- United States

- /

- Aerospace & Defense

- /

- NYSE:RTX

RTX (NYSE:RTX) Secures US$536 Million U.S. Navy Contract For SPY-6 Radar Deployment

Reviewed by Simply Wall St

RTX (NYSE:RTX) recently secured a substantial $536 million contract from the U.S. Navy, marking a significant stride in enhancing naval radar capabilities. This development aligns with the company's broader strategic initiatives and emphasizes its role in national defense. Despite a 6.8% price increase over the quarter, the market similarly climbed, mitigating a direct causal link between these events and RTX's performance. However, Raytheon's ongoing advancements and robust contract portfolio would have added weight to the overall market momentum experienced during the period. Such developments continue to underscore RTX's integral position within the defense sector.

We've spotted 2 warning signs for RTX you should be aware of, and 1 of them is a bit concerning.

The recent $536 million contract with the U.S. Navy is a significant addition to RTX's robust defense portfolio, enhancing its market position and aligning with strategic efforts to boost revenue from government contracts. Over the past five years, RTX's total shareholder return, including share price movements and dividends, was 109.20%, reflecting the company's ability to sustain growth and reward investors. In contrast, the past year saw RTX underperform its industry, which returned 31.1%, indicating a challenging short-term landscape relative to its peers.

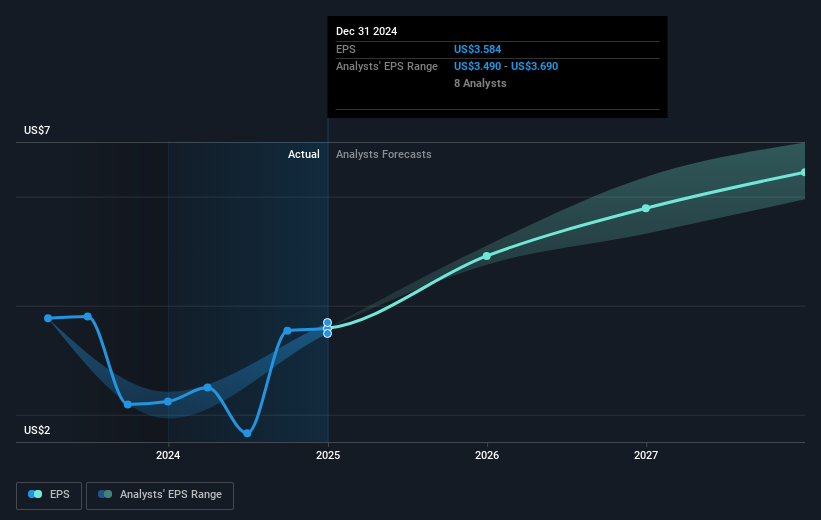

The Navy contract could positively impact revenue forecasts by increasing project backlogs, contributing to the expected revenue growth of 5.2% annually over the next few years. Simultaneously, anticipated defense budget increases in Europe may bolster revenue streams. Analysts expect RTX's earnings to rise to US$8.5 billion by 2028, supported by innovations like the GTF Advantage and LTAMDS. Despite the current share price of $128.16, just 7.1% below the average analyst price target of $137.93, the contract underlines the company's potential to meet or exceed these forecasts.

Examine RTX's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RTX

RTX

An aerospace and defense company, provides systems and services for the commercial, military, and government customers in the United States and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives