The LVMH Moët Hennessy - Louis Vuitton Société Européenne (EPA:MC) Share Price Has Gained 191%, So Why Not Pay It Some Attention?

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on the bright side, you can make far more than 100% on a really good stock. For example, the LVMH Moët Hennessy - Louis Vuitton, Société Européenne (EPA:MC) share price has soared 191% in the last half decade. Most would be very happy with that. It's also up 13% in about a month. But this could be related to good market conditions -- stocks in its market are up 6.1% in the last month.

Check out our latest analysis for LVMH Moët Hennessy - Louis Vuitton Société Européenne

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

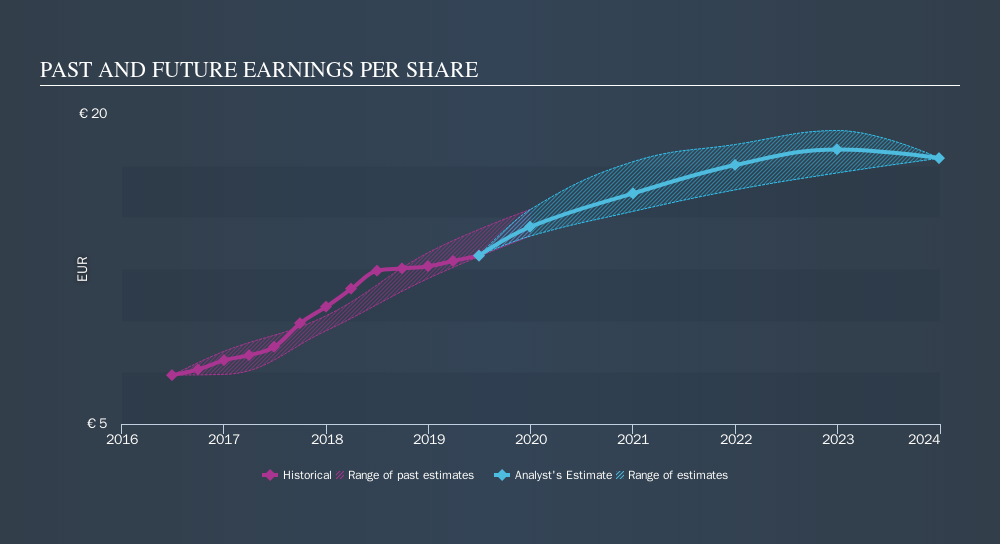

Over half a decade, LVMH Moët Hennessy - Louis Vuitton Société Européenne managed to grow its earnings per share at 14% a year. This EPS growth is lower than the 24% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth.

The company's earnings per share (over time) are depicted in the image below.

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, LVMH Moët Hennessy - Louis Vuitton Société Européenne's TSR for the last 5 years was 257%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that LVMH Moët Hennessy - Louis Vuitton Société Européenne shareholders have received a total shareholder return of 42% over one year. Of course, that includes the dividend. That's better than the annualised return of 29% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Before deciding if you like the current share price, check how LVMH Moët Hennessy - Louis Vuitton Société Européenne scores on these 3 valuation metrics.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:MC

LVMH Moët Hennessy - Louis Vuitton Société Européenne

Operates as a luxury goods company worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives