- United States

- /

- Energy Services

- /

- NYSE:FTI

TechnipFMC (NYSE:FTI) Shareholders Have Enjoyed A 11% Share Price Gain

It hasn't been the best quarter for TechnipFMC plc (NYSE:FTI) shareholders, since the share price has fallen 15% in that time. Looking on the brighter side, the stock is actually up over twelve months. But to be blunt its return of 11% fall short of what you could have got from an index fund (around 37%).

Check out our latest analysis for TechnipFMC

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year TechnipFMC saw its earnings per share (EPS) drop below zero. While some may see this as temporary, we're a skeptical bunch, and so we're a little surprised to see the share price go up. It may be that the company has done well on other metrics.

Revenue was pretty flat year on year, but maybe a closer look at the data can explain the market optimism.

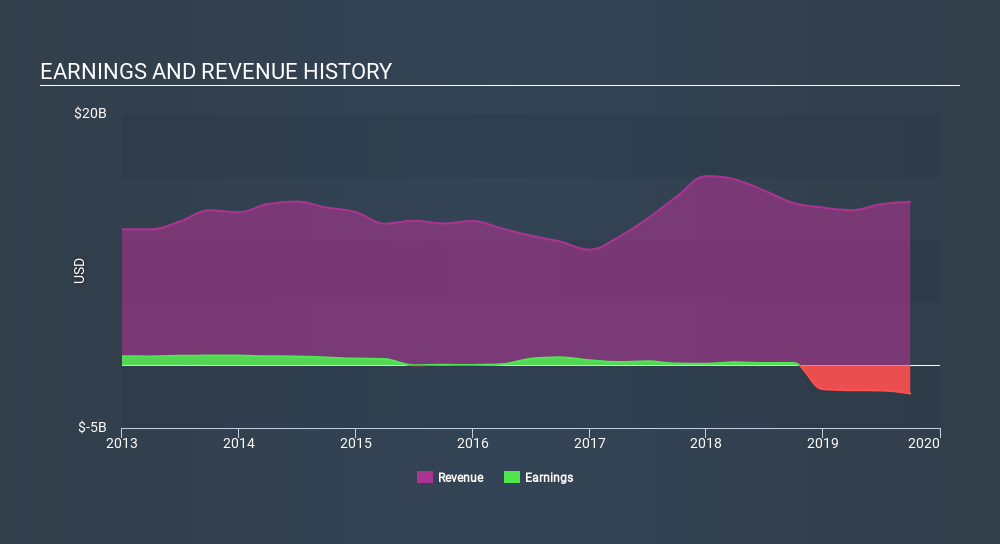

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

While the share price may move with revenue, other factors can also play a role. For example, we've discovered 2 warning signs for TechnipFMC which any shareholder or potential investor should be aware of.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, TechnipFMC's TSR for the last year was 13%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

TechnipFMC shareholders have gained 13% for the year (even including dividends) . The bad news is that's no better than the average market return, which was roughly 37%. The stock trailed the market by 23% in that time, testament to the power of passive investing. It might be that investors are more concerned about the business lately due to some fundamental change (or else the share price simply got ahead of itself, previously). Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of TechnipFMC by clicking this link.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:FTI

TechnipFMC

Engages in the energy projects, technologies, systems, and services businesses in Europe, Central Asia, North America, Latin America, the Asia Pacific, Africa, the Middle East, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives