- United States

- /

- Specialty Stores

- /

- OTCPK:PRTY.Q

The Party City Holdco (NYSE:PRTY) Share Price Is Down 82% So Some Shareholders Are Rather Upset

Over the last month the Party City Holdco Inc. (NYSE:PRTY) has been much stronger than before, rebounding by 47%. But that is meagre solace in the face of the shocking decline over three years. Indeed, the share price is down a whopping 82% in the last three years. So it sure is nice to see a big of an improvement. The thing to think about is whether the business has really turned around.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View 2 warning signs we detected for Party City Holdco

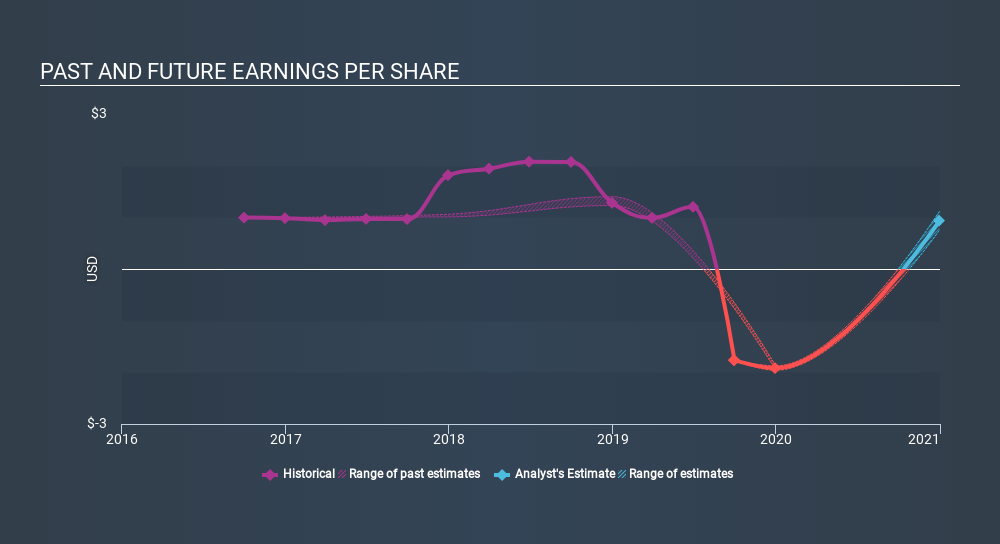

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Party City Holdco saw its share price decline over the three years in which its EPS also dropped, falling to a loss. This was, in part, due to extraordinary items impacting earnings. Due to the loss, it's not easy to use EPS as a reliable guide to the business. But it's safe to say we'd generally expect the share price to be lower as a result!

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. It might be well worthwhile taking a look at our free report on Party City Holdco's earnings, revenue and cash flow.

A Different Perspective

The last twelve months weren't great for Party City Holdco shares, which cost holders 78%, while the market was up about 27%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. The three-year loss of 43% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Party City Holdco (of which 1 is major) which any shareholder or potential investor should be aware of.

Party City Holdco is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OTCPK:PRTY.Q

Party City Holdco

Party City Holdco Inc. designs, manufactures, sources, and distributes party goods worldwide.

Slightly overvalued with weak fundamentals.

Market Insights

Community Narratives