APTS

The Preferred Apartment Communities (NYSE:APTS) Share Price Is Up 34% And Shareholders Are Holding On

The main point of investing for the long term is to make money. But more than that, you probably want to see it rise more than the market average. But Preferred Apartment Communities, Inc. (NYSE:APTS) has fallen short of that second goal, with a share price rise of 34% over five years, which is below the market return. However, if you include the dividends then the return is market beating. The last year has been disappointing, with the stock price down 17% in that time.

View our latest analysis for Preferred Apartment Communities

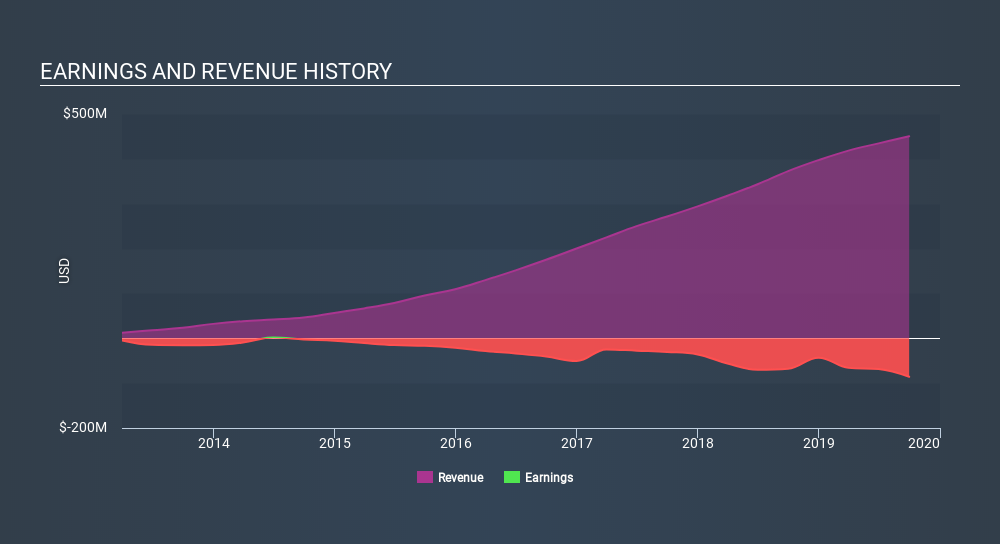

Preferred Apartment Communities wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

For the last half decade, Preferred Apartment Communities can boast revenue growth at a rate of 37% per year. That's well above most pre-profit companies. It's nice to see shareholders have made a profit, but the gain of 6.0% over the period isn't that impressive compared to the overall market. That's surprising given the strong revenue growth. It could be that the stock was previously over-priced - but if you're looking for underappreciated growth stocks, these numbers indicate that there might be an opportunity here.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. If you are thinking of buying or selling Preferred Apartment Communities stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Preferred Apartment Communities's TSR for the last 5 years was 85%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market gained around 25% in the last year, Preferred Apartment Communities shareholders lost 11% (even including dividends) . Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 13% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Be aware that Preferred Apartment Communities is showing 4 warning signs in our investment analysis , and 1 of those is concerning...

Preferred Apartment Communities is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:APTS

Preferred Apartment Communities

Preferred Apartment Communities, Inc. (NYSE: APTS) is a real estate investment trust engaged primarily in the ownership and operation of Class A multifamily properties, with select investments in grocery anchored shopping centers, Class A office buildings, and student housing properties.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives