Should You Be Pleased About The CEO Pay At Jacobs Engineering Group Inc.'s (NYSE:JEC)

Steve Demetriou became the CEO of Jacobs Engineering Group Inc. (NYSE:JEC) in 2015. This analysis aims first to contrast CEO compensation with other large companies. Then we'll look at a snap shot of the business growth. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This method should give us information to assess how appropriately the company pays the CEO.

View our latest analysis for Jacobs Engineering Group

How Does Steve Demetriou's Compensation Compare With Similar Sized Companies?

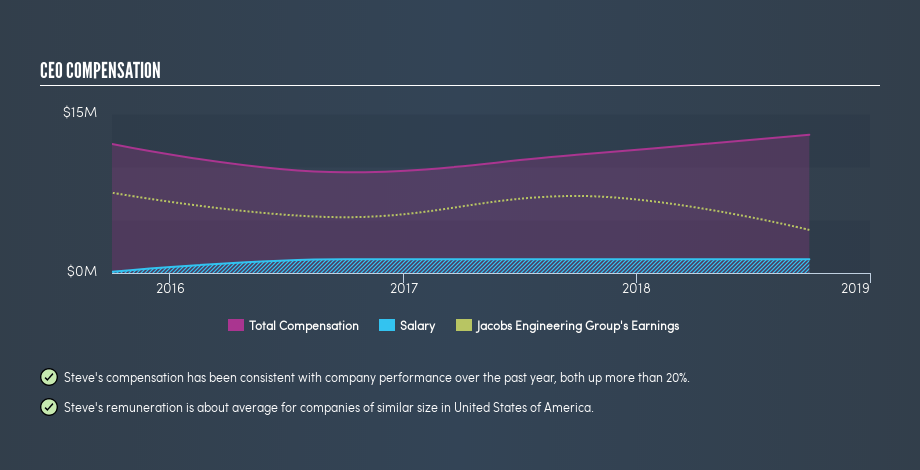

At the time of writing our data says that Jacobs Engineering Group Inc. has a market cap of US$12b, and is paying total annual CEO compensation of US$13m. (This is based on the year to September 2018). We think total compensation is more important but we note that the CEO salary is lower, at US$1.3m. When we examined a group of companies with market caps over US$8.0b, we found that their median CEO total compensation was US$11m. (We took a wide range because the CEOs of massive companies tend to be paid similar amounts - even though some are quite a bit bigger than others).

That means Steve Demetriou receives fairly typical remuneration for the CEO of a large company. Although this fact alone doesn't tell us a great deal, it becomes more relevant when considered against the business performance.

You can see, below, how CEO compensation at Jacobs Engineering Group has changed over time.

Is Jacobs Engineering Group Inc. Growing?

On average over the last three years, Jacobs Engineering Group Inc. has grown earnings per share (EPS) by 6.4% each year (using a line of best fit). In the last year, its revenue is up 64%.

I like the look of the strong year-on-year improvement in revenue. Combined with modest EPS growth, we get a good impression of the company. I'd stop short of saying the business performance is amazing, but there are enough positives to justify further research, or even adding the stock to your watch-list.

Has Jacobs Engineering Group Inc. Been A Good Investment?

Boasting a total shareholder return of 63% over three years, Jacobs Engineering Group Inc. has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Steve Demetriou is paid around what is normal the leaders of larger companies.

While the growth could be better, the shareholder returns are clearly good. So we can conclude that on this analysis the CEO compensation seems pretty sound. If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Jacobs Engineering Group.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:J

Jacobs Solutions

Engages in the infrastructure and advanced facilities, and consulting businesses in the United States, Europe, Canada, India, Asia, Australia, New Zealand, the Middle East, and Africa.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives