- United States

- /

- IT

- /

- NasdaqGS:SHOP

Shopify (SHOP) Sees Strong Q2 Growth With US$906 Million Net Income

Reviewed by Simply Wall St

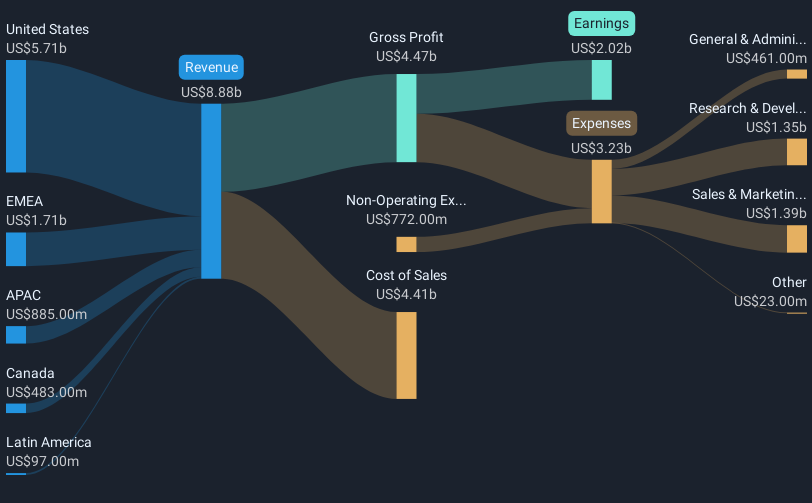

Shopify (SHOP) recently announced its second-quarter results showing substantial increases in sales, revenue, and net income, far exceeding market expectations and reflecting a significant annual growth in its earnings per share. These financial improvements coincided with a 65% rise in Shopify's stock price over the past quarter. Additionally, the rollout of Shopify Plus, new eCommerce functionalities, and strategic partnerships strengthened the company's market position. While the broader market also showed gains, especially in tech stocks, the impressive financial performance and expansion initiatives likely added weight to Shopify's remarkable share price escalation against the backdrop of market trends.

We've spotted 2 warning signs for Shopify you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent announcement of Shopify's strong second-quarter results, alongside its rollout of new functionalities and strategic partnerships, is expected to further solidify the company's position in the e-commerce space. These developments have resulted in substantial short-term gains and could enhance Shopify's long-term growth narrative. Over the past three years, Shopify achieved a very large total return of 281.43%, highlighting its resilience and capacity for growth despite challenges. In comparison, its share price growth has outpaced the US IT industry's 26.9% return over the past year, reinforcing its robust performance amid broader market movements.

Shopify's quarterly performance and strategic advancements are likely to positively influence revenue and earnings forecasts. Analysts project an annual revenue growth of 21.4%, with earnings potentially reaching US$2.6 billion by 2028. However, these forecasts come with caveats, such as potential regulatory pressures and increased competition. Despite a current share price of $154.90, which is above the consensus analyst price target of $135.38, investors may need to weigh these growth prospects against the valuation concerns. The short-term positive momentum may not fully align with the longer-term price target, suggesting a cautious approach to expectations based on company performance.

Explore Shopify's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives