- United States

- /

- Interactive Media and Services

- /

- NYSE:FENG

Some Phoenix New Media (NYSE:FENG) Shareholders Have Copped A Big 55% Share Price Drop

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

While it may not be enough for some shareholders, we think it is good to see the Phoenix New Media Limited (NYSE:FENG) share price up 14% in a single quarter. But that doesn't change the fact that the returns over the last half decade have been disappointing. In that time the share price has delivered a rude shock to holders, who find themselves down 55% after a long stretch. So we're not so sure if the recent bounce should be celebrated. But it could be that the fall was overdone.

View our latest analysis for Phoenix New Media

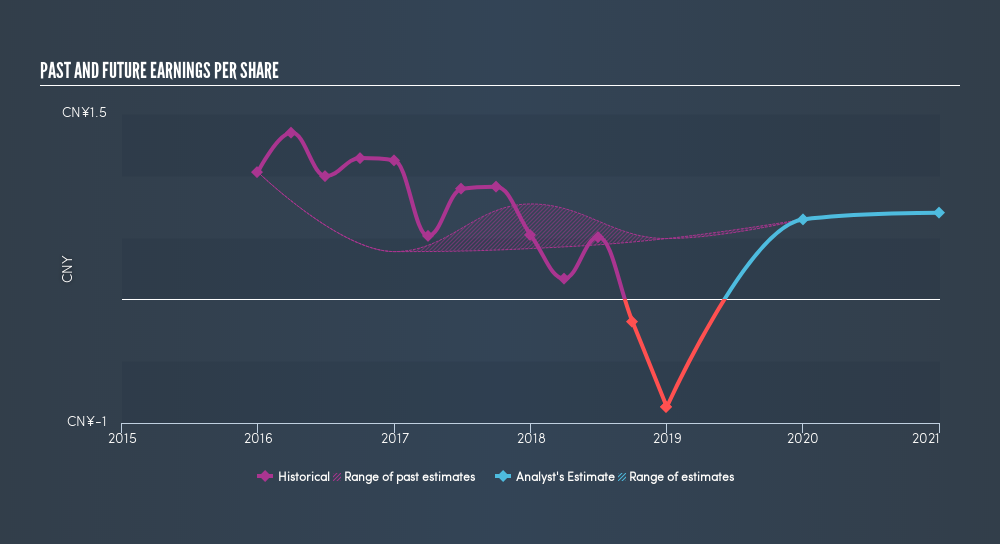

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

In the last half decade Phoenix New Media saw its share price fall as its EPS declined below zero. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on Phoenix New Media's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Phoenix New Media provided a TSR of 7.6% over the last twelve months. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 15% per year, over five years. So this might be a sign the business has turned its fortunes around. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course Phoenix New Media may not be the best stock to buy. So you may wish to see this freecollection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:FENG

Phoenix New Media

Provides content on an integrated Internet platform in the People’s Republic of China.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives