- United States

- /

- Oil and Gas

- /

- NYSE:COP

Shorn Like A Sheep: Analysts Just Shaved Their ConocoPhillips (NYSE:COP) Forecasts Dramatically

Market forces rained on the parade of ConocoPhillips (NYSE:COP) shareholders today, when the analysts downgraded their forecasts for this year. Both revenue and earnings per share (EPS) estimates were cut sharply as the analysts factored in the latest outlook for the business, concluding that they were too optimistic previously. Recent action in the market also suggests ConocoPhillips has lost favour recently, which could make today's downgrade an even greater concern in the near term. The stock price has dropped 9.3% to US$25.59 in the past week.

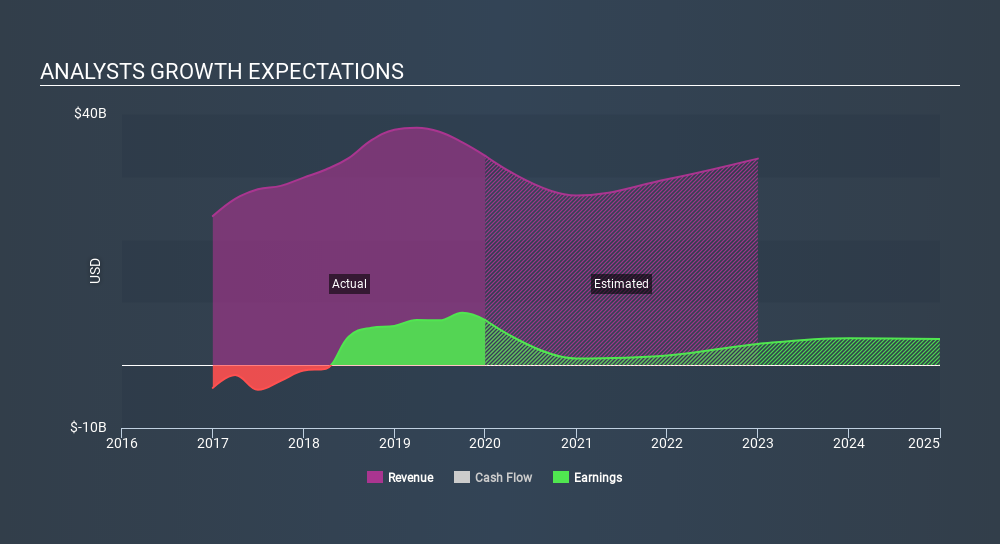

Following the latest downgrade, the current consensus, from the twelve analysts covering ConocoPhillips, is for revenues of US$26b in 2020, which would reflect a stressful 22% reduction in ConocoPhillips's sales over the past 12 months. Statutory earnings per share are anticipated to plummet 88% to US$0.75 in the same period. Prior to this update, the analysts had been forecasting revenues of US$32b and earnings per share (EPS) of US$2.48 in 2020. Indeed, we can see that the analysts are a lot more bearish about ConocoPhillips's prospects, administering a measurable cut to revenue estimates and slashing their EPS estimates to boot.

View our latest analysis for ConocoPhillips

The consensus price target fell 24% to US$53.42, with the weaker earnings outlook clearly leading analyst valuation estimates. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values ConocoPhillips at US$85.00 per share, while the most bearish prices it at US$22.00. As you can see the range of estimates is wide, with the lowest valuation coming in at less than half the most bullish estimate, suggesting there are some strongly diverging views on how think this business will perform. As a result it might not be possible to derive much meaning from the consensus price target, which is after all just an average of this wide range of estimates.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. One more thing stood out to us about these estimates, and it's the idea that ConocoPhillips's decline is expected to accelerate, with revenues forecast to fall 22% next year, topping off a historical decline of 2.8% a year over the past five years. Compare this against analyst estimates for companies in the wider industry, which suggest that revenues (in aggregate) are expected to grow 1.1% next year. So while a broad number of companies are forecast to decline, unfortunately ConocoPhillips is expected to see its sales affected worse than other companies in the industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. After such a stark change in sentiment from analysts, we'd understand if readers now felt a bit wary of ConocoPhillips.

There might be good reason for analyst bearishness towards ConocoPhillips, like a weak balance sheet. Learn more, and discover the 4 other risks we've identified, for free on our platform here.

Another thing to consider is whether management and directors have been buying or selling stock recently. We provide an overview of all open market stock trades for the last twelve months on our platform, here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:COP

ConocoPhillips

Explores for, produces, transports, and markets crude oil, bitumen, natural gas, liquefied natural gas (LNG), and natural gas liquids.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Rare Pure High Grade Silver with 35% Insider (Near Producer)

Swedens Constellation Software

Inotiv NAMs Test Center

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.