- United States

- /

- Banks

- /

- NasdaqGM:KFFB

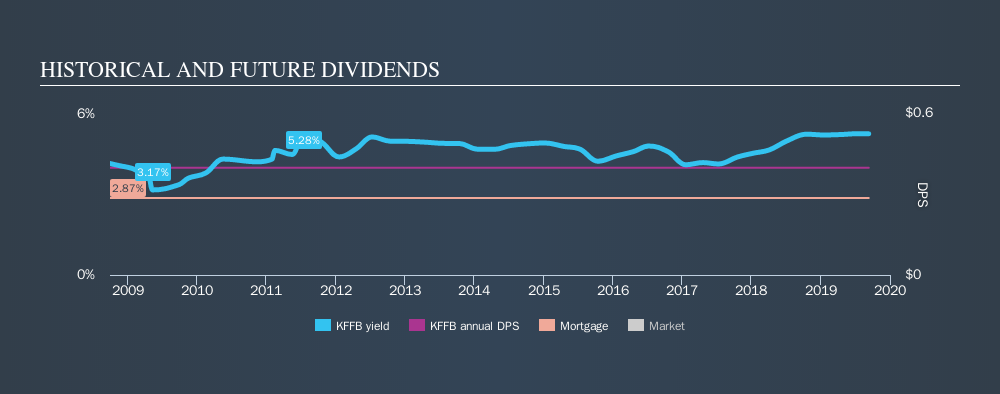

Something To Consider Before Buying Kentucky First Federal Bancorp (NASDAQ:KFFB) For The 5.3% Dividend

Dividend paying stocks like Kentucky First Federal Bancorp (NASDAQ:KFFB) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

A high yield and a long history of paying dividends is an appealing combination for Kentucky First Federal Bancorp. It would not be a surprise to discover that many investors buy it for the dividends. The company also bought back stock during the year, equivalent to approximately 1.1% of the company's market capitalisation at the time. There are a few simple ways to reduce the risks of buying Kentucky First Federal Bancorp for its dividend, and we'll go through these below.

Explore this interactive chart for our latest analysis on Kentucky First Federal Bancorp!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Kentucky First Federal Bancorp paid out 411% of its profit as dividends, over the trailing twelve month period. Unless there are extenuating circumstances, from the perspective of an investor who hopes to own the company for many years, a payout ratio of above 100% is definitely a concern.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Kentucky First Federal Bancorp has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. During this period the dividend has been stable, which could imply the business could have relatively consistent earnings power. During the past ten-year period, the first annual payment was US$0.40 in 2009, compared to US$0.40 last year.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. Over the past five years, it looks as though Kentucky First Federal Bancorp's EPS have declined at around 16% a year. With this kind of significant decline, we always wonder what has changed in the business. Dividends are about stability, and Kentucky First Federal Bancorp's earnings per share, which support the dividend, have been anything but stable.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. First, it's not great to see how much of its earnings are being paid as dividends. Moreover, earnings have been shrinking. While the dividends have been fairly steady, we'd wonder for how much longer this will be sustainable if earnings continue to decline. To conclude, we've spotted a couple of potential concerns with Kentucky First Federal Bancorp that may make it less than ideal candidate for dividend investors.

Now, if you want to look closer, it would be worth checking out our free research on Kentucky First Federal Bancorp management tenure, salary, and performance.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGM:KFFB

Kentucky First Federal Bancorp

Operates as the holding company for First Federal Savings and Loan Association of Hazard, Kentucky, and Frankfort First Bancorp, Inc.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion