The Navistar International (NYSE:NAV) Share Price Has Gained 17% And Shareholders Are Hoping For More

On average, over time, stock markets tend to rise higher. This makes investing attractive. But not every stock you buy will perform as well as the overall market. For example, the Navistar International Corporation (NYSE:NAV), share price is up over the last year, but its gain of 17% trails the market return. However, the longer term returns haven't been so impressive, with the stock up just 1.9% in the last three years.

View our latest analysis for Navistar International

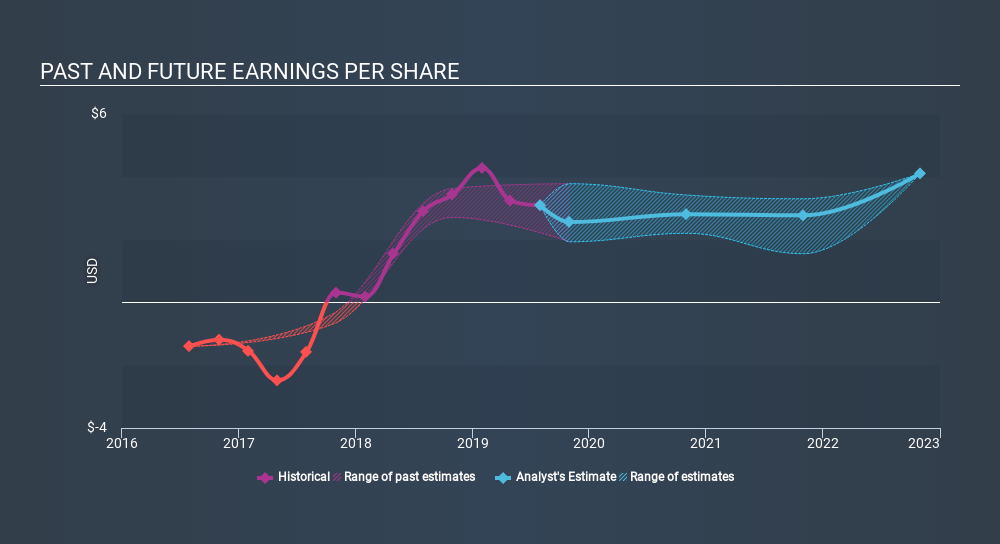

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Navistar International was able to grow EPS by 6.5% in the last twelve months. This EPS growth is significantly lower than the 17% increase in the share price. This indicates that the market is now more optimistic about the stock.

The graphic below depicts how EPS has changed over time.

We know that Navistar International has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Navistar International's financial health with this free report on its balance sheet.

A Different Perspective

Navistar International provided a TSR of 17% over the last twelve months. But that was short of the market average. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 1.9% endured over half a decade. It could well be that the business is stabilizing. Before spending more time on Navistar International it might be wise to click here to see if insiders have been buying or selling shares.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Market Insights

Community Narratives