- United States

- /

- Software

- /

- NasdaqGS:SNPS

Synopsys (SNPS) Completes Acquisition Of Ansys, Expands Market Reach To US$31 Billion

Reviewed by Simply Wall St

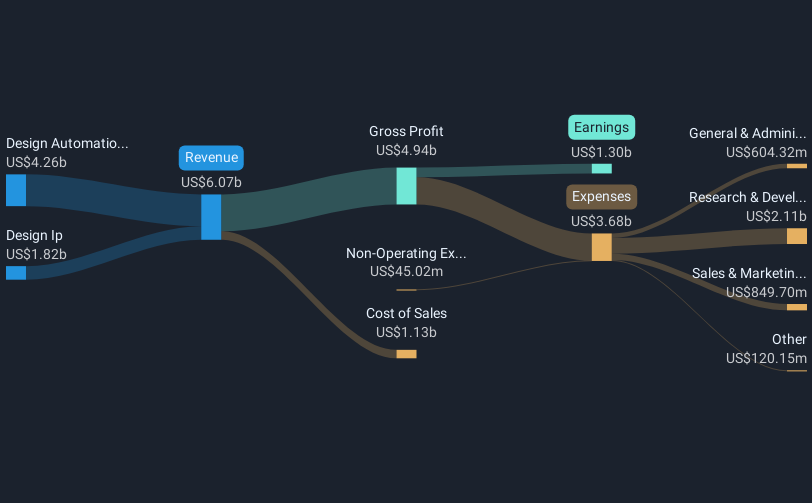

Synopsys (SNPS) has recently concluded its acquisition of Ansys, a move designed to fortify its position in silicon design and simulation. The company's stock experienced a notable increase of 43% over the last quarter. This upward trajectory seems supported by several factors: the successful integration of Ansys with its expanded market reach, new collaborations, and positive revenue guidance. Additionally, index inclusion and robust earnings in Q2 further bolstered the price movement. Despite a mixed global market and economic environment, these developments helped Synopsys gain investor confidence, resulting in significant stock appreciation relative to broader market indicators.

Buy, Hold or Sell Synopsys? View our complete analysis and fair value estimate and you decide.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent acquisition of Ansys and its integration into Synopsys is likely to enhance the company's leadership in electronic design automation (EDA) tools. This move aligns with the company's ongoing focus on AI-powered solutions, which are expected to bolster revenue through improved market position and strengthened customer offerings. The successful completion of this acquisition, combined with the launch of AI-driven systems like HAPS-200 and ZeBu-200, should contribute positively to Synopsys' revenue and earnings forecasts.

Over the longer term, Synopsys has delivered a total shareholder return of 197.78% over five years, reflecting a strong performance in the market. This substantial return underscores the company's resilience and growth capabilities in a competitive industry landscape. However, in the past year, Synopsys has underperformed relative to the US Software industry, which returned 26.1% over the same period. Despite the shortfall, the company's long-term growth remains robust, supported by its strategic initiatives.

The current share price of US$589.01, in close proximity to the consensus analyst price target of US$607.33, indicates limited upside potential according to market analysts. Yet, the positive developments related to the Ansys acquisition and advancements in AI tools may affect future revenue and earnings, potentially adjusting this outlook. Analysts forecast revenue to grow by 13.9% annually over the next three years, with earnings projected to reach US$2.3 billion by 2028. These expectations are aligned with the company's current strategic direction and market expansion goals.

Unlock comprehensive insights into our analysis of Synopsys stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNPS

Synopsys

Provides electronic design automation software products used to design and test integrated circuits.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives