- United States

- /

- Software

- /

- NasdaqCM:WULF

TeraWulf (NasdaqCM:WULF) Reports Decline In Sales And Increase In Net Loss

Reviewed by Simply Wall St

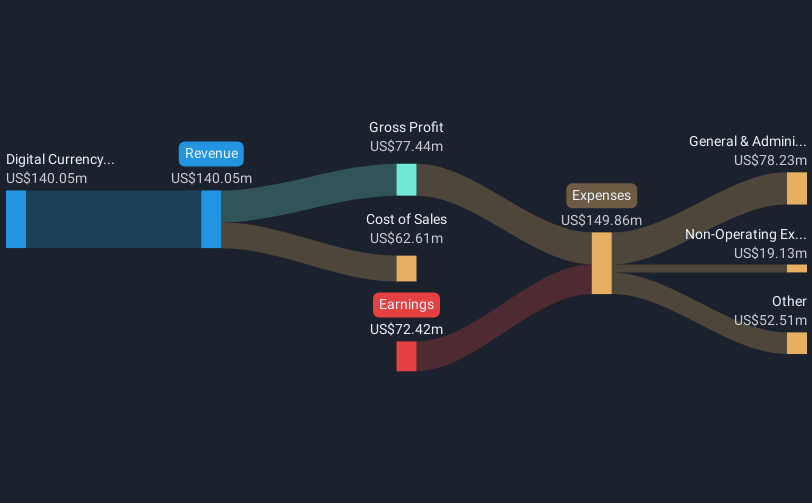

TeraWulf (NasdaqCM:WULF) has shown a price movement of 25% over the last month, which coincides with the company's recent financial disclosures and share buyback activity. The firm reported a substantial decline in sales and an increase in net loss in its latest earnings report. Concurrently, it has pursued share buybacks, reflecting a dedication to shareholder value. These actions provided a mixed backdrop against broader market trends, where the S&P 500 and Nasdaq saw notable increases. External factors, such as trade policy uncertainties and improved economic data, might have added weight to the company's movement within the market.

The recent 25% increase in TeraWulf's share price could indicate investor optimism surrounding the company's share buyback initiative and strategic refocusing on HPC hosting. This move is expected to enhance revenue streams, as highlighted by the planned expansion of capacity and infrastructure. However, the challenges of a substantial decline in sales and increased net loss put pressure on the company's ability to achieve its ambitious revenue and earnings forecasts. Analysts foresee significant growth and increased profit margins, but uncertainties like high power costs and Bitcoin market fluctuations could affect these projections.

Over the past year, TeraWulf delivered a comprehensive total return of 59.65%, contrasting with the more moderate industry return of 22.8%. This performance suggests that, despite short-term volatility, TeraWulf's long-term strategies might be positively influencing investor sentiment. However, the current share price of US$2.92 still reflects a significant discount from the consensus analyst price target of US$7.45, indicating a potential upside of 60.8%. Investors should weigh these factors and market conditions carefully when interpreting this potential, especially given TeraWulf's ambitious revenue growth targets and the ongoing industry uncertainties.

Our valuation report here indicates TeraWulf may be overvalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TeraWulf might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:WULF

TeraWulf

Operates as a digital asset technology company in the United States.

High growth potential low.

Similar Companies

Market Insights

Community Narratives