- United States

- /

- Software

- /

- NYSE:CRM

Salesforce (NYSE:CRM) Gains Momentum With ACI Infotech Partnership For AI-Powered Growth

Reviewed by Simply Wall St

Salesforce (NYSE:CRM) recently established a significant partnership with ACI Infotech's Agentforce platform, emphasizing strategic growth in Data + AI, digital experience, and cloud modernization. This collaboration aligns with the broader trend of digital transformation and could contribute positively to the company's market presence. Over the past week, Salesforce's stock movement was mostly in line with broader market trends, which showed little change amid geopolitical uncertainties and economic forecasts. The partnership may add long-term value by enhancing Salesforce's capabilities, yet the short-term price movement remained flat against market dynamics.

You should learn about the 1 possible red flag we've spotted with Salesforce.

The partnership between Salesforce and ACI Infotech's Agentforce platform could fortify Salesforce's expansion into AI and cloud modernization. While recent market conditions kept Salesforce's stock movement relatively flat, the long-term potential for growth remains intact as these initiatives align with the company's emphasis on AI-driven technologies and digital experiences. By branching into agentic technologies, Salesforce hopes to bolster its offerings and potentially drive significant revenue growth through new multibillion-dollar product lines like Data Cloud and Agentforce, aimed at enhancing efficiency and customer engagement.

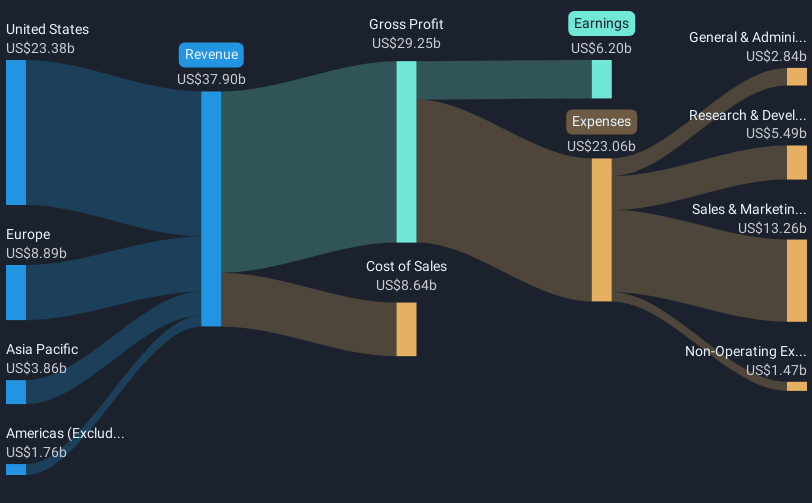

Over the past five years, Salesforce has delivered a total shareholder return of 42.91%. This performance should be seen in the context of its recent one-year underperformance compared to the US Software industry, which returned 17.7% during that time. The partnership and new product lines may address some challenges such as heightened competition and reliance on partnerships, as they could enhance operational margins and expand Salesforce's market share.

Analysts anticipate a transition from Salesforce's current seat-based pricing to consumption-based models, which could impact revenue forecasts positively by offering more flexible options. The long-term earnings forecast anticipates an increase to US$9.9 billion by 2028, a goal supported by these strategic initiatives. Given a share price of US$273.36, there is a 25% potential upside to the consensus price target of approximately US$364.65, reflecting analysts' confidence in future earnings growth and the success of Salesforce's new strategic direction.

Understand Salesforce's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRM

Salesforce

Provides customer relationship management (CRM) technology that connects companies and customers together worldwide.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives