Seiko Group (TSE:8050) To Consider Change In Officers At Upcoming Board Meeting

Reviewed by Simply Wall St

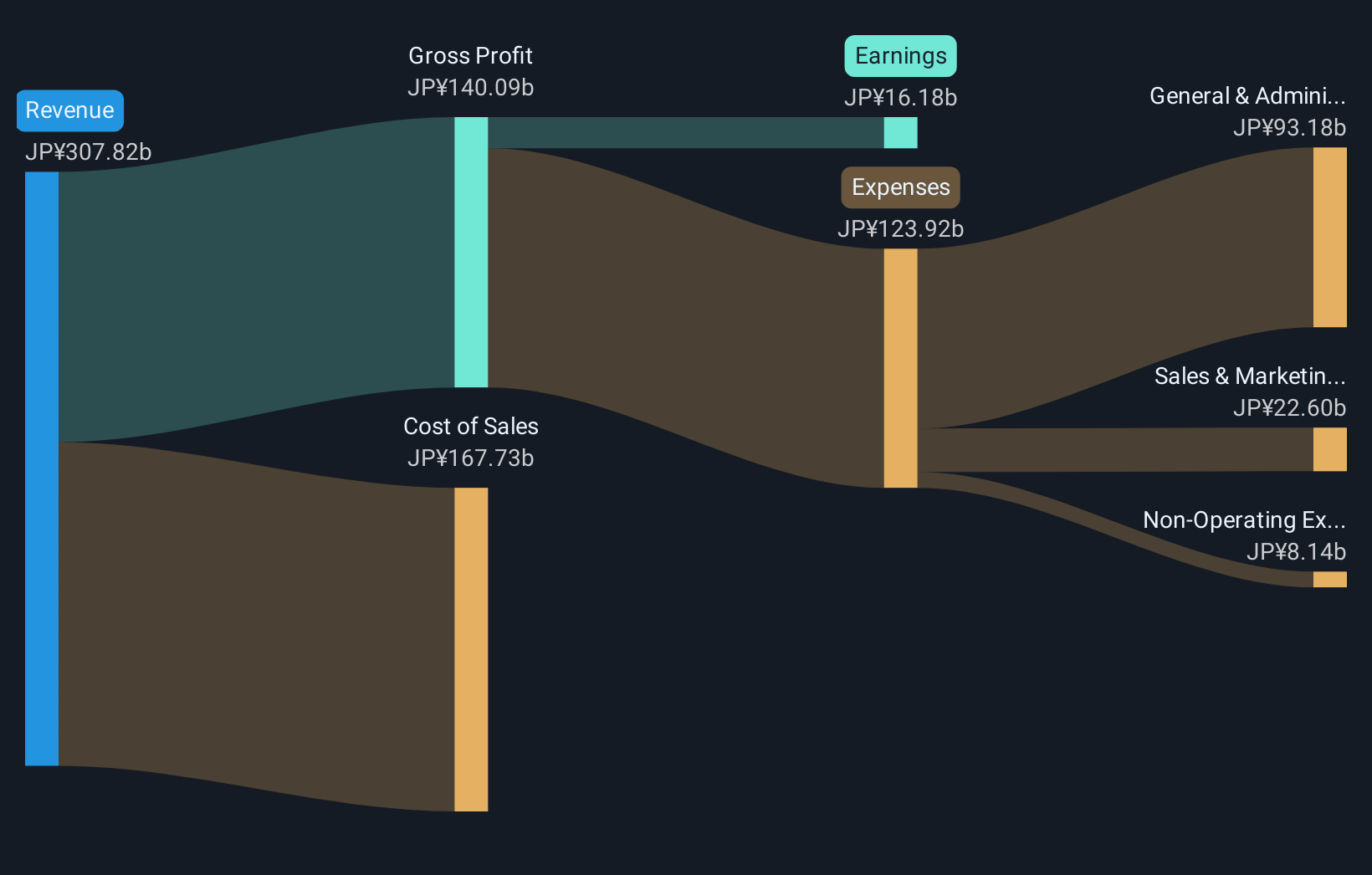

Seiko Group (TSE:8050) recently held a Board Meeting on September 9, 2025, which focused on potential leadership changes, possibly setting the stage for future strategic shifts. During the last quarter, the company's share price surged by 61%, a move potentially influenced by these management discussions, alongside its positive earnings guidance issued earlier in August. While the broader market showed robust performance with the S&P 500 and Nasdaq reaching all-time highs, Seiko's significant price gain highlighted unique company-specific factors, such as its leadership restructuring and forward-looking earnings expectations. These events likely added weight to Seiko's upward trajectory amidst a generally positive market environment.

You should learn about the 3 possible red flags we've spotted with Seiko Group.

Over the past five years, Seiko Group's total shareholder return was significant, resulting in a 390.69% increase. This considerable growth reflects the company's consistent performance and strategic decisions, such as the recent focus on leadership restructuring and earnings management. In comparison, Seiko outperformed the JP Luxury industry, which gained 39.4% over the last year, indicating strength in its operations and investor confidence.

The strategic developments mentioned earlier, particularly leadership changes and positive earnings guidance, likely influence future revenue and earnings forecasts. These factors may align with Seiko's solid historical growth pattern. With a current share price of ¥6,720, the movement towards the consensus analyst price target of ¥6,733.33 suggests limited perceived upside, indicating that the market might have already priced in recent developments. Nevertheless, the relatively stable price target amidst a robust market environment underscores Seiko's steady trajectory in the luxury industry.

Examine Seiko Group's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8050

Seiko Group

Engages in watches, devices solutions, systems solutions, apparels, clocks, fashion accessories, system clocks and other businesses in Japan and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives