- United States

- /

- Insurance

- /

- NasdaqGS:AMSF

Should Amerisafe (NASDAQ:AMSF) Be Disappointed With Their 56% Profit?

Passive investing in index funds can generate returns that roughly match the overall market. But in our experience, buying the right stocks can give your wealth a significant boost. For example, the Amerisafe, Inc. (NASDAQ:AMSF) share price is 56% higher than it was five years ago, which is more than the market average. It's also good to see that the stock is up 11% in a year.

See our latest analysis for Amerisafe

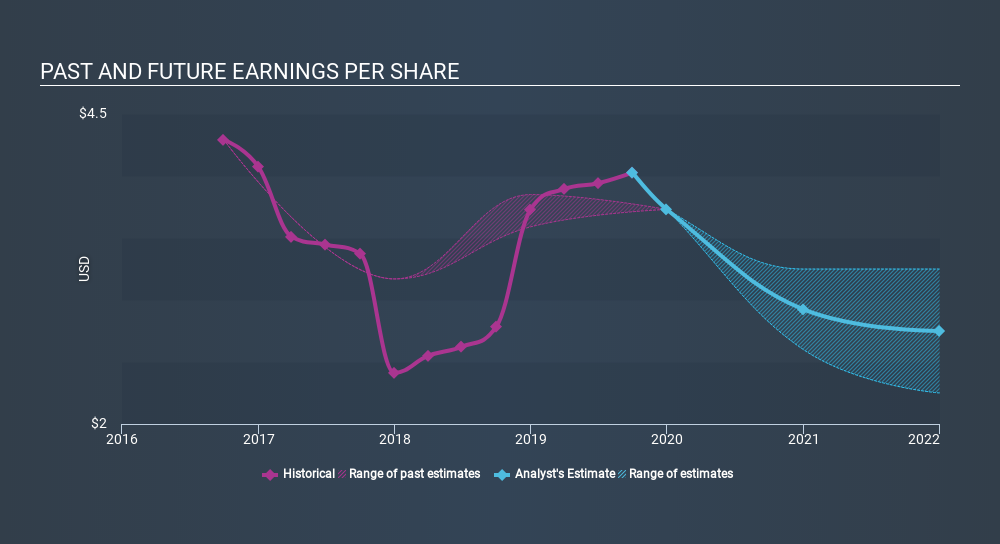

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over half a decade, Amerisafe managed to grow its earnings per share at 6.7% a year. This EPS growth is lower than the 9.3% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on Amerisafe's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Amerisafe's TSR for the last 5 years was 119%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Amerisafe provided a TSR of 18% over the last twelve months. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 17% over half a decade It is possible that returns will improve along with the business fundamentals. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 2 warning signs we've spotted with Amerisafe (including 1 which is shouldn't be ignored) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:AMSF

AMERISAFE

An insurance holding company, underwrites workers’ compensation insurance in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives