- United States

- /

- Capital Markets

- /

- NasdaqGS:HOOD

Robinhood Markets (NasdaqGS:HOOD) Expands Services Across 30 EU and EEA Countries

Reviewed by Simply Wall St

Robinhood Markets (NasdaqGS:HOOD) has announced a plethora of initiatives, including the expansion of its services across 30 EU and EEA countries and the introduction of crypto staking and stock tokens, aimed at enhancing product offerings. Additionally, inclusion in multiple growth indices, such as the Russell 1000 Growth Index, likely solidified investor confidence. All these developments coincided with broader market factors like the rise in the Nasdaq, where tech shares boosted the index. Together, these initiatives and external market trends likely added weight to the company's 116% price move over the last quarter.

Robinhood Markets has 1 weakness we think you should know about.

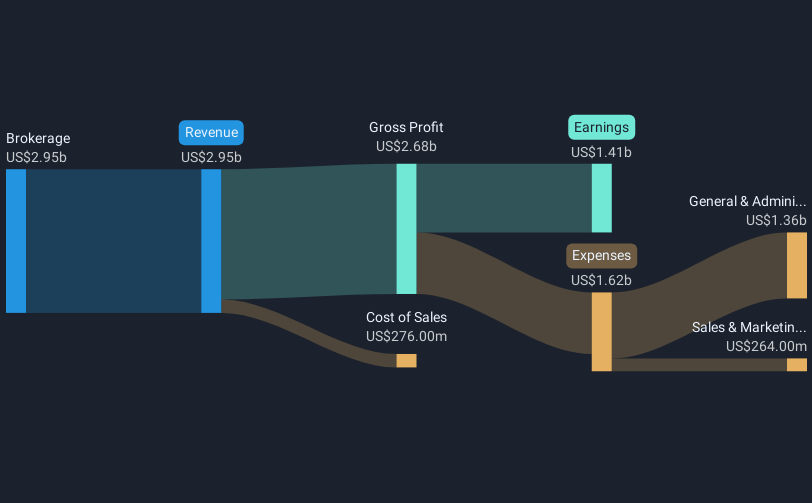

Robinhood Markets' recent initiatives could significantly impact its revenue and earnings forecasts, particularly with the expansion into the EU, EEA, crypto staking, and stock tokens. These efforts might enhance transaction volumes and engagement, potentially boosting revenue. However, regulatory challenges and competitive pressures may temper these prospects. While the announcement of international growth and inclusion in growth indices coincides with a short-term share price boost, it remains essential to consider the long-term impacts on earnings and revenue.

Over the past three years, the company's total shareholder return, including share price and dividends, has been exceedingly large at nearly 1000%. Acknowledging this context, Robinhood's recent share price growth of 116% over the last quarter reflects enthusiasm around its initiatives and favorable external market trends. Yet, compared to the broader market over the past year, Robinhood exceeded both the US Market's 13.9% return and the US Capital Markets industry's 34.2% return.

The share price of US$48.69 shows potential upside relative to the analysts' consensus price target of US$59.29, a 17.9% higher target that reflects expectations of future earnings growth and margin projections. However, analysts assume Robinhood's earnings will decline while it trades at a Price-to-Earnings ratio higher than the industry average, indicating a broader disagreement in market sentiment versus analyst expectations. This scenario suggests investors should critically evaluate their assumptions and view the share price movement in light of industry dynamics and company-specific developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOOD

Robinhood Markets

Operates financial services platform in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives