- United States

- /

- Software

- /

- NYSE:IOT

Samsara (IOT) Partners With First Student To Revolutionise School Bus Safety And Efficiency

Reviewed by Simply Wall St

Samsara (IOT) recently announced a substantial partnership with First Student, equipping approximately 46,000 vehicles with its advanced technology to enhance transportation safety. This collaboration, alongside improved financial health reflected in a narrowed net loss and increased sales in Samsara's second-quarter earnings, contributed to the company's stock rising by 14% over the last month. Despite these notable advancements, broader market trends, such as the S&P 500 and Nasdaq hitting record highs and increased AI demand impacting the technology sector, likely also buoyed Samsara's share performance, aligning it with the overall positive market momentum.

Be aware that Samsara is showing 2 weaknesses in our investment analysis.

Find companies with promising cash flow potential yet trading below their fair value.

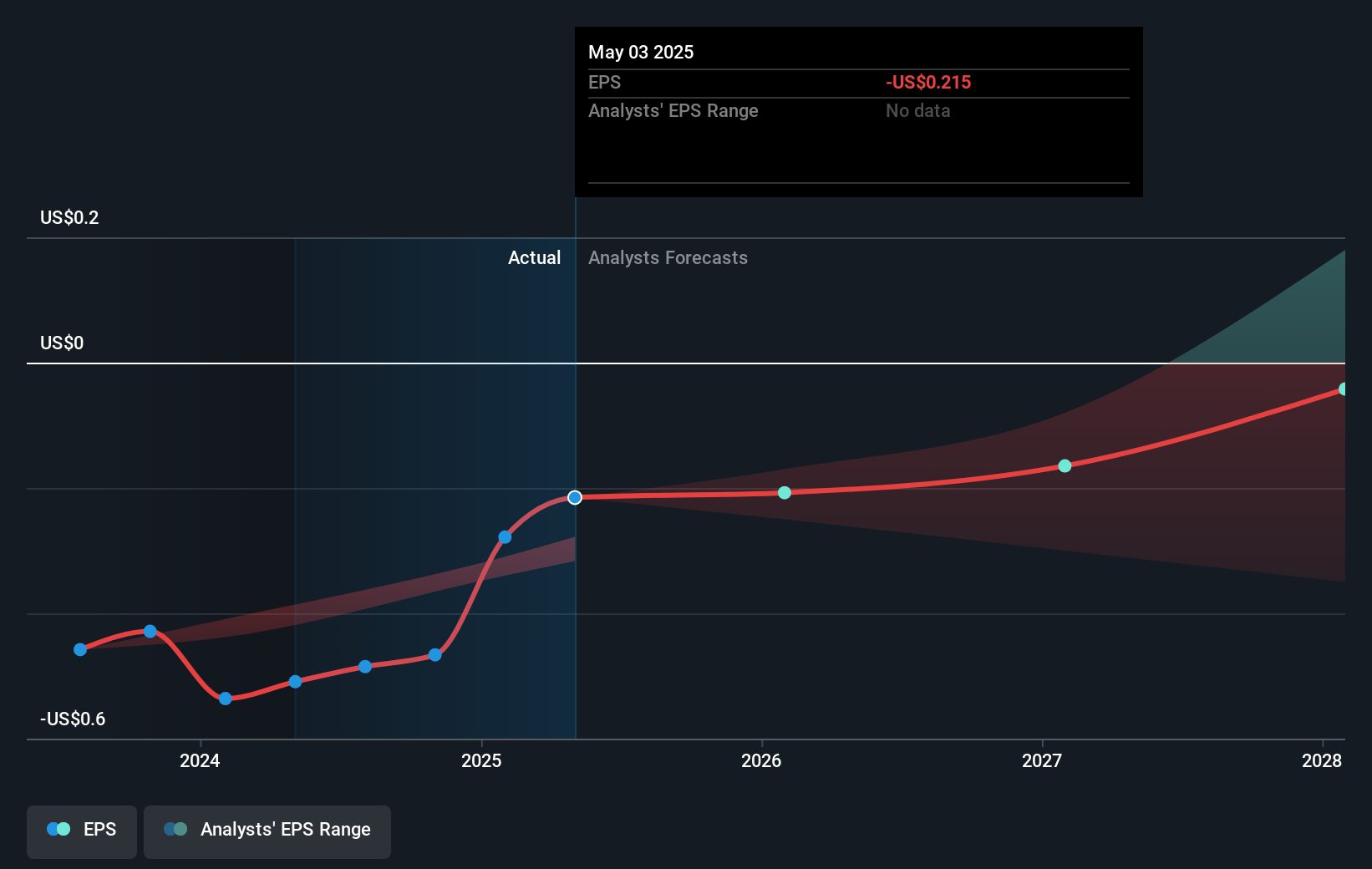

The recent partnership with First Student and Samsara's improved financial metrics could significantly influence its growth narrative. This collaboration enhances Samsara's position in transportation technology, potentially boosting future revenue streams by increasing demand for its telematics solutions in an under-penetrated market. The partnership aligns with the company's narrative of innovation and expanding its product base, which may contribute positively to both revenue and earnings forecasts.

Over the past three years, Samsara's total shareholder return was 202.51%, providing a long-term context of impressive performance, although it underperformed the US Software industry and the broader US market over the past year. This indicates that while the company has shown strong past gains, recent performance has lagged behind industry peers.

The company's recent share price increase of 14%, in response to its enhanced financial health and market conditions, points towards positive investor sentiment. However, the current share price of $38.60 still reflects a discount to the consensus analyst price target of $48.20. This suggests potential upside if Samsara can meet or exceed earnings expectations and capitalize on market opportunities such as increased AI demand and continued platform expansion.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IOT

Samsara

Provides solutions to connect physical operations data to its connected operations platform in the United States and internationally.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives