- United States

- /

- Professional Services

- /

- NasdaqGS:CNDT

Spotlight On 3 Promising Penny Stocks With Over $50M Market Cap

Reviewed by Simply Wall St

The U.S. stock market remains resilient, with the S&P 500 and Nasdaq recently hitting new record highs despite the ongoing government shutdown. While major indices continue to capture headlines, penny stocks often fly under the radar yet offer unique opportunities for investors willing to explore smaller or newer companies. Though considered a somewhat outdated term, penny stocks still represent potential value and growth when backed by strong financials. In this article, we spotlight three such stocks that combine balance sheet strength with promising prospects for future growth.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.06 | $443.61M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.89 | $683.54M | ✅ 4 ⚠️ 0 View Analysis > |

| Sensus Healthcare (SRTS) | $3.16 | $51.62M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.95 | $23.5M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.98 | $676.36M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Table Trac (TBTC) | $4.70 | $21.71M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.9501 | $7.12M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.79 | $87.68M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.78 | $9.23M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 363 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Toro (TORO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Toro Corp. is a shipping company that acquires, owns, charters, and operates oceangoing LPG carrier vessels globally, with a market cap of $55.37 million.

Operations: Toro does not report any specific revenue segments.

Market Cap: $55.37M

Toro Corp.'s recent financial performance highlights its challenges and opportunities within the penny stock landscape. The company reported a decline in second-quarter revenue to US$4.06 million from US$5.43 million the previous year, though net income increased to US$1.43 million from US$1.13 million, indicating some operational improvements despite decreased sales. Toro's strategic moves include a shelf registration filing for US$9.42 million and selling a vessel for $20 million, reflecting efforts to optimize capital structure and asset utilization amidst high share price volatility and an inexperienced board with an average tenure of 2.6 years.

- Click to explore a detailed breakdown of our findings in Toro's financial health report.

- Learn about Toro's historical performance here.

Acrivon Therapeutics (ACRV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Acrivon Therapeutics, Inc. is a clinical stage biopharmaceutical company focused on discovering and developing oncology medicines tailored to patients' tumor profiles using its generative phosphoproteomics platform, with a market cap of $56.93 million.

Operations: Acrivon Therapeutics, Inc. has not reported any revenue segments.

Market Cap: $56.93M

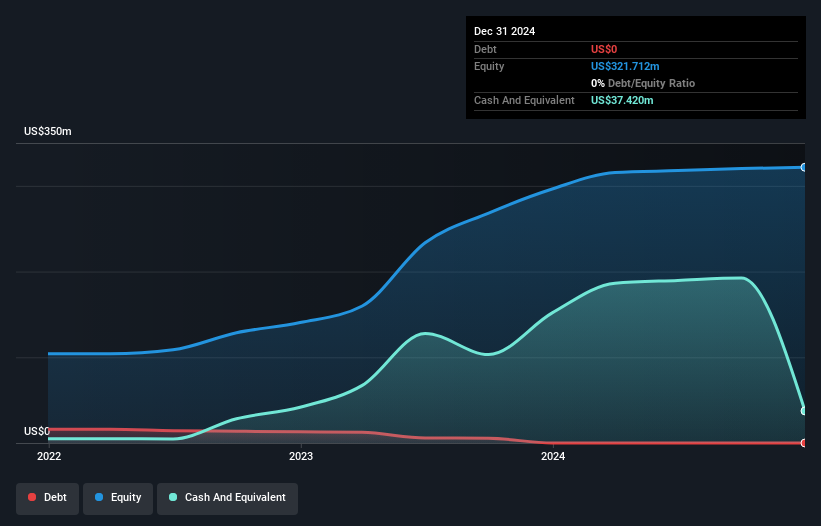

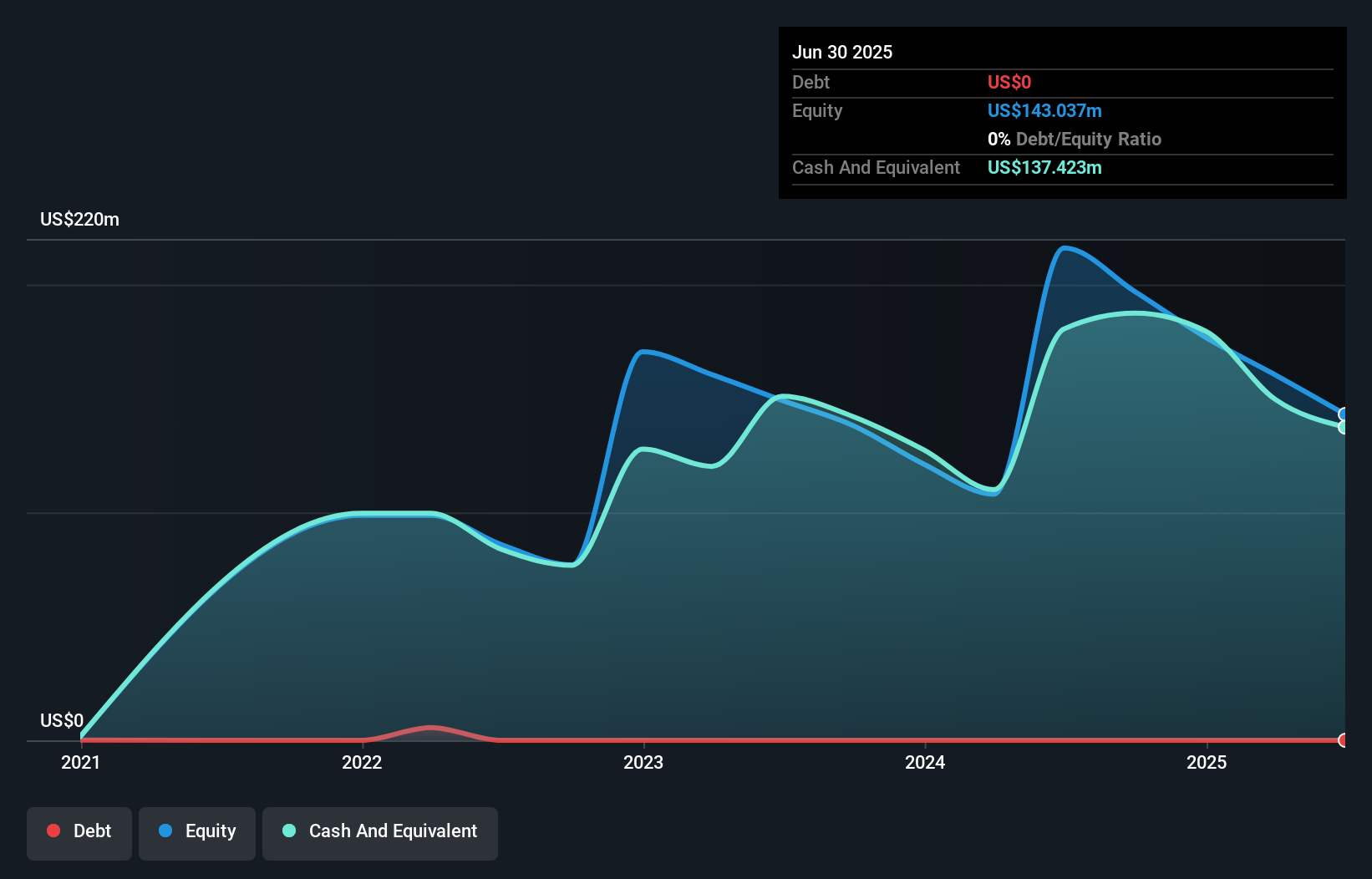

Acrivon Therapeutics, Inc., a clinical-stage biopharmaceutical company, remains pre-revenue with no significant income streams. Despite being debt-free and having short-term assets of US$138.4 million that cover both short and long-term liabilities, Acrivon faces challenges typical in the penny stock arena. The company's cash runway is sufficient for over a year under current free cash flow conditions, but it has experienced increased losses over recent years. Recent earnings announcements revealed a net loss of US$21.01 million for Q2 2025, emphasizing its ongoing unprofitability amidst high share price volatility and an experienced management team with an average tenure of 3.5 years.

- Get an in-depth perspective on Acrivon Therapeutics' performance by reading our balance sheet health report here.

- Understand Acrivon Therapeutics' earnings outlook by examining our growth report.

Conduent (CNDT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Conduent Incorporated offers digital business solutions and services across the commercial, government, and transportation sectors globally, with a market cap of approximately $442.33 million.

Operations: The company's revenue comprises $1.57 billion from the commercial sector, $935 million from government services, and $585 million from transportation.

Market Cap: $442.33M

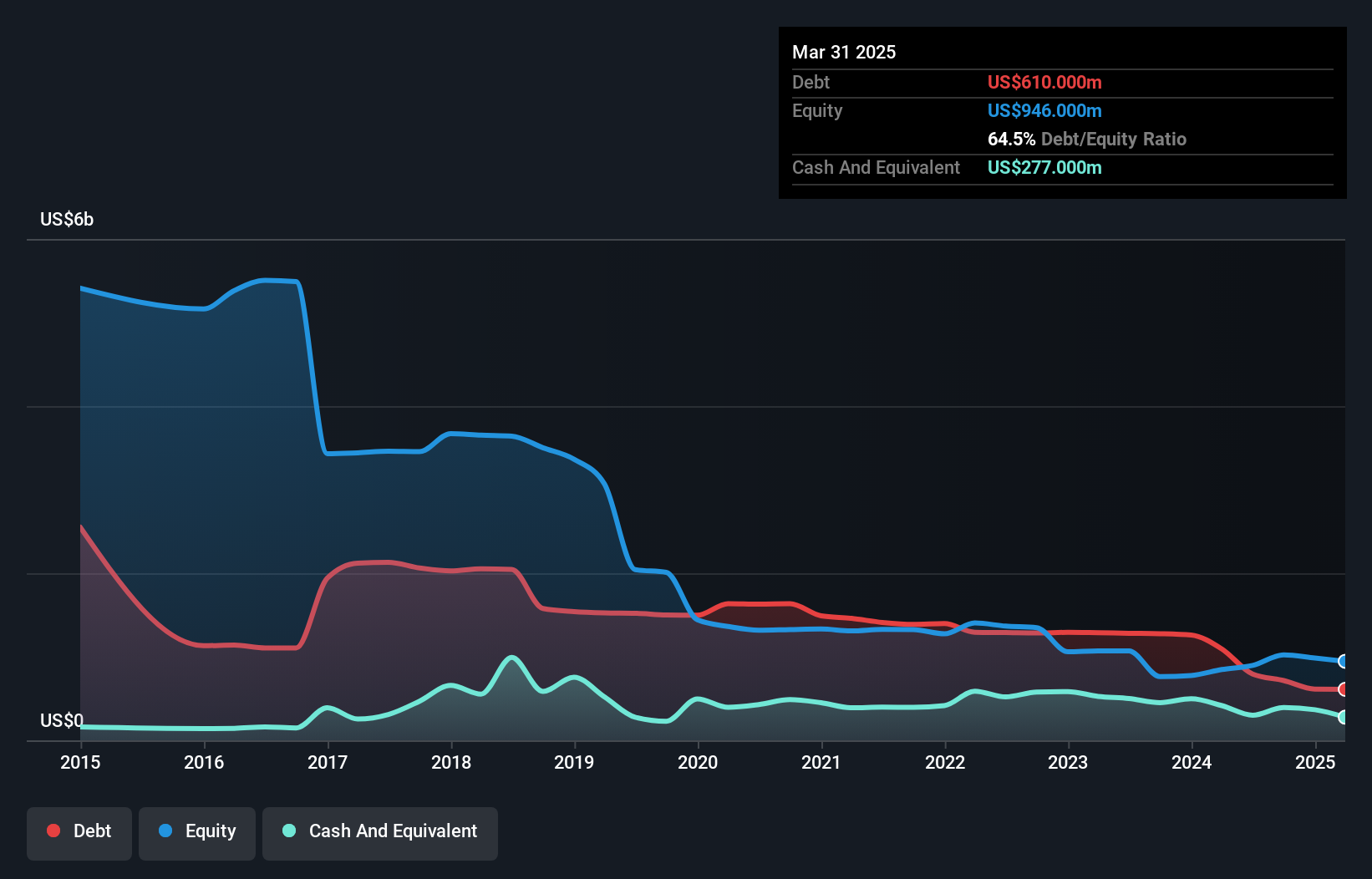

Conduent Incorporated, with a market cap of US$442.33 million, operates across commercial, government, and transportation sectors. The company has recently embedded advanced AI technologies to enhance fraud prevention for government programs like Medicaid and SNAP. Despite stable weekly volatility and a satisfactory net debt to equity ratio of 36.7%, Conduent faces challenges such as declining profit margins and negative earnings growth over the past year. However, strategic refinancing efforts aim to bolster its financial stability. The management team is relatively new with an average tenure of 1.4 years, while the board is experienced at 6.2 years on average.

- Dive into the specifics of Conduent here with our thorough balance sheet health report.

- Learn about Conduent's future growth trajectory here.

Where To Now?

- Jump into our full catalog of 363 US Penny Stocks here.

- Seeking Other Investments? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CNDT

Conduent

Provides digital business solutions and services for the commercial, government, and transportation spectrum in the United States, Europe, and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success