Tata Coffee Limited (NSE:TATACOFFEE) Not Flying Under The Radar

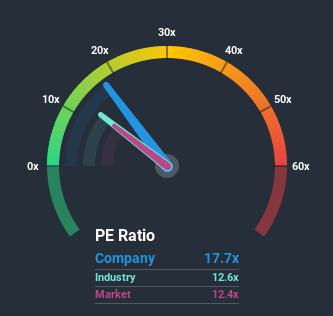

Tata Coffee Limited's (NSE:TATACOFFEE) price-to-earnings (or "P/E") ratio of 17.7x might make it look like a sell right now compared to the market in India, where around half of the companies have P/E ratios below 12x and even P/E's below 6x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Tata Coffee has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Tata Coffee

Where Does Tata Coffee's P/E Sit Within Its Industry?

An inspection of average P/E's throughout Tata Coffee's industry may help to explain its high P/E ratio. It turns out the Food industry in general has a P/E ratio similar to the market, as the graphic below shows. So it appears the company's ratio isn't really influenced by these industry numbers currently. In the context of the Food industry's current setting, most of its constituents' P/E's would be expected to be held back. Nonetheless, the greatest force on the company's P/E will be its own earnings growth expectations.

How Is Tata Coffee's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Tata Coffee's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 20% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 45% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to remain buoyant, climbing by 14% during the coming year according to the one analyst following the company. With the rest of the market predicted to shrink by 7.3%, that would be a fantastic result.

In light of this, it's understandable that Tata Coffee's P/E sits above the majority of other companies. Right now, investors are willing to pay more for a stock that is shaping up to buck the trend of the broader market going backwards.

What We Can Learn From Tata Coffee's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Tata Coffee maintains its high P/E on the strength of its forecast growth potentially beating a struggling market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Our only concern is whether its earnings trajectory can keep outperforming under these tough market conditions. Although, if the company's prospects don't change they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Tata Coffee that you should be aware of.

Of course, you might also be able to find a better stock than Tata Coffee. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

If you decide to trade Tata Coffee, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tata Coffee might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:TATACOFFEE

Tata Coffee

Tata Coffee Limited, together with its subsidiaries, produces, trades in, and distributes coffee, tea, and allied products.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives