- United States

- /

- Insurance

- /

- NasdaqGS:SIGI

Selective Insurance Group, Inc.'s (NASDAQ:SIGI) Shares Lagging The Market But So Is The Business

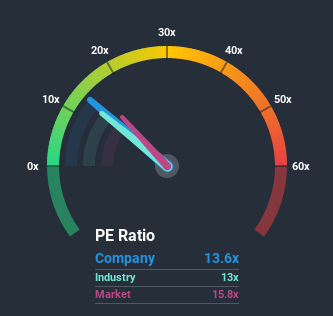

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 16x, you may consider Selective Insurance Group, Inc. (NASDAQ:SIGI) as an attractive investment with its 13.6x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Selective Insurance Group's earnings growth of late has been pretty similar to most other companies. One possibility is that the P/E is low because investors think this modest earnings performance may begin to slide. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

View our latest analysis for Selective Insurance Group

Where Does Selective Insurance Group's P/E Sit Within Its Industry?

An inspection of average P/E's throughout Selective Insurance Group's industry may help to explain its low P/E ratio. It turns out the Insurance industry in general also has a P/E ratio lower than the market, as the graphic below shows. So it appears the company's ratio could be influenced considerably by these industry numbers currently. In the context of the Insurance industry's current setting, most of its constituents' P/E's would be expected to be toned down. Still, the strength of the company's earnings will most likely determine where its P/E shall sit.

How Is Selective Insurance Group's Growth Trending?

Selective Insurance Group's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Regardless, EPS has managed to lift by a handy 28% in aggregate from three years ago, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to plummet, contracting by 19% during the coming year according to the seven analysts following the company. With the rest of the market predicted to shrink by 12%, it's a sub-optimal result.

With this information, it's not too hard to see why Selective Insurance Group is trading at a lower P/E in comparison. Nonetheless, with earnings going quickly in reverse, it's not guaranteed that the P/E has found a floor yet. Even just maintaining these prices could be difficult achieve as the weak outlook is already weighing down the shares heavily.

The Bottom Line On Selective Insurance Group's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Selective Insurance Group's analyst forecasts revealed that its even shakier outlook against the market is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. However, we're still cautious about the company's ability to resist even greater pain to its business from the broader market turmoil. For now though, it's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Selective Insurance Group, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

If you decide to trade Selective Insurance Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account.Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:SIGI

Selective Insurance Group

Provides insurance products and services in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives