- South Korea

- /

- Tech Hardware

- /

- KOSE:A005930

Samsung Electronics (KOSE:A005930) Expands Automotive Tech Collaboration With Valens Semiconductor

Reviewed by Simply Wall St

In recent developments, Valens Semiconductor has formed a partnership with Samsung Electronics (KOSE:A005930) to advance the MIPI A-PHY standard for high-speed sensor connectivity. Over the past quarter, Samsung's stock price rose 22%, supported by strategic alliances and new product launches, such as its Bespoke AI appliances and the Galaxy Z Fold7 Series. Additionally, the company's significant contract with Tesla for chip manufacturing further bolstered its shares. This aligns with the overall market's strong performance, as major indices like the Nasdaq and S&P 500 reached record highs, indicating investor optimism.

The collaboration between Valens Semiconductor and Samsung Electronics to enhance the MIPI A-PHY standard could significantly influence Samsung's growth prospects. By advancing technology for high-speed sensor connectivity, Samsung is likely to bolster its leadership in advanced semiconductors, potentially accelerating revenue growth and improving profitability. This aligns with the ongoing narrative of Samsung capitalizing on the demand for AI and high-performance memory solutions.

Over the past three years, Samsung's total shareholder return, including dividends, was 36.7%, showcasing a strong long-term performance. However, in the last year alone, its performance fell short of the broader KR market, which achieved a higher return of 27.2%, indicating a challenging competitive environment within the local market and tech industry.

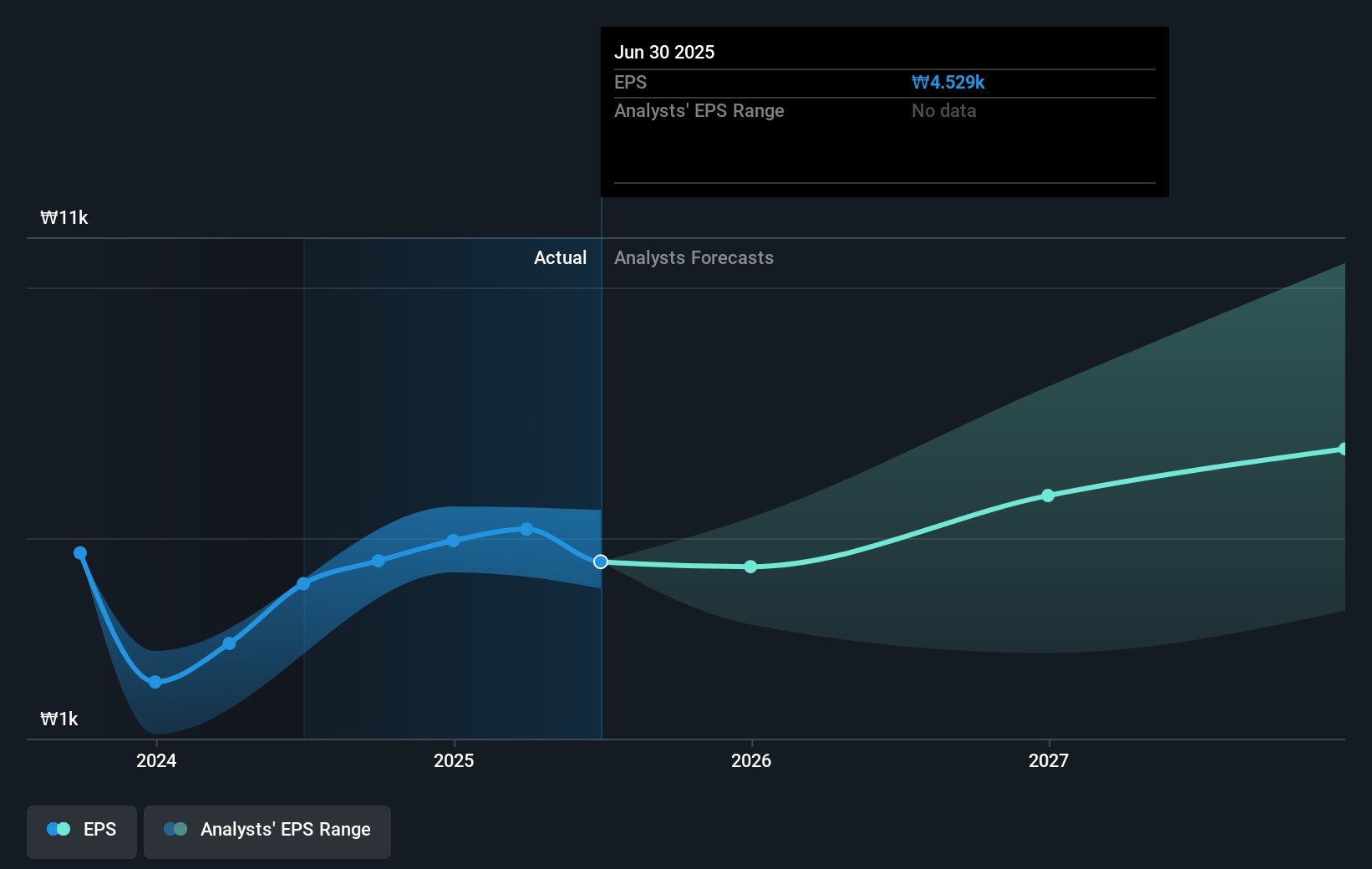

In light of the recent partnership news, revenue forecasts for Samsung might be positively adjusted, as the collaboration could drive new business opportunities and increased demand for its semiconductor solutions. Earnings forecasts may also see an uptick if the partnership translates into better pricing power and margin improvements. Despite the current share price of ₩72,600 being below the analyst price target of ₩82,987.29, the agreement with Valens could bridge this gap if the anticipated business growth is realized, narrowed to the 14.3% discount currently observed. Investors might see the alignment with technological advancement as a catalyst for reaching and potentially exceeding the projected valuations.

Assess Samsung Electronics' future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A005930

Samsung Electronics

Engages in the consumer electronics, information technology and mobile communications, and device solutions businesses worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives