- Germany

- /

- Electrical

- /

- XTRA:ENR

Siemens Energy (XTRA:ENR) Partners With Eaton To Revolutionise Data Center Power Solutions

Reviewed by Simply Wall St

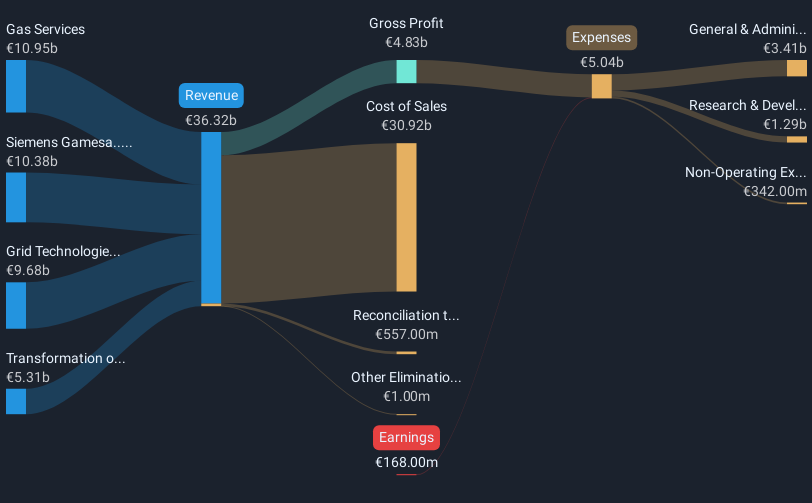

On June 3, 2025, Siemens Energy (XTRA:ENR) announced a significant alliance with Eaton to expedite data center construction through integrated power solutions. This partnership, along with recent strategic alliances and operational streamlining efforts, aligns with Siemens Energy's adaptability approach. Following these developments, the company's share price rose by 71% over the last quarter. Additionally, although Siemens Energy's earnings showed a decline, the strategic announcements potentially reinforced the company's positioning, exhibited by a strong price uptake compared to the broader market growth of 2% in the past week and 12% over the last year.

Buy, Hold or Sell Siemens Energy? View our complete analysis and fair value estimate and you decide.

The announcement of Siemens Energy's alliance with Eaton on June 3, 2025, represents a significant move towards expanding the company's capabilities in providing integrated power solutions for data centers. This partnership is likely to enhance Siemens Energy's revenue and earnings forecasts by tapping into the growing demand for efficient data infrastructure. The alliance aligns with the company's strategic investments in technology and capacity expansion, particularly in offshore wind and gas turbines, potentially driving future revenue growth and profitability.

Over the past three years, Siemens Energy's total shareholder returns, including dividends, have increased by 367.60%. This substantial growth over the long term provides context to the recent quarterly share price surge of 71%. Comparatively, Siemens Energy has outperformed the broader market, which grew by 15.2% over the past year, further underscoring its strong performance relative to industry peers. Despite a 10.3% gap between the current share price of €67.54 and the analyst consensus price target of €61.26, the market's confidence in the company's strategic direction is evident.

The recent developments and strategic initiatives are expected to contribute positively to Siemens Energy's revenue and earnings over the coming years. Analysts project an annual revenue growth of 9.1% and a significant rise in profit margins, underscoring the potential impact of the alliance on the company's financial health. However, ongoing challenges such as the integration with Siemens Gamesa and fluctuations in gas turbine demand need careful management to sustain this growth trajectory. The current valuation suggests that while the company is trading slightly above analyst expectations, its future prospects and strategic moves may justify the existing price levels in the long term.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ENR

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives