- Australia

- /

- Household Products

- /

- ASX:PTL

Should You Be Pleased About The CEO Pay At Pental Limited's (ASX:PTL)

In 2014, Charlie McLeish was appointed CEO of Pental Limited (ASX:PTL). This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. After that, we will consider the growth in the business. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. The aim of all this is to consider the appropriateness of CEO pay levels.

Check out our latest analysis for Pental

How Does Charlie McLeish's Compensation Compare With Similar Sized Companies?

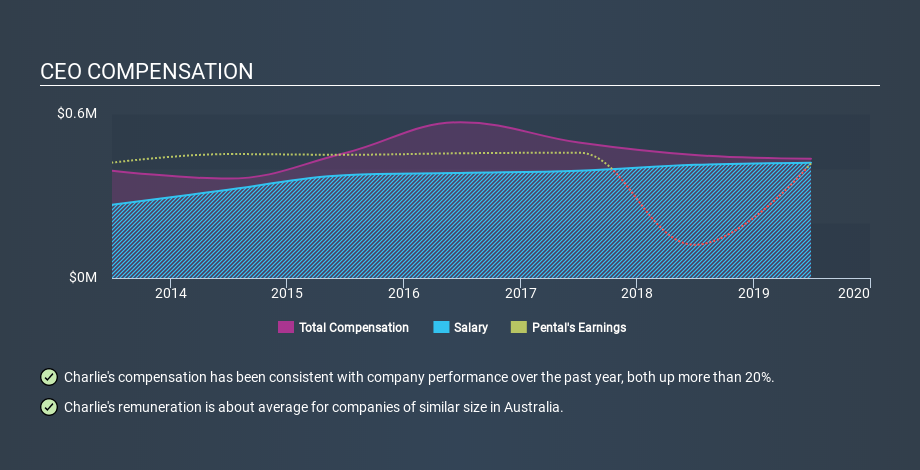

According to our data, Pental Limited has a market capitalization of AU$48m, and paid its CEO total annual compensation worth AU$436k over the year to June 2019. It is worth noting that the CEO compensation consists almost entirely of the salary, worth AU$422k. We looked at a group of companies with market capitalizations under AU$292m, and the median CEO total compensation was AU$379k.

Pay mix tells us a lot about how a company functions versus the wider industry, and it's no different in the case of Pental. Talking in terms of the sector, salary represented approximately 47% of total compensation out of all the companies we analysed, while other remuneration made up 53% of the pie. Pental has gone down a largely traditional route, paying Charlie McLeish a high salary, giving it preference as a compensation method to non-salary benefits.

So Charlie McLeish receives a similar amount to the median CEO pay, amongst the companies we looked at. While this data point isn't particularly informative alone, it gains more meaning when considered with business performance. The graphic below shows how CEO compensation at Pental has changed from year to year.

Is Pental Limited Growing?

On average over the last three years, Pental Limited has shrunk earnings per share by 40% each year (measured with a line of best fit). It achieved revenue growth of 25% over the last year.

The reduction in earnings per share, over three years, is arguably concerning. But on the other hand, revenue growth is strong, suggesting a brighter future. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Although we don't have analyst forecasts shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Pental Limited Been A Good Investment?

With a three year total loss of 35%, Pental Limited would certainly have some dissatisfied shareholders. So shareholders would probably think the company shouldn't be too generous with CEO compensation.

In Summary...

Remuneration for Charlie McLeish is close enough to the median pay for a CEO of a similar sized company .

The company cannot boast particularly strong per share growth. And we think the shareholder returns - over three years - have been underwhelming. So many would argue that the CEO is certainly not underpaid. Moving away from CEO compensation for the moment, we've identified 4 warning signs for Pental that you should be aware of before investing.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ASX:PTL

Prestal Holdings

Manufactures, markets, and distributes household chemical, cleaning products, and gift hampers in Australia.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026