- Canada

- /

- Electrical

- /

- TSX:BLDP

Shareholders Are Raving About How The Ballard Power Systems (TSE:BLDP) Share Price Increased 431%

For many, the main point of investing in the stock market is to achieve spectacular returns. And we've seen some truly amazing gains over the years. Just think about the savvy investors who held Ballard Power Systems Inc. (TSE:BLDP) shares for the last five years, while they gained 431%. And this is just one example of the epic gains achieved by some long term investors. And in the last month, the share price has gained -0.6%. But the price may well have benefitted from a buoyant market, since stocks have gained 8.7% in the last thirty days.

See our latest analysis for Ballard Power Systems

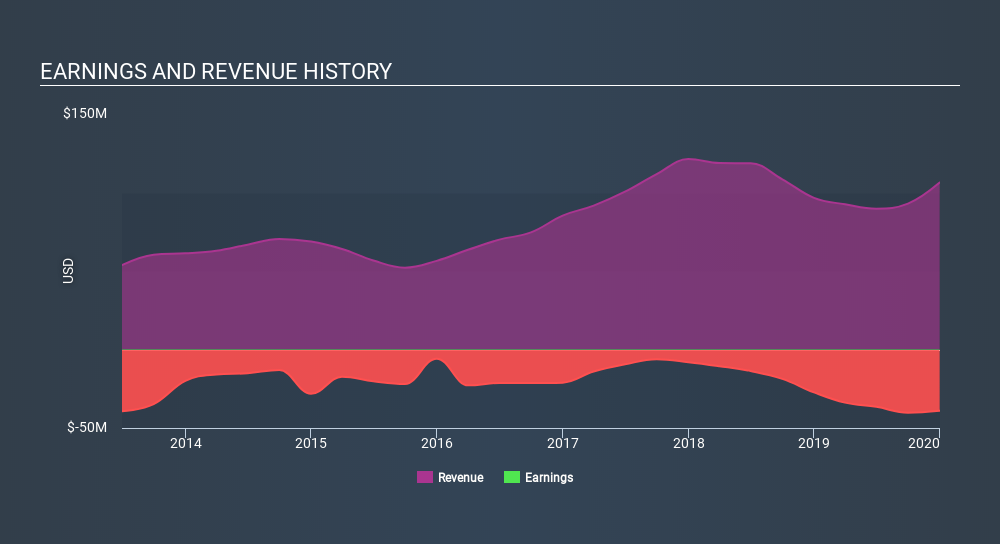

Ballard Power Systems wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

For the last half decade, Ballard Power Systems can boast revenue growth at a rate of 12% per year. That's a pretty good long term growth rate. However, the share price gain of 40% during the period is considerably stronger. We usually like strong growth stocks but it does seem the market already appreciates this one quite well!

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. If you are thinking of buying or selling Ballard Power Systems stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

It's good to see that Ballard Power Systems has rewarded shareholders with a total shareholder return of 230% in the last twelve months. That gain is better than the annual TSR over five years, which is 40%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Ballard Power Systems better, we need to consider many other factors. Even so, be aware that Ballard Power Systems is showing 3 warning signs in our investment analysis , you should know about...

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:BLDP

Ballard Power Systems

Engages in the design, development, manufacture, sale, and service of proton exchange membrane (PEM) fuel cell products.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026