Stock Analysis

- United States

- /

- Specialty Stores

- /

- NYSE:GES

Exploring Dividend Stocks For Your Portfolio In March 2024

As the United States market prepares for significant changes in policy shift, investors are closely watching these adjustments and their potential impacts on market dynamics. In this evolving landscape, identifying dividend stocks that offer stability and growth potential becomes increasingly important for building a resilient portfolio.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Premier Financial (NasdaqGS:PFC) | 6.20% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.36% | ★★★★★★ |

| Lakeland Bancorp (NasdaqGS:LBAI) | 4.92% | ★★★★★★ |

| Bank of Marin Bancorp (NasdaqCM:BMRC) | 6.00% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.80% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 6.44% | ★★★★★★ |

| Sandy Spring Bancorp (NasdaqGS:SASR) | 5.98% | ★★★★★★ |

| Southside Bancshares (NasdaqGS:SBSI) | 5.03% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.97% | ★★★★★★ |

| West Bancorporation (NasdaqGS:WTBA) | 5.68% | ★★★★★★ |

Click here to see the full list of 267 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

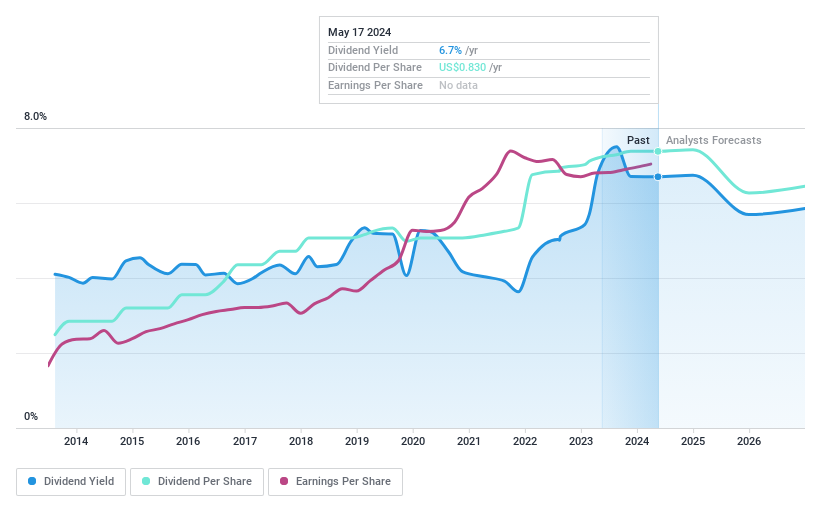

United Bancorp (NasdaqCM:UBCP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: United Bancorp, Inc., serving as the bank holding company for Unified Bank, offers commercial and retail banking services primarily in Ohio, with a market capitalization of approximately $85.34 million.

Operations: United Bancorp, Inc. generates its revenue primarily through banking services, amounting to $30.34 million.

Dividend Yield: 5.5%

United Bancorp has shown a modest earnings growth of 8.2% over the past year, with forecasts predicting a continued annual growth rate of 4.14%. Despite its volatile and unreliable dividend history over the last decade, recent actions indicate a positive shift. The company recently increased its quarterly dividend to US$0.1725, marking a 6.2% rise from the previous year, and announced a special dividend of US$0.15 per share, reflecting strong earnings and financial health. With dividends currently well covered by earnings at a 40.8% payout ratio and expected to remain so in three years (39.8%), United Bancorp's forward yield stands at an attractive 5.4%, placing it in the top tier of US dividend payers.

- Delve into the full analysis dividend report here for a deeper understanding of United Bancorp.

-

Upon reviewing our latest valuation report, United Bancorp's share price might be too pessimistic.

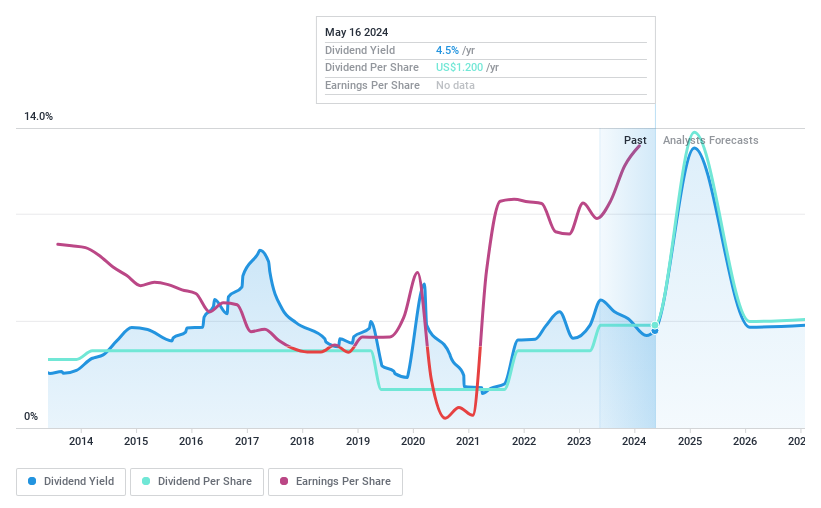

Guess? (NYSE:GES)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Guess?, Inc. is a global company that designs, markets, distributes, and licenses lifestyle collections of apparel and accessories for men, women, and children, with a market capitalization of approximately $1.68 billion.

Operations: Guess?, Inc. generates its revenue from various segments, including Asia ($276.87 million), Europe ($1.48 billion), Licensing ($113.25 million), Americas Retail ($710.91 million), and Americas Wholesale ($199.90 million).

Dividend Yield: 3.8%

Guess? has demonstrated a solid financial performance with a notable increase in net income from US$149.61 million to US$198.2 million year-over-year, alongside revenue growth from US$2,687.35 million to US$2,776.53 million. Despite this positive earnings trajectory and a low payout ratio of 30.3%, the dividend yield at 3.85% remains below the top quartile of US dividend payers at 4.7%. The company's dividends have shown volatility over the past decade, raising questions about their stability despite recent affirmations and a special dividend announcement of $2.25 per share payable in May 2024, indicating potential for future growth but also highlighting past inconsistencies in payouts.

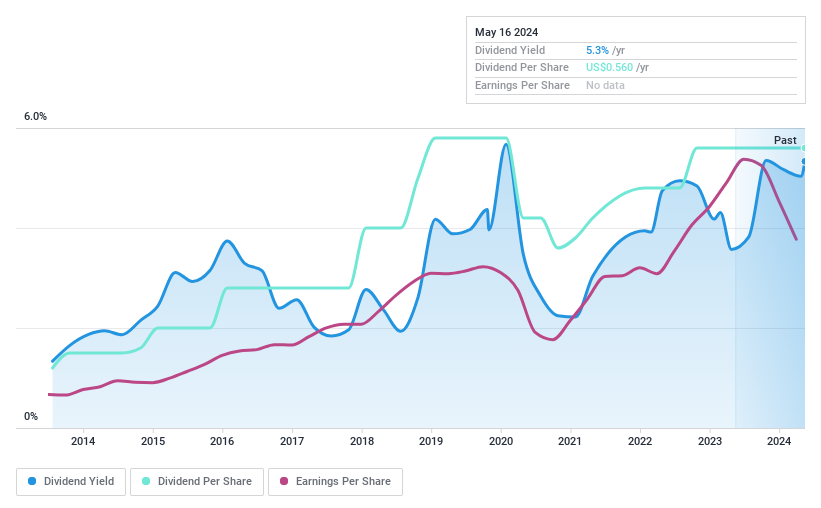

Marine Products (NYSE:MPX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Marine Products Corporation, a global company specializing in the design, manufacture, and sale of recreational fiberglass powerboats for the sport boat and sport fishing markets, has a market capitalization of approximately $396.43 million.

Operations: Marine Products Corporation generates its revenues primarily through its powerboat manufacturing segment, amounting to $383.73 million.

Dividend Yield: 4.9%

Marine Products Corporation, with a dividend yield of 4.9%, positions itself above the median in the US market. Despite a challenging year with sales dropping to US$383.73 million from US$381 million and net income slightly increasing to US$41.7 million, the company maintained its dividend at $0.14 per share, showcasing a commitment to shareholder returns amidst volatility. The firm's payout ratios—46.3% from earnings and 41.6% from cash flows—indicate dividends are well-supported, albeit past fluctuations in payments suggest caution regarding long-term stability.

Make It Happen

- Dive into all 267 of the Top Dividend Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore small companies with big growth potential before they take off.

- Fuel your portfolio with fast-growing stocks poised for rapid expansion .

- Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Guess? is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GES

Guess?

Guess?, Inc. designs, markets, distributes, and licenses lifestyle collections of apparel and accessories for men, women, and children.

Flawless balance sheet, undervalued and pays a dividend.