- United States

- /

- Life Sciences

- /

- NasdaqGS:TEM

Tempus AI (TEM) Secures FDA Clearance For ECG-Low EF Software

Reviewed by Simply Wall St

Tempus AI (TEM) recently secured FDA clearance for its Tempus ECG-Low EF software and expanded its collaboration with Personalis for colorectal cancer detection, measures that collectively strengthened its market position. These advances, alongside its inclusion in various Russell indices, have contributed to the company's 19% share price increase over the last quarter. During this period, broader markets, such as the S&P 500 and Nasdaq, also reached all-time highs, bolstered by easing tariff tensions and strong corporate earnings. Tempus' product innovations in healthcare further enhanced its visibility and appeal among investors, aligning with the bullish market trend.

Be aware that Tempus AI is showing 3 warning signs in our investment analysis.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

The recent FDA clearance for Tempus AI's ECG-Low EF software and its expanded collaboration with Personalis marks significant strides in the company's market positioning. This development may further fuel its revenue growth trajectory, given the emphasis on AI-driven precision medicine in its narrative. The integration of such innovations is likely to enhance product differentiation and elevate revenue forecasts, aligning with market momentum towards personalized healthcare solutions.

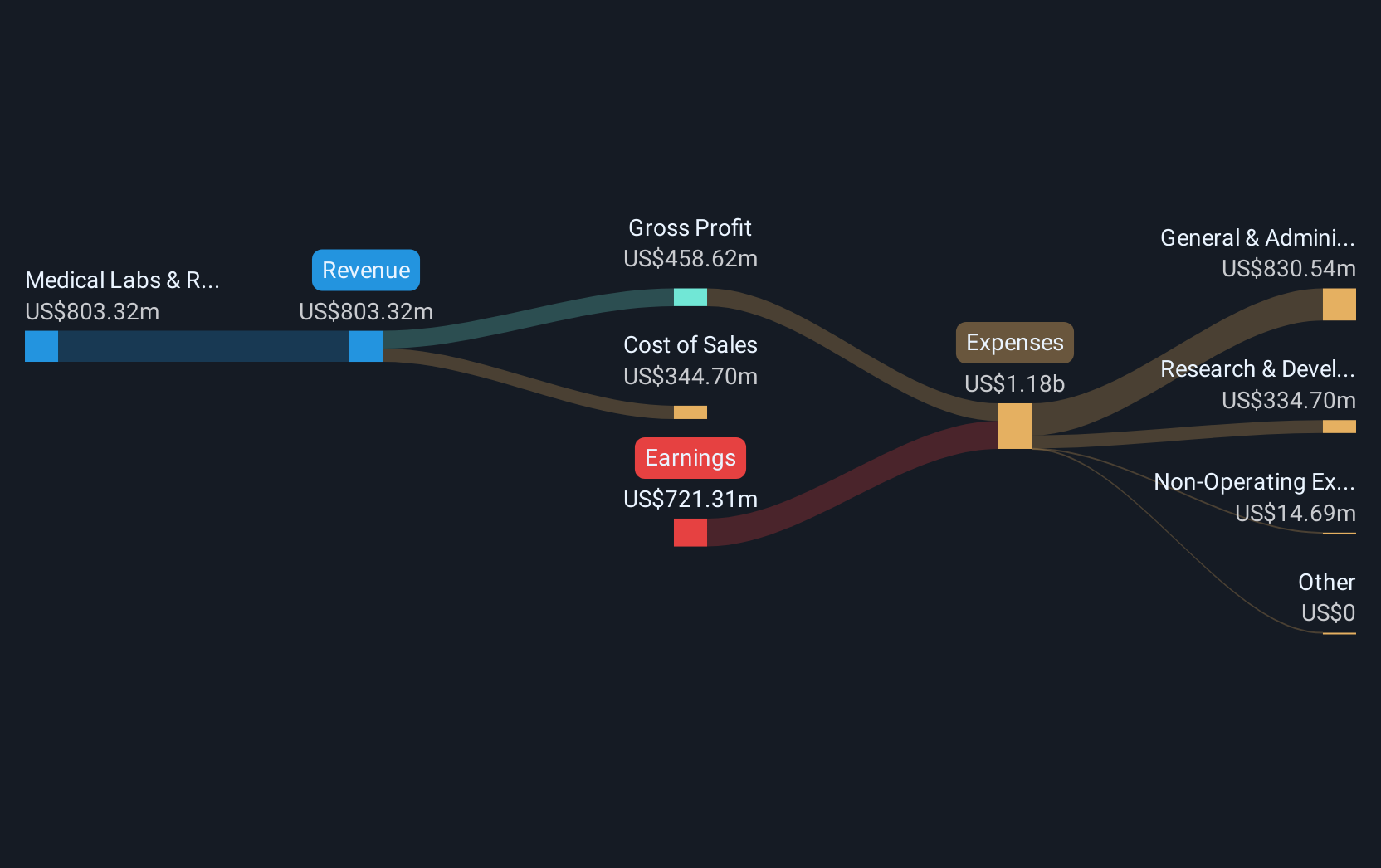

Tempus AI shares have risen 19% in the last quarter, supported by broader market gains, with the past year's return reaching 47%. This places the company above the US Life Sciences industry, which saw a decline of 19.6% over the same period. This longer-term performance illustrates Tempus's ability to leverage its growth strategies effectively, despite recorded earnings losses of US$721.31 million and enduring profitability challenges.

The current share price of $64.49, slightly below the consensus price target of $66.77, suggests limited upside potential based on existing analyst estimates. Analysts anticipate revenue growth of 22.77% annually, although the company is not expected to achieve profitability in the immediate term. The recent news of collaborations and product approvals could positively influence these forecasts, potentially bringing the share price closer to or beyond the target, contingent on successful implementation and market reception.

Review our growth performance report to gain insights into Tempus AI's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tempus AI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TEM

Moderate growth potential low.

Similar Companies

Market Insights

Community Narratives