- Germany

- /

- Auto Components

- /

- XTRA:CON

The Continental (ETR:CON) Share Price Is Down 21% So Some Shareholders Are Getting Worried

Continental Aktiengesellschaft (ETR:CON) shareholders should be happy to see the share price up 17% in the last quarter. But that doesn't change the fact that the returns over the last three years have been less than pleasing. In fact, the share price is down 21% in the last three years, falling well short of the market return.

View our latest analysis for Continental

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

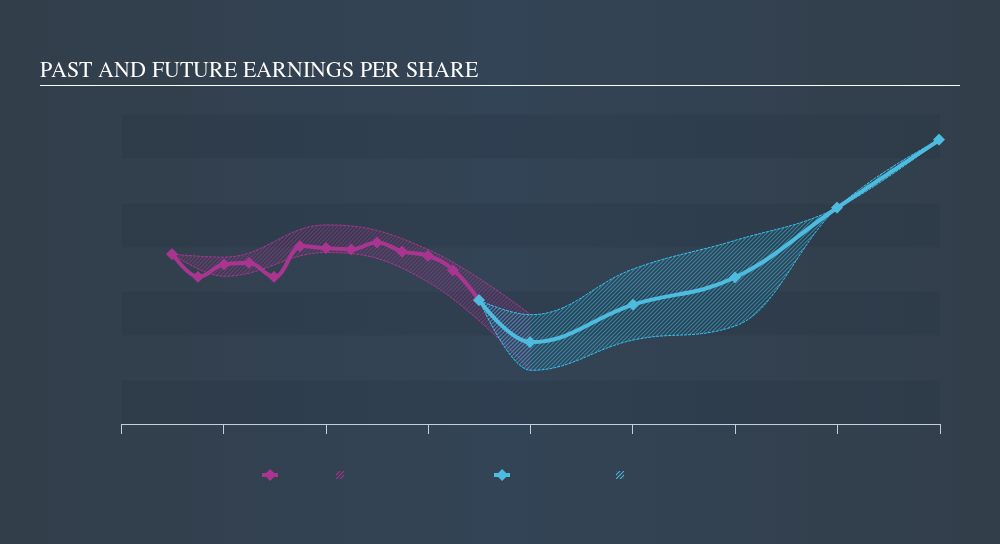

Continental saw its EPS decline at a compound rate of 6.3% per year, over the last three years. This fall in EPS isn't far from the rate of share price decline, which was 7.5% per year. So it seems like sentiment towards the stock hasn't changed all that much over time. In this case, it seems that the EPS is guiding the share price.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Continental's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Continental's TSR for the last 3 years was -15%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Continental shareholders are down 0.6% for the year (even including dividends) , but the market itself is up 13%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 1.0% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. Keeping this in mind, a solid next step might be to take a look at Continental's dividend track record. This free interactive graph is a great place to start.

We will like Continental better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About XTRA:CON

Continental

A technology company, provides solutions for vehicles, machines, traffic, and transportation worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives